With the first look at 2021/22 supply and demand estimates, the May 2021 World Agricultural Supply and Demand Estimates (WASDE) report is full of valuable insights to unpack. New crop corn futures edged lower on reduced demand estimates in the new crop year, largely from a smaller export number.

Old crop soybean futures rose on smaller Argentine production this year and bullish soybean import projections from China. Prospects for a large U.S. wheat harvest this summer sent wheat futures lower following the report’s release.

Corn

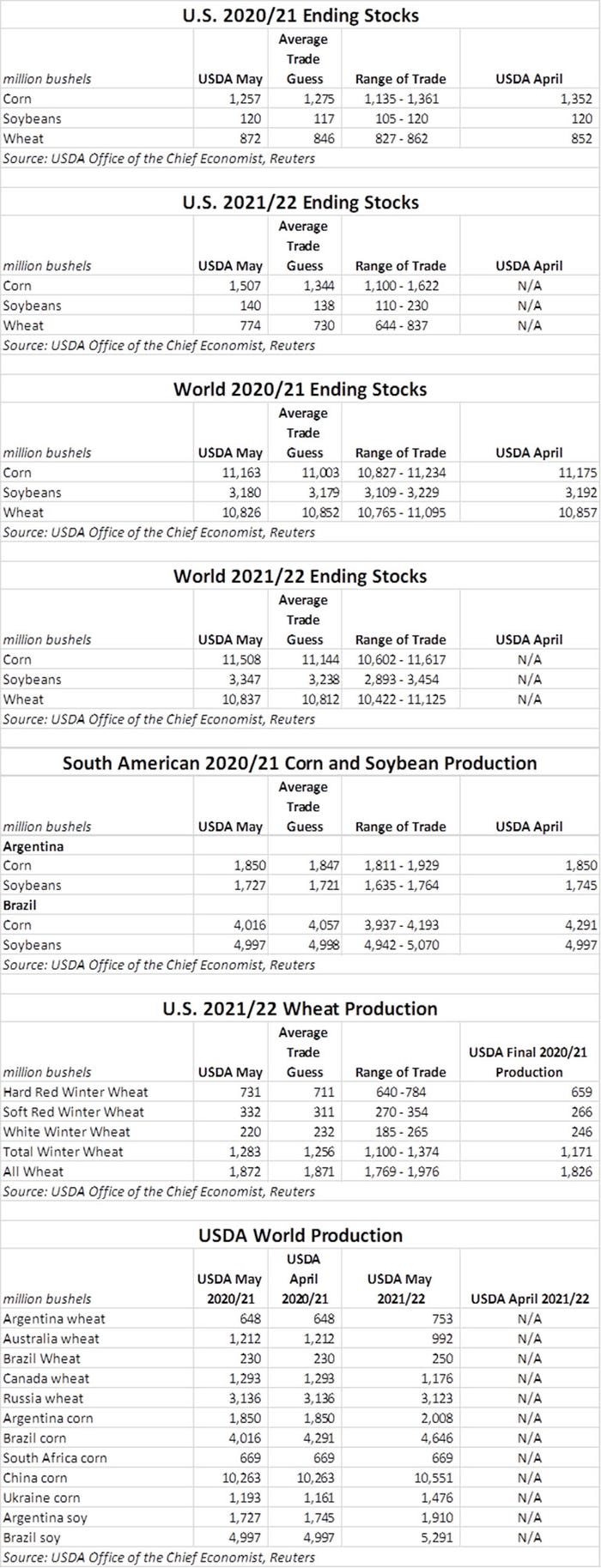

USDA’s outlook for corn this month assumes farmers will return to trendline yields of 179.5 bushels per acre for a total production of 15.0 billion bushels. The agency also expects improved domestic use, lower exports and higher ending stocks.

