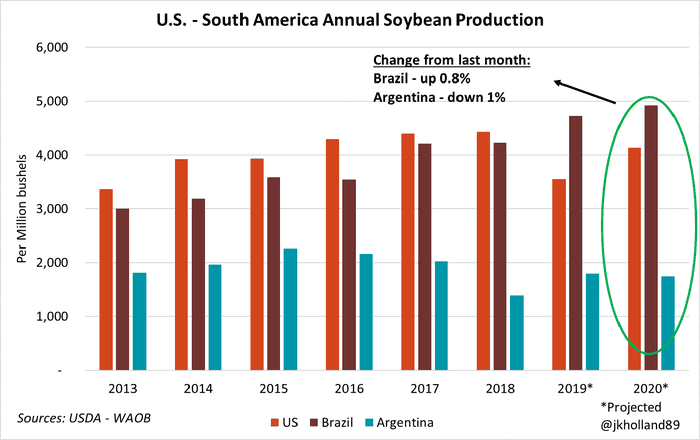

The March 2021 World Agricultural Supply and Demand Estimates (WASDE) report was largely expected to be a bit of a sleeper. But keeping true to form over the past year, USDA surprised markets by forecasting higher Brazilian soybean production instead of slightly lowering that total. The World Agricultural Outlook Board (WAOB) added 36.7 million bushels of output to Brazil’s soybean crop.

USDA’s upward adjustment is meant to reflect increased production for the 2019/20 Brazilian crop. Beginning global soybean stocks for 2020/21 also saw an upward adjustment on Paraguay’s 2019 production, which rose 27.2 million bushels to 38.9 million bushels.

But even with the uptick in available stocks, soaring global soybean usage rates will keep ending 2020/21 supplies at the tightest level in twelve years.

Brazil has struggled in recent weeks to harvest the crop in a timely fashion due to persistent rains. Many market watchers believed USDA’s estimates today could have gone at least 147 million bushels lower due to growing concerns about eroding crop quality amid the rain delays. USDA left Brazil’s corn production estimate unchanged despite the majority of the crop still unplanted – outside of the optimal yield window.

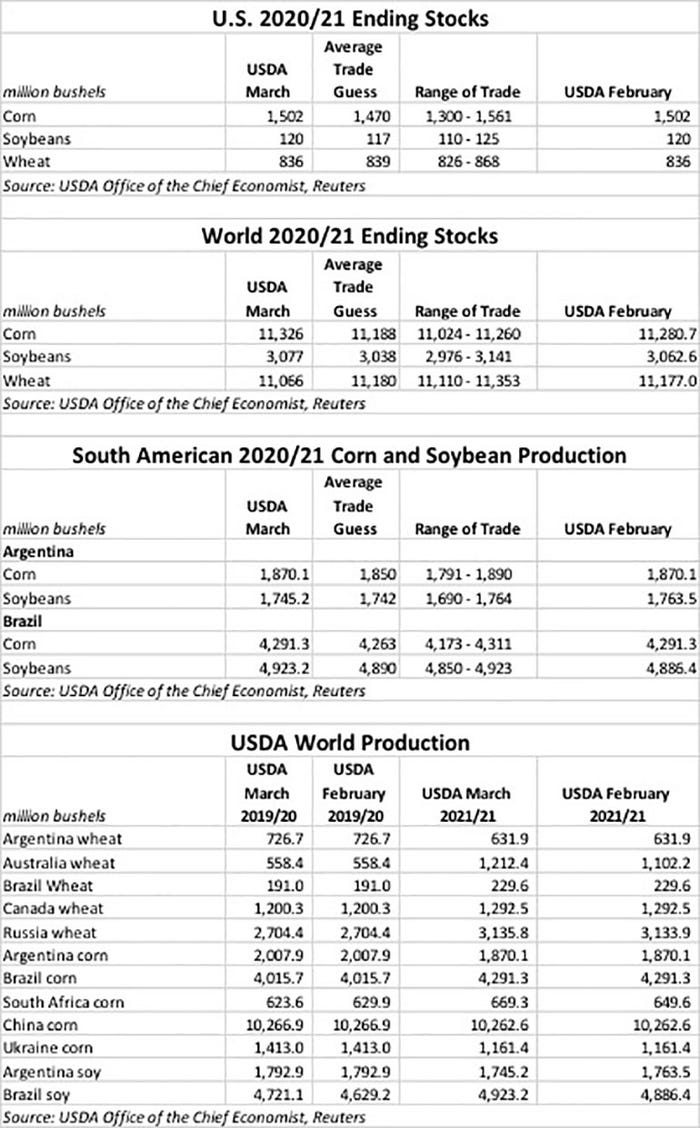

Corn prices fell 1% after no significant South American losses were reported. Soybean futures slipped half a percent on the increase in Brazil’s 2020/21 crop. USDA also left U.S. demand forecasts largely unchanged following a few minor balance sheet adjustments for 2019/20 corn and 2020/21 soybeans.

U.S. corn ending stocks remained stable, at 1.502 billion bushels. Analysts were expecting a moderate reduction, however, with an average trade guess of 1.471 billion bushels. USDA also held the season-average farm price steady from February, at $4.30 per bushel.

