Tightening 2020/21 U.S. and South American corn and soybean production estimates led USDA to slash global ending stocks, powering price growth in the aftermath of USDA’s January 2021 World Agricultural Supply and Demand Estimates (WASDE) reports this morning.

Higher-than-expected corn usage rates in late 2020 also depleted U.S. corn supplies more than the market was estimating. 2020/21 winter wheat sowings came in smaller than trade estimates, and the Argentine crop shrunk, lending support to the wheat complex. All told, corn, soybeans and wheat contracts all carved out double-digit gains immediately following the report’s release.

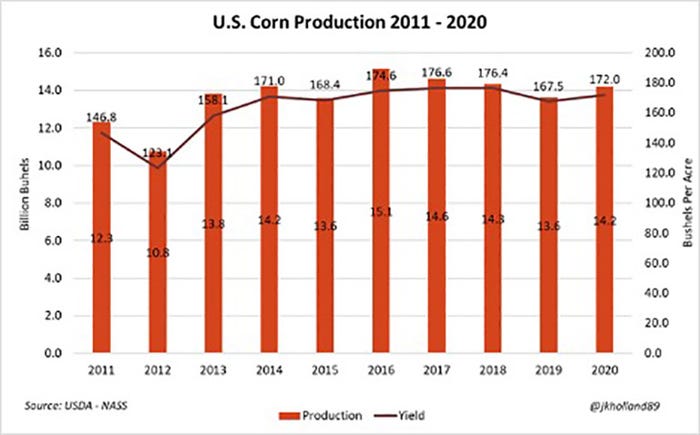

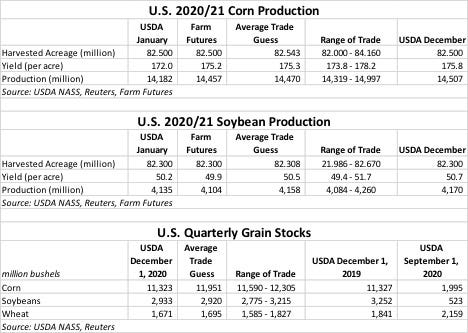

USDA’s estimates for 2020 U.S. corn yields fell sharply lower, dropping from 175.8 bushels per acre in November all the way down to 172 bpa in today’s report. Analysts were expecting a decrease but had offered an average trade guess of 175.3 bpa. That also lowers the agency’s estimates for total production from 14.507 billion bushels down to 14.182 billion bushels. Despite the cuts, 2020 corn yields were still the fourth-highest on record, and production was the fifth-highest ever.

“Corn bulls just got the feed they need,” says Farm Futures grain market analyst Jacquie Holland. “Even amid domestic demand reductions to livestock feed, ethanol, and – surprisingly – exports, the 3.2 bushel per acre cut to 2020 yields erased 151 million bushels from 2020/21 ending stocks.”

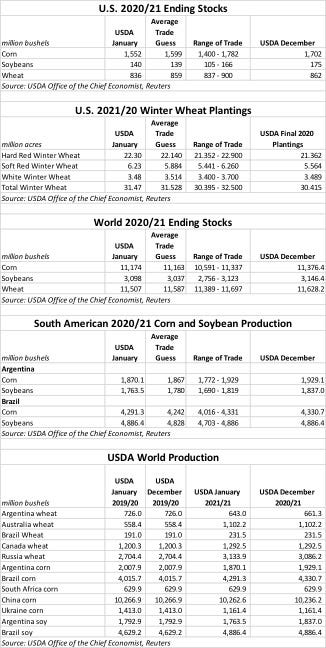

Total corn use fell 250 million bushels lower, falling to 14.575 billion bushels. USDA also lowered exports by 100 million bushels, citing “sharply lower supplies and higher expected prices.” Feed and residual use also fell 50 million bushels to 5.650 billion bushels. Supplies fell more than use, however, so corn stocks dropped 150 million bushels to 1.552 billion bushels. That was mostly in line (but slightly lower) than the average trade guess of 1.559 billion bushels.

“U.S. corn supplies are now at their tightest level since the 2013/14 marketing year,” Holland says. “It was the rally farmers across the Heartland have been waiting for as local grain sales dried up over the past week in anticipation for tightened corn stocks.”

USDA also once again raised its season-average farm price estimates, which are now at $4.20 per bushel.

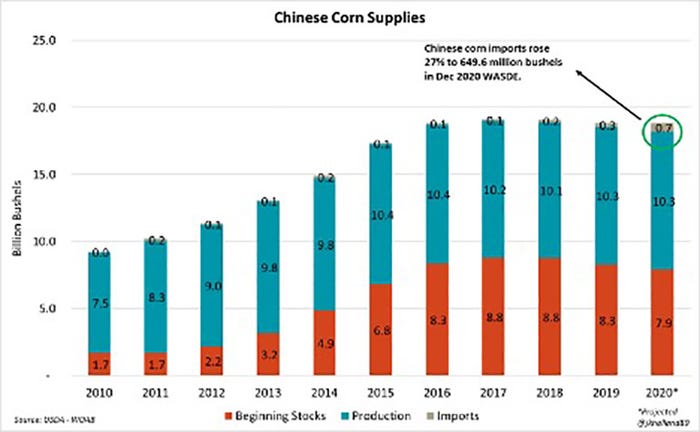

Global corn production also fell by 9.3 million metric tons to 1,438.5 MMT. Foreign production fell after USDA pegged declines in South America that more than offset increases in China and India. Global corn stocks were also down, falling 5.1 MMT to 283.8 MMT. Brazil and Argentina corn production each spilled lower, moving to 4.291 billion bushels and 1.870 billion bushels, respectively.