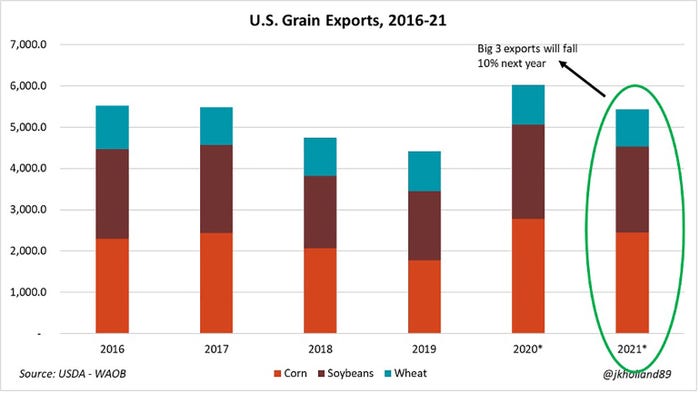

USDA predicts U.S. corn exports will decline 325 million bushels during the 2021/22 marketing year. A hiccup in South American production should help U.S. prospects during the first half of the upcoming marketing year, but USDA also expects a 335-million-bushel increase in Russian and Ukrainian exports in 2021/22, which should limit domestic upside potential.

With that in consideration, ending stocks for 2021/22 should rise 250 million bushels year-over-year to 1.507 billion bushels, according to USDA. Analysts were expecting that number to be much lower, with an average trade guess of 1.344 billion bushels.

“The season-average corn price received by producers in 2021/22 is projected at $5.70 per bushel, up $1.35 from a year ago when much of the crop was marketed at lower prices,” the report also notes.

South American production saw some revisions from April. In Brazil, production potential fell 275 million bushels to 4.016 billion bushels. In Argentina, USDA held estimates steady from a month ago, with 1.850 billion bushels.

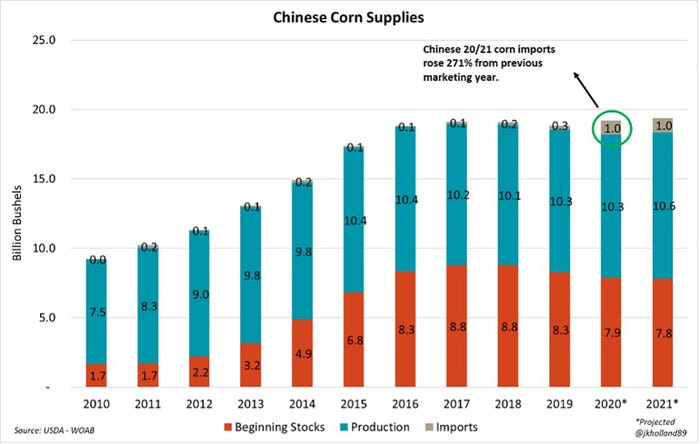

“Reductions in the Brazilian corn crop due to planting delays and drought conditions plaguing yield prospects for the safrinha crop have played a major role in strong U.S. corn exports in the later half of the current 2020/21 marketing year,” notes Farm Futures grain market analyst Jacquie Holland. “USDA added another 100 million bushels to 2020/21 U.S. corn export targets, with the new estimate of 2.775 billion bushels notching a new record high on unprecedented demand from China.”

“Despite earlier guidance last month from China’s ministry of agriculture recommending livestock producers reduce corn and soybean volumes in livestock rations, USDA expects China to continue its trend of steady corn and soybean purchases in the new year,” Holland continued. “China is likely to buy 3.8 billion bushels of international soybeans and another 1.0 billion bushels of corn next year from foreign sources.”

World ending stocks for 2021/22 were also higher than trade guesses, coming in at 11.508 million bushels. Analysts had offered up an average estimate of 11.144 prior to today’s report.

Soybeans

USDA’s 2021/22 soybean outlook calls for lower supplies and exports, an improving crush volume and higher ending stocks compared to the current marketing year. USDA estimates this year’s soybean production will reach 4.4 million bushels, based on more acres and trendline yields. Favorable crush margins should push the 2021/22 crush 35 million bushels higher year-over-year to reach 2.2 billion bushels.

