USDA’s February 2021 World Agricultural Supply and Demand Estimates (WASDE) report surprised markets – but not quite in the way everyone expected. Domestic corn and soybean supplies tightened on rising exports to China, but global corn and soybean production is forecast to reap strong yields despite dry global growing conditions.

With increased domestic usage largely baked into prices, the lack of adjustment to South American supplies sent corn futures prices over 1% lower in the moments following the report’s release. Soybean futures posted fractional gains, while wheat futures fell 1% on increased global supplies.

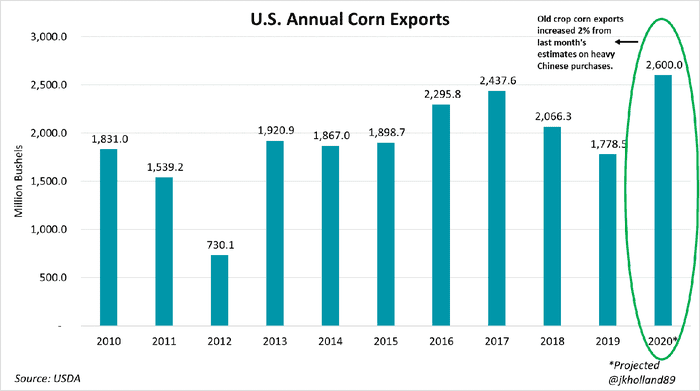

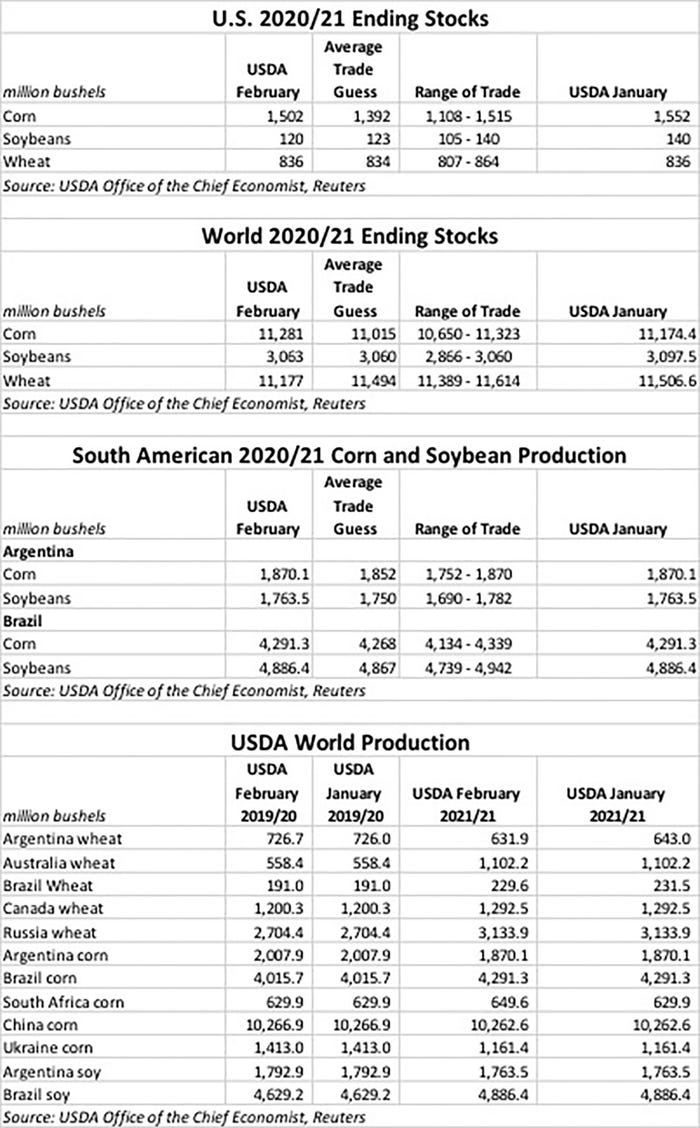

USDA trimmed 2020/21 U.S. corn ending stocks by another 50 million bushels from its January estimates, spilling down to 1.502 billion bushels. Still, that was still notably higher than the average trade guess of 1.392 billion bushels. The agency largely attributed this decline to a flurry of large corn sales to China last month.