“USDA has more than doubled projections on Chinese corn imports past four months, adding another 39.4 million bushels to their forecast this month,” Holland notes. “The increase came amid higher production estimates from China in 2020/21, which paints an increasingly desperate picture for Chinese livestock feeders searching for cheap sources of feed. And that bodes very well for U.S. corn growers, as evidenced by the current rally.”

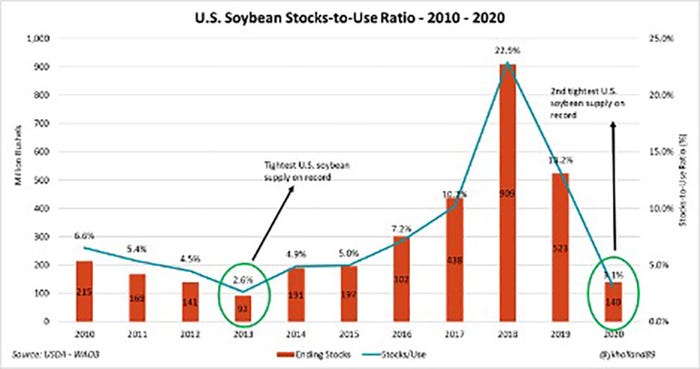

USDA’s estimates for soybean yields fell from 50.7 bushels per acre in November down to 50.2 bpa. Trade estimates were a bit higher, at 50.5 bpa. Production estimates also moved lower, from 4.170 billion bushels in November down to 4.135 billion bushels – also dropping below trade estimates of 4.158 billion bushels. USDA noted in particular reductions for Minnesota, Iowa and Kansas.

With higher beginning stocks and improved exports, supplies fell another 14 million bushels lower. That, along with an uptick in use, pushed ending stocks down to 140 million bushels – mostly in line with the average trade guess of 139 million bushels.

“Though residual usage was cut for the 2020/21 year and 20 million bushels of imports were added to the U.S. soy balance sheet, ending soybean stocks shrunk even more as export and domestic crushing demand increased,” Holland says. “U.S. soybean supplies remain at their second tightest level on record as strong global and domestic demand sends global buyers scrambling for our grain.”

Prices remain bullish, with USDA moving the average farm price for 2020/21 to $11.15 per bushel, jumping 60 cents higher than the agency’s prior estimates. Soymeal prices rose $20 per short ton to reach $390, and soyoil prices are now forecasted at 38.5 cents per pound, up 2.5 cents.

For wheat, quarterly stocks fell from 2.159 billion bushels on September 1 down to 1.671 billion bushels on December 1. Analysts didn’t predict a big-enough drop, with the average trade guess at 1.695 billion bushels.

Projected 2020/21 ending wheat stocks fell another 26 million bushels to 836 million bushels, meantime. That’s 19% lower than the same point a year ago.

“Global and domestic livestock feed demand for wheat continues to build amid rising corn prices,” Holland says. “And after today, that trend is only likely to increase. Despite a seasonal slowdown in U.S. wheat exports, a weak dollar and tight Russian exportable supplies convinced USDA to increase their demand targets on both exports and livestock feed for wheat.”

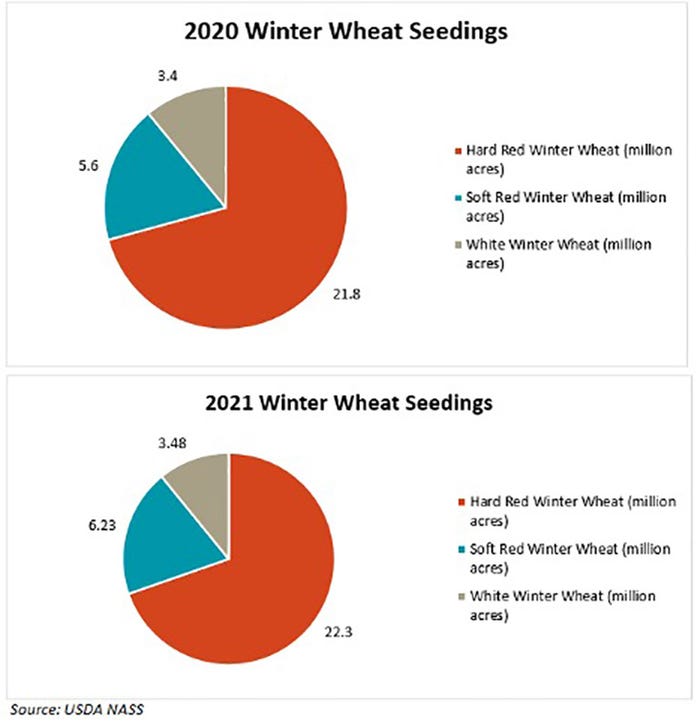

Winter wheat plantings moved higher than expected, jumping to 31.991 million acres. Analysts expected a big jump but still only offered an average trade guess of 31.528 million acres. Hard red winter plantings account for more than half of that total, with an expected 22.3 million acres. Soft red winter wheat (6.23 million acres) and white winter wheat (3.48 million acres) picked up the remainder.

“Even with more 2020/21 winter wheat acres in the U.S., doubts are now floating about whether the increased acreage will be enough to satisfy demand,” Holland says.

Season-average farm prices improved another 15 cents per bushel to reach $4.85, “based on NAAS prices reported to date and expectations for futures and cash prices for the remainder of the year,” according to USDA.

The agency’s 2020/21 global wheat outlook calls for smaller supplies, improved consumption, higher exports and lower stocks. Russian production is expected to move another 66 million bushels higher to reach a record 3.134 billion bushels. However, that boost is more than offset by falling production estimates for China, and in Argentina, where production is now predicted to fall to a five-year low.

About the Author(s)

You May Also Like