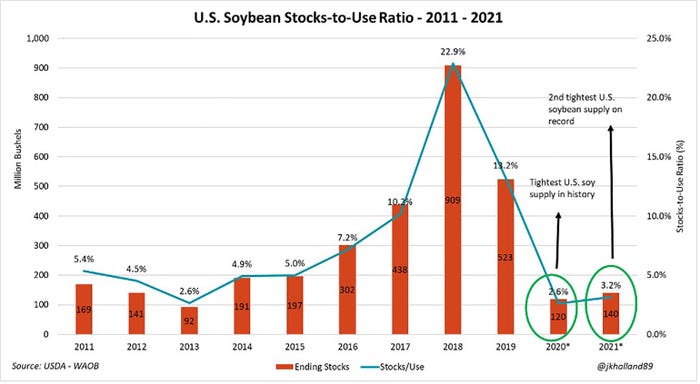

“Soybean stocks in the U.S. will end the current marketing year at the tightest level on record, while 2021/22 supplies with a stocks-to-use ratio of 3.2% are expected to be the third smallest ending stocks in history,” Holland says.

“But as supplies in the U.S. tighten, USDA expects export demand will be the first casualty as a result of dwindling stocks,” Holland adds. “Combined corn, soybean, and wheat exports are expected to fall nearly 10% in 2021/22 from the previous year. But it may be too soon to determine that exports will be forced to shrink in an era of scarce grain stocks. Time and the highest bidder will likely have the final say in that determination.”

Soybean exports this upcoming marketing year are expected to slide 205 million bushels below 2020/21 volume, to 2.1 billion bushels. That leaves ending stocks at 140 million bushels, which was slightly above the average trade guess of 138 million bushels. The U.S. share of total global exports is also expected to drop from 36% this year down to 33%. Prices could average $13.85 per bushel, which is an improvement of $2.60 compared to 2020/21.

South American production saw estimates hold steady for Brazil, with 4.997 billion bushels, while Argentina’s production slid 18 million bushels lower from a month ago, to 1.727 billion bushels.

“After a subpar year of crop development amid battling La Niña weather conditions, Brazil will seek to increase acreage and produce a new record volume of soybeans in 2021/22,” Holland says. “Barring any further weather disruptions, USDA expects Brazil will harvest 5.3 billion bushels of soybeans next year.”

Globally, USDA estimates 2021/22 soybean stocks at 3.347 billion bushels. That’s a bit above the average trade guess of 3.238 billion bushels.

Wheat

For wheat, USDA’s first glimpse into the 2021/22 marketing year predicts smaller supplies, higher domestic use, lower exports and reduced stocks. All-wheat yield estimates rose 0.3 bushels higher year-over-year to 50.0 bushels per acre. Domestic use is expected to rise 6%, primarily due to higher feed, residual and food use. Food use could rise another 3 million bushels to 963 million bushels, and annual feed and residual use is projected at 170 million bushels – the highest level in eight years.

Exports are expected to decline 65 million bushels to a total of 900 million bushels, however. Still, ending stocks are expected to decline 11% to 774 million bushels, falling to a seven-year low. Analysts were expecting a sharper decline, with an average trade guess of 730 million bushels.

“The U.S. wheat harvest expected later this summer is likely to be 3% larger than last year’s haul at 1.872 billion bushels,” Holland says. “Despite strong export demand from China in the 2020/21 marketing year, U.S. wheat exports will likely fall in 2021/22 to give way for rising domestic feed demand for wheat.”

USDA projects the season-average farm price for wheat at $6.50 per bushel, which would represent a year-over-year increase of $1.45, if realized, which the agency says will be due to “reduced stocks and significantly higher U.S. corn prices.”

Global stocks for 2021/22 are at 10.837 billion bushels, according to USDA. That was higher than the average trade guess of 10.812 billion bushels.

About the Author(s)

You May Also Like