Soybean bulls are rejoicing in progress being made between U.S. and Chinese leaders regarding trade. There's also continued debate surrounding crop losses in Argentina and lack of U.S. demand by Chinese buyers. The bulls believe the lack of Argentine supply will eventually be reason enough for higher prices as soymeal becomes an even hotter commodity.

Bears have been battling this argument by pointing to another record crop being harvested in Brazil, near record acres being planted here in the U.S., and recent political trade complications throwing a monkey-wrench in current U.S. demand forecasts. Even though we've seen some recent steps in the right direction between U.S. and Chinese trade negotiations, many bears are still thinking we could ultimately see 3 to 4 MMTs of beans previously purchased by the Chinese either "canceled" or a portion rolled forward becoming new-crop sales.

Either way, it reduces the demand for U.S. old-crop soybeans. What I learned late last week from the USDA, is that buyers from an undisclosed destination have recently "canceled" 949,000 MTs of U.S. soybean purchases.

Of that total, 829,000 MTs were for shipment before September. Meaning we are already starting to see the cancellations and rolls. We need to keep a close eye on this moving forward as Brazilian prices the past couple of weeks have gotten much cheaper for the Chinese than prices for soybeans coming from the U.S. Just a few weeks back prices seemed to be about equal, now I'm hearing the Chinese can bring in Brazilian soybeans about -$15 to -$20 per ton less than shipments from the U.S. Gulf.

Keep in mind, on Friday morning alone, the Brazilian currency had weakened by almost -1.5% and is now down about -10% in the past 30-days and over -12% since January. I'm worried that some of the world's largest global investors are already starting to eyeball the upcoming Brazilian presidential election in October and don't like what they see. If it looks like more social unrest and uncertainty in the government we could continue to see the Brazilian currency devalue. Also keep in mind, even though the Argentine peso has stabilized the past couple of days, it has recently posted a series of all-time lows and is down over -16% just during the month of May.

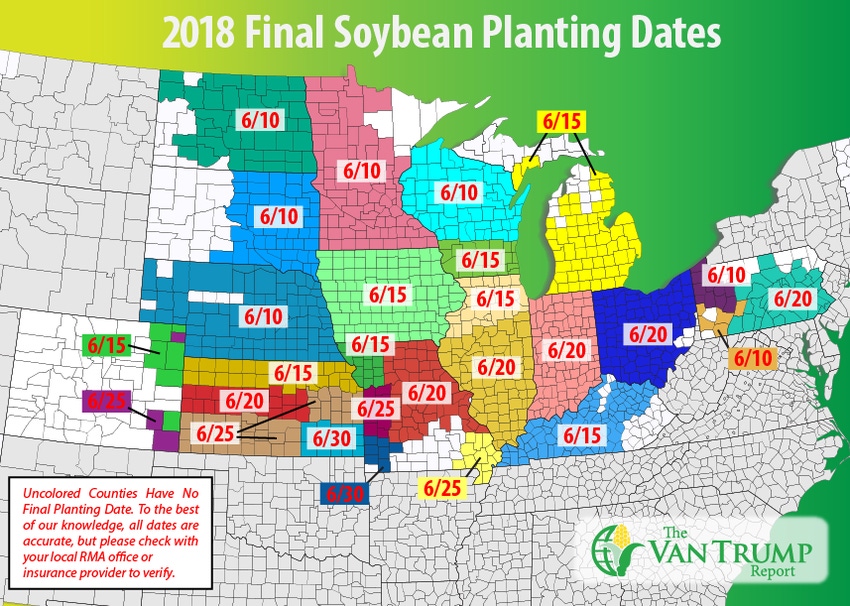

Remember, back in late-April into early-May, Argentine's central bank raised their interest rates from 27.25%, a week later to 30.25%, a day later to 33.25%, then quickly to 40%, all in an effort to help support the peso and battle their 25% inflation. Again, there's just a ton of moving parts in this soybean market. Here at home, traders are looking for U.S. producers to now have over +50% of their new-crop acres planted. This is allowing the bears to argue there will ultimately be more bean acres than the USDA currently has forecast. I continue to remain optimistic longer-term, believing a wide-spread U.S. weather hiccup and or some type of trade resolution could easily propel prices higher.

Unfortunately, in the interim, it could be difficult maintaining the upside momentum.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like