Grain futures are lower this morning, paced by selling in corn after USDA reported much larger than expected March 1 inventories and prospective plantings.

“Today’s USDA reports gave corn a double dose of bearish news that was enough to drag wheat and soybeans lower too, even though the numbers for those crops were a bit friendly,” according to Farm Futures senior grain market analyst Bryce Knorr.

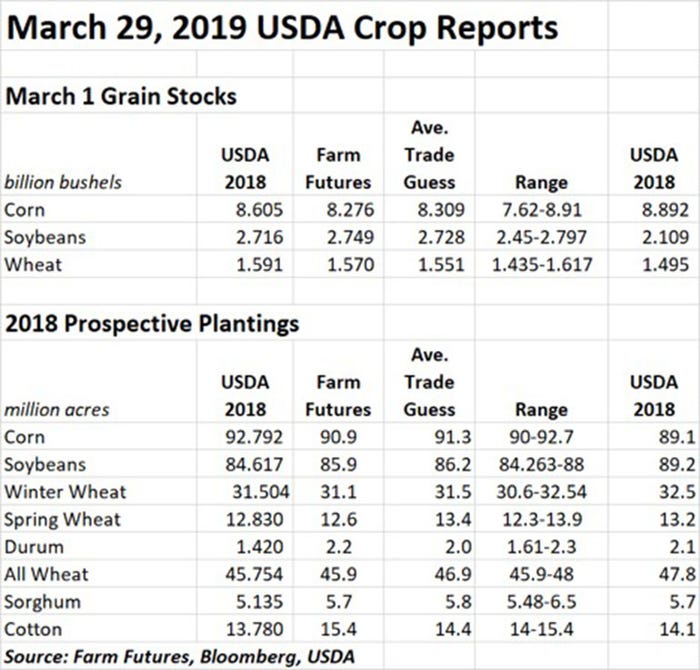

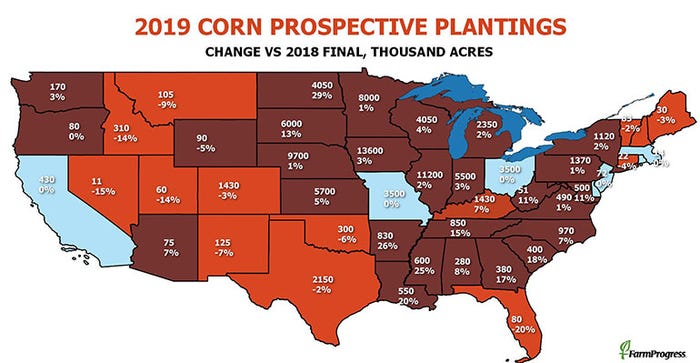

USDA expects 2019 corn acres to top 92.792 million acres this year. As expected, that number surpassed 2018’s total of 89.1 million acres. But the agency’s expectations are moderately above analysts guesses, providing an average estimate of 91.3 million acres.

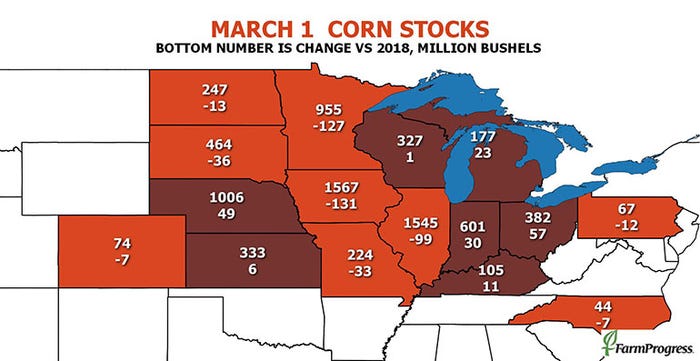

USDA is calling for smaller corn stocks, moving from 8.892 billion bushels down to 8.605 billion bushels. But this estimate is much more aggressive than analysts anticipated after offering an average guess of 8.309 billion bushels.

Farm Futures, which regularly participates in these analyst surveys ahead of key USDA reports, included estimates of 90.9 million acres and 8.276 billion bushels.

“The government’s grain stocks and prospective plantings estimate for corn adds more than 600 million bushels of potential supply to the market, which could disrupt the friendly dynamics that appeared to be developing into the 2019 marketing year,” Knorr says. “Of course, there are plenty of questions about whether farmers will actually be able to plant all the acres USDA found.”

That’s because USDA collected its data during the first two weeks of March. But the Farm Futures survey, which found 1.9 million fewer acres, was conducted March 4 to 21, and may reflect some of the weather concerns that developed after the “bomb cyclone” March 13, Knorr says.

The huge grain stocks reported by the agency are another matter, however, Knorr adds.

“While some of this may be statistical noise – the mean error is 1.9%, or around 165 million bushels – those bushels will remain on the balance sheet for at least another three months and suggest much lower-than-normal feed usage over the winter,” he says. “This could knock another 175 million bushels or more off USDA estimate of total feed usage for the 2018 marketing year.”