“Chinese and unknown buyers have booked nearly 260 million sales of old crop U.S. corn export shipments in the past month, offsetting weak ethanol demand to send prices rising to seven-and-a-half-year highs over the past couple weeks,” according to Farm Futures grain market analyst Jacquie Holland.

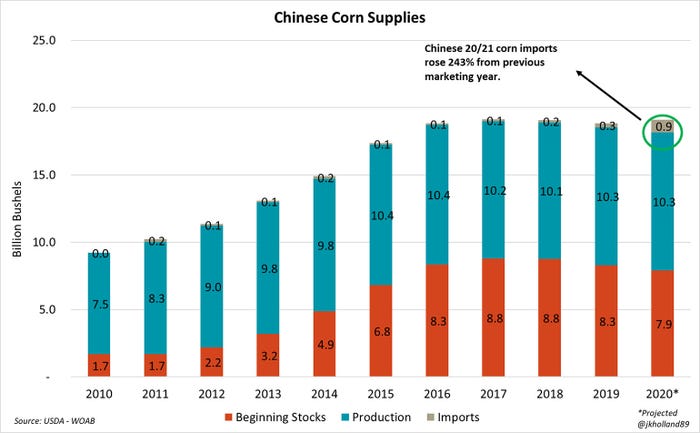

“USDA’s 2020/21 estimates for Chinese corn imports have more than tripled since the October 2020 WASDE report, rising to 944.9 million bushels,” Holland points out. “The estimate is 78 million bushels higher than a recent USDA attaché report. It is a sure sign that Chinese demand for corn will remain exceptionally high in the months to come, especially as livestock demand for feed grows as the nation increases its appetite for meat.”

USDA now notes an average farm price of $4.30 per bushel this marketing year, moving 10 cents higher since January.

USDA slightly raised its estimates for global corn production, now at 1.439 billion metric tons. The agency assumes more production, less consumption and higher ending stocks vs. January. However, USDA also notes an uptick in corn exports for the U.S., India and South Africa. For imports, increases to China have partially offset reductions to the EU, South Korea, India, Saudi Arabia and Turkey. Global ending stocks are up modestly from January, reaching 11.281 billion bushels.

Production in South America held steady, although analysts expected to see some declines from a month ago. That leaves Brazilian estimates at 4.291 billion bushels, with Argentina’s production remaining at 1.870 billion bushels.

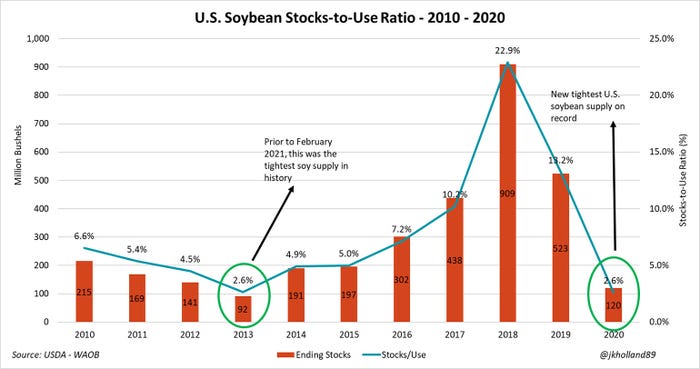

For soybeans, USDA raised its estimates for 2020/21 exports by another 20 million bushels, reaching 2.25 billion bushels. With no changes to crushing levels, that leaves ending stocks down another 20 million bushels to 120 million bushels – falling to the lowest level since 2013/14 and tumbling 77% from a year ago. It was also slightly below the average trade guess of 123 million bushels.

