Soybean prices continue to consolidate near the bottom of the barrel. Technical bulls are arguing a close above-$8.50 could help to build a longer-term floor. Unfortunately, bears still see rising tensions between U.S. and Chinese officials as reason enough to keep a lid on prices.

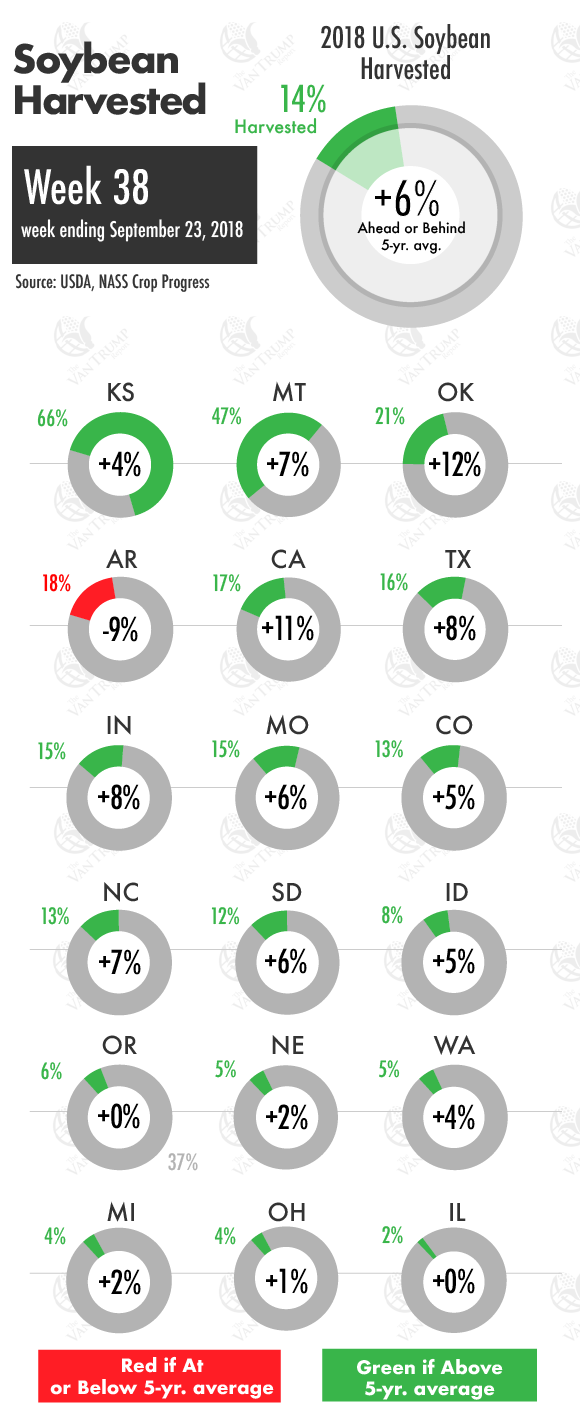

Bears are also pointing to a massively burdensome U.S. ending stock number and record setting yield and record setting total production. The USDA showed improved conditions, going from 67% to 68% now rated GD/EX. The USDA is also showing the U.S. harvest is off to a very fast start with 14% now complete vs. the 5-year average of 8%. Big production states like Iowa, Illinois, Minnesota and Nebraska are all running well ahead of schedule and still showing some extremely strong "Excellent" ratings.

Really the only state running behind their historical harvest pace is Arkansas. Also off to fast start are producer planting in Brazil. There's talk many big production areas are running well ahead of schedule and could be harvesting a large number of soybeans by late-December or early-January. That certainly leaves U.S. exporters with a fairly narrow window of opportunity, especially when you consider we will be sitting on record U.S. supply, while being fairly limited by ongoing trade negotiations and tariffs.

For what it's worth, the are rumors circulating that Chinese officials are now saying there may be no official trade talks until after the November U.S. mid-term elections. Bulls are now pointing to the fact U.S. soybeans out of the PNW are now cheaper than soybeans out of Brazil even with the 25% tariff tacked on. Bulls are also pointing to the fact the USDA announced a daily sale of 162,000 MTs of U.S soybeans for delivery in the 2018-19 season to an "unknown" destination.

Hence, Chinese buyers are probably nibbling in the U.S. market. Bulls continue to argue that China ultimately has no choice but to import U.S. soybeans in larger doses. It's going to be interesting to see if the Chinese can hold out.

As a producer, I'm not wanting to bet against President Trump, but I'm also not comfortable betting that the Chinese are going to cave easily. Hence, I'm worried we could be in a deadlock for an extend period of time. At least beyond many of our pricing window goals for the remainder of 2018. That's why I'm looking to use any surprise rallies as an opportunity to reduce a bit more nearby risk. Those who have ample storage and cash-flow might be in a better position to gamble on a positive outcome.

As as a spec, I still think there is further downside. I want to be a longer-term buyer, but have gotten burned once and the stove still looks hot. I remain in no hurry to be long... Keeping a longer-term eye on some heavy rains building in parts of southern Brazil.

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

About the Author(s)

You May Also Like