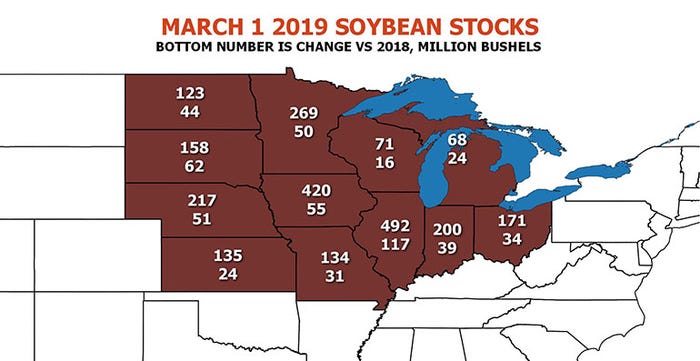

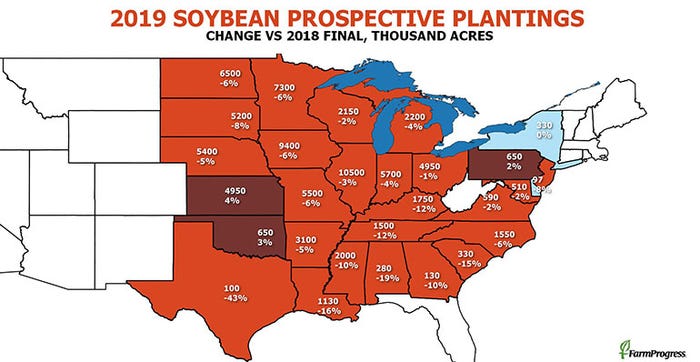

For soybeans, USDA is expecting an even bigger drop in acreage this year than analysts had previously anticipated, moving from last year’s total of 89.2 million acres all the way down to 84.617 million acres. Analysts predicted a smaller drop with an average trade guess of 86.2 million acres, which included a Farm Futures estimate of 85.9 million acres.

“History suggests a 70% chance that farmers will plant more soybeans than USDA reported today, and that probability rises if the ratio of new crop soybean to corn futures keeps increasing as it is today,” Knorr says. “That’s one reason to be cautious about reading too much into either the stocks or acreage estimates. Soybean supplies are still very burdensome, with or without a China trade deal.”

Soybean stocks are expected to rise significantly, moving from 2.109 million bushels a year ago up to 2.716 billion bushels, per the latest USDA estimates. That figure was very close to analyst expectations, which offered an average trade guess of 2.728 billion bushels (including a Farm Futures estimate of 2.749 billion bushels).

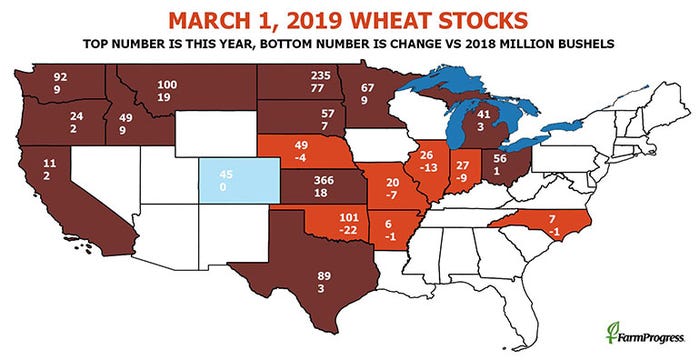

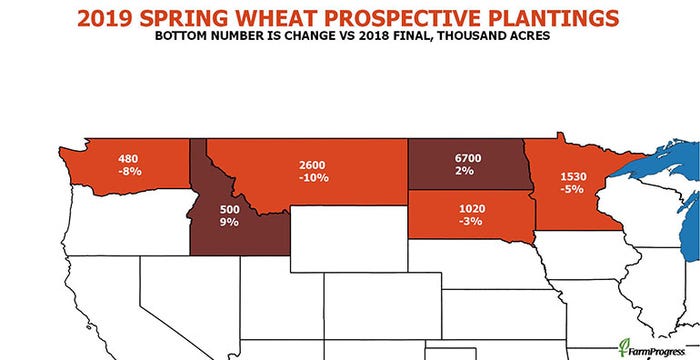

All-wheat plantings are also expected to take a dip this year, moving from 47.8 million acres in 2018 down to 45.754 million acres, as durum, winter and spring wheat acres are all expected to make moderate declines compared to a year ago.

But rising wheat stocks will continue to apply downward pressure to grain prices. Today’s USDA estimate of 1.591 billion bushels was even higher than the average trade guess of 1.551 billion bushels and a Farm Futures estimate of 1.570 billion bushels.

“Much of USDA’s lower wheat acreage estimate came in durum, which won’t have much impact on the market,” Knorr says. “State ratings for winter wheat put out this week show much of the crop in good condition, anyway. Plus, the higher-than-expected stocks reading suggests feed usage will wind up even less than anticipated.”

Farmers who are able to choose other row crops such as sorghum and cotton aren’t heavily investing in more acres there, either. For sorghum, USDA estimates that acreage this year will fall from 5.7 million acres in 2018 down to 5.135 million acres. And cotton acres are expected to fall from 2018’s tally of 14.1 million acres down to 13.780 million acres.

“Cotton prices are rising in the aftermath of this report and could draw some acres if the South ever dries out,” Knorr says. “But USDA also found fewer total acres – the same conclusion reached by our survey. Farmers are looking for alternatives to traditional crops wherever they can find them due to poor profit margins. That effort won’t be stopped by today’s reports.”

About the Author(s)

You May Also Like