Global production in 2020/21 is expected to creep modestly higher, with USDA tacking on an additional 232 million bushels since February. The agency expects increases in places like India, South Africa and Bangladesh to more than offset decreases in Mexico. After noting some various changes to export and import levels, USDA marks global ending stocks at 11.326 billion bushels, moving slightly higher month-over-month.

USDA did not make any adjustments to China’s corn imports or production forecast, notes Farm Futures market analyst Jacquie Holland. Following USDA’s Annual Agriculture Outlook forum a few weeks ago, China released “Document Number One,” which outlined goals for increasing emphasis on food security and availability. China is expected to increase grain production this year amid record high prices and scarce supplies for processors.

“What is slightly more concerning in today’s report was the lack of adjustments to South American corn production estimates,” she adds. “It’s no secret that planting progress for Brazil’s safrinha crop is woefully behind schedule due to soybean harvest delays. What’s more apparent to markets now is the fact that the majority of the safrinha crop is going to be planted outside the optimal yield window.”

Argentina’s corn crop has undergone a significant amount of heat stress over the past weeks due to the sudden weather shift to hot and dry temperatures, Holland says. USDA may have played it safe on estimating South American corn losses this month, but it does not seem likely it will be able to avoid reducing its forecasts for very long.

For soybeans, USDA’s estimates for usage and supplies are “mostly unchanged” this month. Total soybean crush for the 2020/21 marketing year is expected to reach 2.2 billion bushels, with exports coming in around 2.25 billion bushels. Ending stocks held steady, at 120 million bushels, although analysts expected the agency to trim that total by another 3 million bushels. Even so, domestic stocks remain historically low for now.

USDA’s season-average farm price projections also remained stable, at $11.15 per bushel.

Globally, USDA’s forecast calls for “higher production, exports and ending stocks.” Total oilseed production (including soybeans, canola, sunflower oil, etc.) moved slightly higher. In South America, USDA raised its estimates for Brazilian production to 4.924 billion bushels while slightly trimming Argentinian production to 1.745 billion bushels.

“Cuts to Argentina’s soybean crop came in as expected, falling 18 million bushels,” Holland notes. “Combined with the increase to Brazilian soybean output, global soybean stocks on paper appear to be less tight than previously expected. But there is more to that story – as long as Brazilian soybean shipments remain delayed, markets will likely continue to trade primarily on the tight supply conditions.”

The outlook for U.S. wheat supply and demand was also left mostly unchanged this month. USDA noted improved white wheat exports after recent demand from China and South Korea. Conversely, hard red winter wheat exports tilted lower. Ending stocks held steady at 836 million bushels, with analysts expecting to see a 3-million-bushel increase from February. USDA left the season-average farm price unchanged, at $5.00 per bushel.

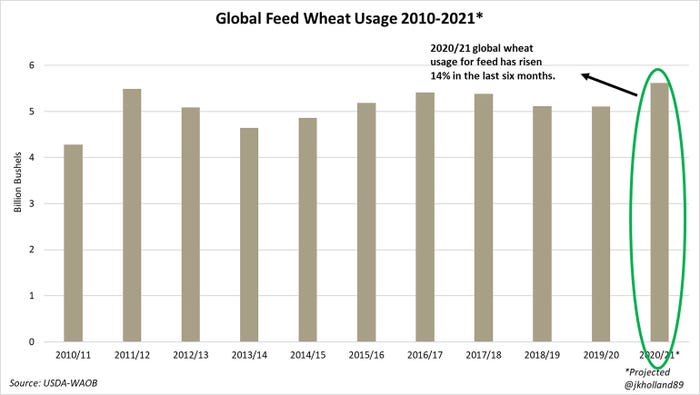

Globally, USDA anticipates “larger supplies, increased consumption, higher exports and reduced stocks.” Australia could see a record harvest this season, with estimates now at 1.213 billion bushels. Also worth noting is China – but as a consumer. The country’s wheat feed and residual use is expected to rise another 183.7 million bushels to reach a record 1.286 billion bushels. China (50%) and India (9%) are currently holding nearly three out of every five wheat bushels right now. The world’s total global ending stocks for 2020/21 declined slightly to 11.066 billion bushels.

“Increased wheat production in Australia and Russia will likely be quickly snapped up by international livestock feeders in the coming months,” Holland says. “USDA increased global wheat export forecasts by 105 million bushels due in large part to a 3.5% increase in wheat consumption for feed. Global feed consumption of wheat now stands at 5.620 billion bushels – a record high. Citizens – and livestock – around the world are hungry for wheat in the pandemic era.”

Globally, USDA anticipates “larger supplies, increased consumption, higher exports and reduced stocks.” Australia could see a record harvest this season, with estimates now at 1.213 billion bushels. Also worth noting is China – but as a consumer. The country’s wheat feed and residual use is expected to rise another 183.7 million bushels to reach a record 1.286 billion bushels. China (50%) and India (9%) are currently holding nearly three out of every five wheat bushels right now. The world’s total global ending stocks for 2020/21 declined slightly to 11.066 billion bushels.

About the Author(s)

You May Also Like