“Exports are the highest volume on record and over a third higher than 2019/20 loading paces,” Holland says.“But some U.S. suppliers could run low on – or even out of – soybeans before harvest begins this fall. The revised export number, due in large part to shipping delays in Brazil, will squeeze U.S. supplies to the tightest level on record. The stocks to use ratio for U.S. soybeans sank from 3.6% in last month’s WASDE report to 2.6%, narrowly besting 2013/14 supplies as the tightest on record.”

USDA left its season-average farm price for soybeans unchanged this month, at $11.15 per bushel.

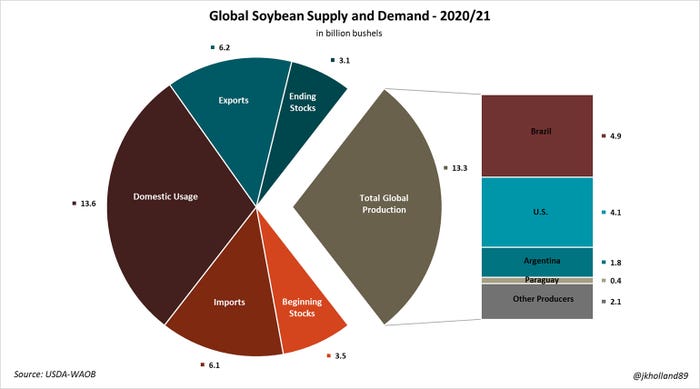

Globally, soybean ending stocks for 2020/21 also took a spill, falling to 3.063 billion bushels, mostly in line with trade estimates and down more than 34 million bushels from a month ago.

South American production estimates remained stable. Brazilian estimates remain at 4.886 billion bushels, with Argentina’s production still at 1.764 billion bushels. Analysts were expecting to see a small decline for both countries.

“Heavy rains over the past month and increased acreage mitigate potential yield losses due to dry weather from La Niña climate patterns earlier this winter,” Holland says. “The market was expecting a little more news on this front and was subsequently disappointed at the lack of revisions.”

2020/21 U.S. wheat stocks remained steady, meantime, with 836 million bushels. Analysts were expecting a modest decline, with an average trade guess of 834 million bushels. The agency still upped its season-average farm price by another 15 cents this month, to $5.00 per bushel, “based on NASS prices reported to date and expectations for futures and cash prices for the remainder of the marketing year.”

World ending stocks for wheat saw a moderate decline, in contrast, moving from 11.507 billion bushels in January down to 11.177 billion bushels this month. That was a sharper drop than analysts expected, with an average trade guess of 11.494 billion bushels.

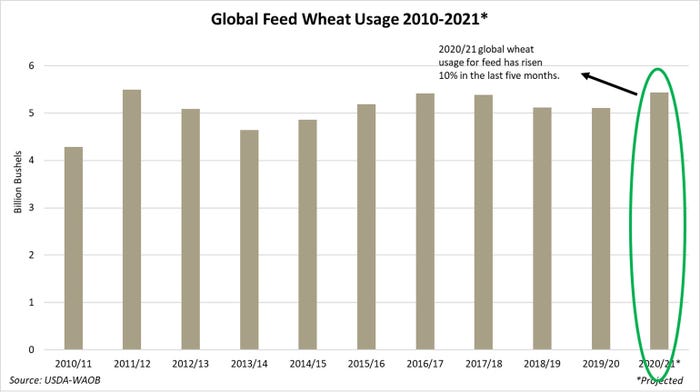

“Despite a fifth straight month of increasing global wheat usage estimates for livestock feed, wheat prices fell largely due to increased supplies in Kazakhstan as well as a recent uptick in Chinese auctions of state wheat reserves,” Holland says. “The pandemic trend of global wheat hoarding will leave China with 51% of the world’s wheat reserves by the end of 2020/21.”

About the Author(s)

You May Also Like