Corn traders are eagerly awaiting today's USDA update. Most sources in the trade continue to look for the USDA to lower their corn yield from last months record large estimate of 178.4 bushels per acre. I might be the odd man out, but I'm just not on the same page. As I've mentioned the past few days, it's just tough for me to believe the USDA would take such a big and bold step in the August report, bumping the yield higher by a massive +4.4 bushels per acre, then turning right around and lowering the estimate.

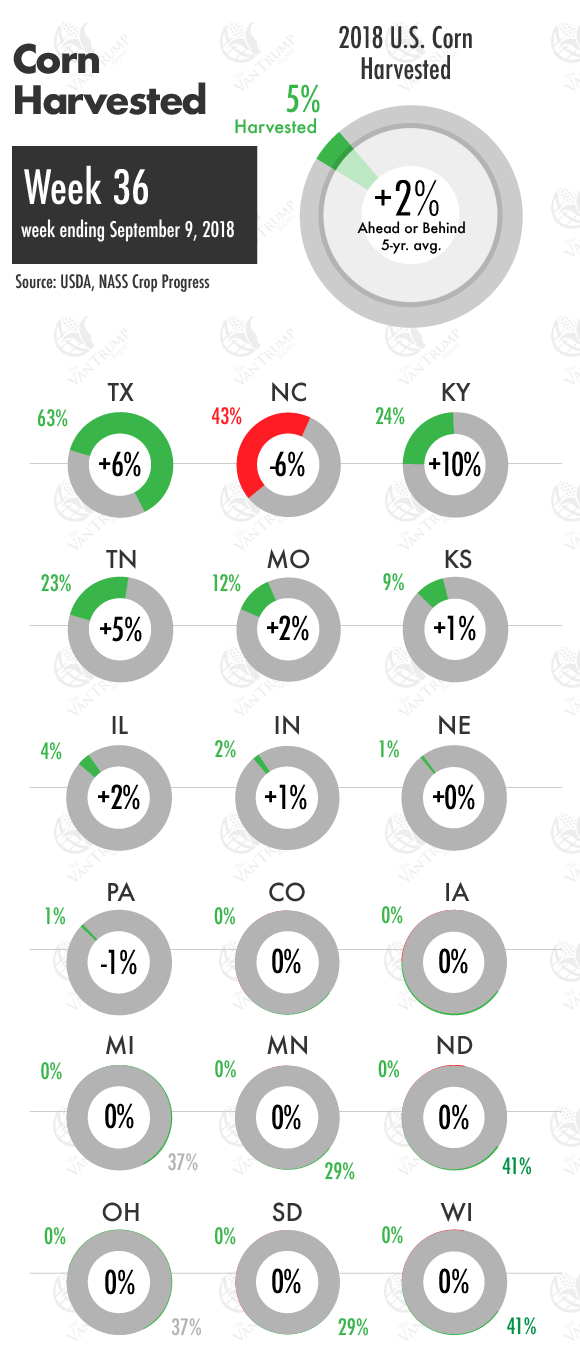

I can certainly see the argument from a traditional fundamental perspective, as crop-conditions in several parts of the nation have deteriorated since the August report. The most recent data shows the USDA lowering their overall crop-condition rating from 71% rated GD/EX ahead of the August report, down to 68% ahead of the September report. States showing the largest drop in GD/EX conditions are: North Dakota down -22% from the August 5th report to the September 9th report; South Dakota and Wisconsin down -6%; Illinois down -4%; Nebraska down -3%; Iowa, Kansas and Texas down -2%; Minnesota and Colorado down -1%.

States showing the largest gains in GD/EX conditions are: North Carolina +6% from the August 5th report to the September 9th report; Kentucky +5%; Michigan +4%; Ohio +3%; Missouri +2%; Indian up +1%; Pennsylvanian and Tennessee "unchanged". Yes, I can understand why many suspect the overall yield could be trimmed a bit, but at the same time that doesn't necessarily mean it's going to happen. I think we stay "unchanged."

Bulls also argue that corn used for exports and ethanol demand should be raised higher. I agree, but similar to the yield estimate, I'm just not 100% sold on the fact the adjustment will happen in this report. Bottom-line, most inside the trade are looking for a bullish report, via the USDA lowering yield and raising their demand estimates. I just have a hard time seeing it happen in this report. Hence the reason I still believe we haven't seen the lows put in place. The DEC18 new-crop contract low was posted back on July 12th at $3.50^2.

I believe with cooperating weather from pollination to harvest, which we have seen, historically mid-July feels a bit early to see a low being posted, especially with some of the macro headwinds currently in play. I believe nearby we stay somewhat range-bound, grind slowly lower, then start to climb our way out of the hole post-harvest and into the new year. Staying extremely patient as a producer. As a spec, I'm looking to start building a longer-term bullish spec position at sub-$3.50 levels.

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

About the Author(s)

You May Also Like