Soybean bears are talking about improved U.S. weather, mostly normal temperatures and above normal rainfall now in the forecast across large portions of the key U.S. growing regions.

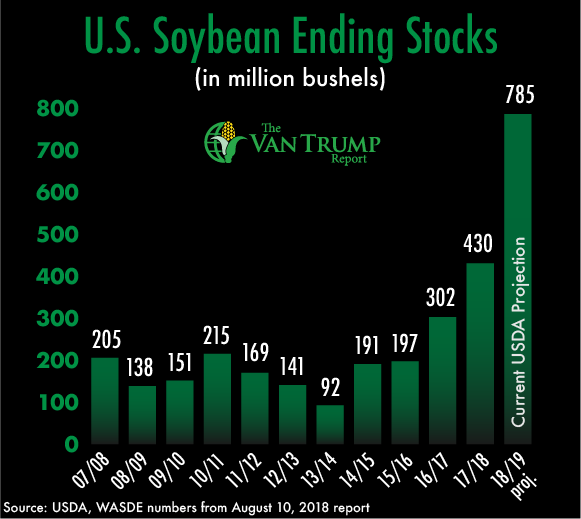

This is starting to bring about more talk of increasing yields and the more realistic probability of the U.S. harvesting a +4.5 billion bushel crop and ending stocks staying north of 750 million bushels.

The bears clearly believe there is more downside risk in the market and that prices could eventually fall to sub-$8.00. Keep in mind, the USDA recently lowered the U.S. season-average farm price by -35 cents per bushel with the range now being from $7.65 to $10.15.

Despite the massive ending stock numbers being tossed around, the bulls continue to talk about strong demand for new-crop soybeans, and perhaps China booking more U.S. new-crop shipments than the market has currently given credit.

From a technical perspective, bulls were happy to see the soybean market trade back above its 50-day moving average yesterday. I suspect there will be even more optimism if we can eventually close back above $9.00 per bushel. It still feels like there are a couple of pockets of stiff resistance in the NOV18 contract. The first between $8.85 and $8.90 and next between $9.10 and $9.20 per bushel.

On the downside, it seems like nearby support is in the $8.50 to 8.60 range. A bit more longer-term is the most recent low, set back in mid-July, down at $8.26^2.

As for today, the trade will be wanting to see the latest NOPA crush data, where most are expecting to see the July numbers set another monthly record. The previous record for the month of July happened in 2016 with an estimate of 145.23 million bushels.

The trade is thinking we will see something north of +161.00 million bushels for July of 2018.

About the Author(s)

You May Also Like