Soybean bulls are talking about a few cargoes of old-crop U.S. beans loading and moving to China and the pace of harvest in big production states like Iowa and Minnesota falling to over -30% behind their historical pace.

Bulls hope these fresh new headlines can help hold and build on the recent gains. Prices are up around +80 cents from the most recent lows.

As a producer, I took advantage of the recent rally and decided to eliminate some additional price-risk. I purchased the JUL19 $9.00 puts to build a longer-term floor and at the same time priced another 10% of my production with the JAN19 contract trading north of $9.00 per bushel.

I also went ahead and pulled the trigger on reducing some of our estimated 2019 price risk. I priced my first round with NOV19 prices trading just under $9.50 per bushel. I also hedged another small percent in order to reduce further downside risk.

The back-end of the market is offering some opportunity to reduce some of our longer-term exposure should the Chinese trade negations play out longer than anticipated. I'm just a little nervous longer-term with the balance sheet being so burdensome at over +880 million bushels.

We also have to remember, South America is getting fairly cooperative weather and Brazil is planting a record number of acres.

The USDA showed crop-conditions here in the U.S. deteriorating from 68% down to 66% rated GD/EX. Despite the recent reduction, this is still much better than last years 61% rated GD/EX.

States showing weekly deterioration were: Iowa, Kansas and Ohio -5%, Missouri and Tennessee -4%, Arkansas -3%, Kentucky, Minnesota, Nebraska, and South Dakota -2%, Indiana and Wisconsin -1%.

States left "unchanged" on the week are: Illinois, Louisiana, Michigan, and Mississippi.

The only state showing improvement was North Carolina.

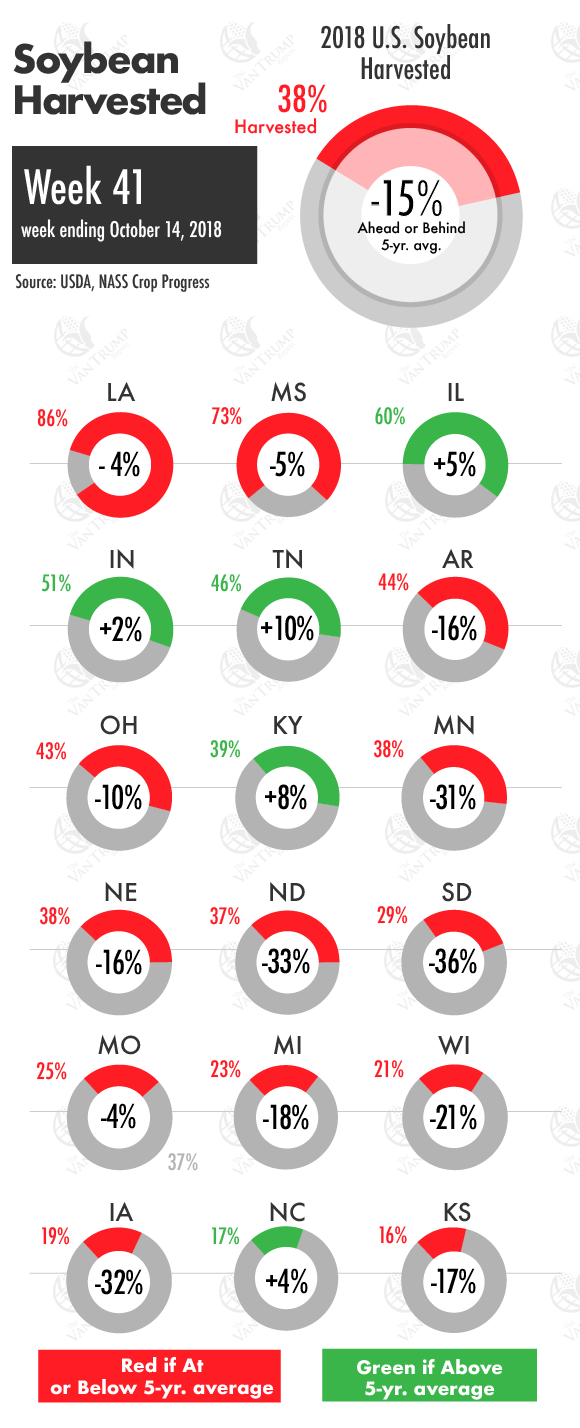

Harvest was reported at just 38% complete vs. the 5-year average of 53%.

States the furthest behind their 5-year historical harvest pace are: South Dakota -36% behind, North Dakota -33% behind, Iowa -32% behind, Minnesota -31%, Wisconsin -21%, Michigan -18%, Kansas -17%, Arkansas and Nebraska -16%, Ohio -10%, Mississippi -5%, Louisiana and Missouri -4%.

States with harvest running slightly ahead are: Illinois, Indiana, Kentucky, North Carolina, and Tennessee.

The NOPA September soy crush was reported at a record 160.8 million bushels vs. last years 136.4 million bushels.

Weekly soybean export inspections were also much stronger than most were forecasting.

Bottom-line, demand has caught a couple of bullish headlines and rough weather is complicating the U.S. harvest. I like the thought of reducing price risk and rewarding the rally. As a spec, I remain patient not wanting to chase the market higher and not wanting to play the short side.

To gain more insights for your operation, click HERE for a FREE TRIAL of the Van Trump Report.

About the Author(s)

You May Also Like