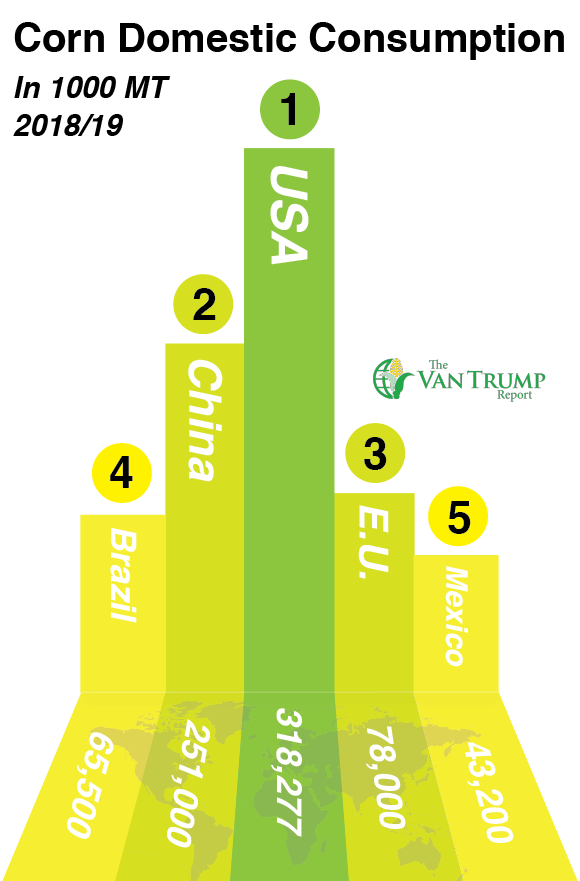

Corn prices are up a bit this morning, with the DEC18 contract back above $3.80. Prices eased a bit yesterday on renewed worries about trade, a slightly improved and more cooperative U.S. weather forecast, and a pullback in the macro space, i.e. oil prices falling under a little nearby pressure. I continue to hear private traders using corn crop product estimates with a yield averaging between 177 and 180 bushels per acre. Bulls continue to talk about strong U.S. demand for corn. U.S. exports remain robust and demand for U.S. ethanol also remains strong.

There's also a massive livestock herd that is providing strong demand for corn. From a technical perspective, the DEC18 contract has run into stiff nearby resistance up around $3.90. From there the trade sees additional hurdles at the $4.00 and $4.20 range. As a producer, this is not a period of time when we want to stick our head in the ground and "hope" for higher prices. I've been saying the past few weeks that we must pivot and switch our attention from being so heavily price oriented to paying more attention to total estimated revenue per acre based on our most updated yield estimates on the farm.

For some, the combination of increased yields, lower prices on the board and steady to stronger basis is actually more of a winner than a few weeks back. As a spec, I continue to see the market as somewhat rangebound, from $3.70 to $4.10 sounds very realistic. A win with NAFTA and some weather worries could certainly get us back north of $4.00. A continued delay in NAFTA and cooperative weather, we probably drift sideways to lower. I still say "demand" alone has a tough time doing all of the lifting.

About the Author(s)

You May Also Like