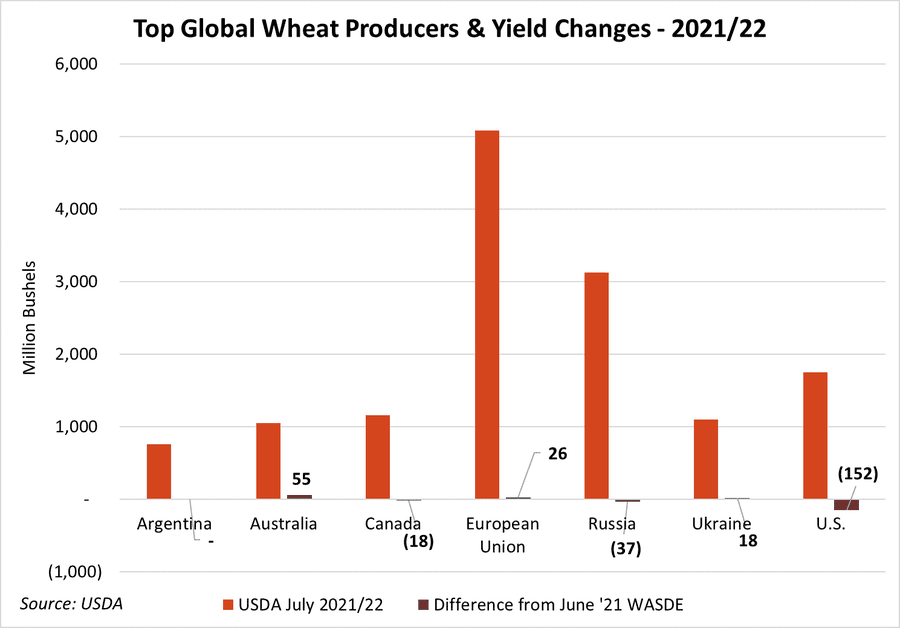

As drought continues to take a toll on spring wheat condition in the Northern Plains and quality issues begin to plague hard red winter wheat farmers in the Central and Southern Plains after bountiful rains in recent weeks, USDA took today’s monthly World Agricultural Supply and Demand Estimates (WASDE) report to focus on trimming domestic wheat output and usage.

USDA trimmed 152 million bushels, or 8%, from June 2021 production estimates to bring total U.S. wheat output in 2021/22 to 1.75 billion bushels. Futures contracts in Chicago, Kansas City and Minneapolis traded 1.5-2.5% higher as global stocks for the 2021/22 marketing year shrunk 1%.

A smaller-than-expected reduction to Brazil’s crop and larger-than-anticipated 2021 U.S. corn production erased some of the morning’s gains in the corn complex following the report’s release. U.S. soybean stocks remained unchanged for both the current and new crop marketing years, but high global production is likely to ease supply availability in the upcoming marketing season, paring the morning’s gains.

Corn

USDA’s outlook for corn this month calls for “larger supplies, greater feed and residual use, increased exports and higher ending stocks.” USDA is still projecting average yields at 179.5 bushels per acre, despite widespread weather concerns earlier in the season before stabilizing in recent weeks. The agency also expects production to improve by 175 million bushels based on more planted and harvested acres than was reported in its June 30 Acreage report.

“During June, harvested-area weighted precipitation for the major corn producing states was below normal but did not represent an extreme deviation from the 1988 to 2020 average,” USDA also notes in today’s report. “For much of the crop the critical pollination period will be during middle and late July and USDA will provide its first survey-based corn yield forecast of the season in the August 12 Crop Production report.”

Farm Futures grain market analyst Jacquie Holland points out that USDA’s June 30 Acreage and Quarterly Grain Stocks reports showed higher feed and residual disappearance as well as robust intentions for 2021/22 export sales. The 1.6-million-acre increase in 2021 corn acres added another 175 million bushels of production to 2021 estimates.

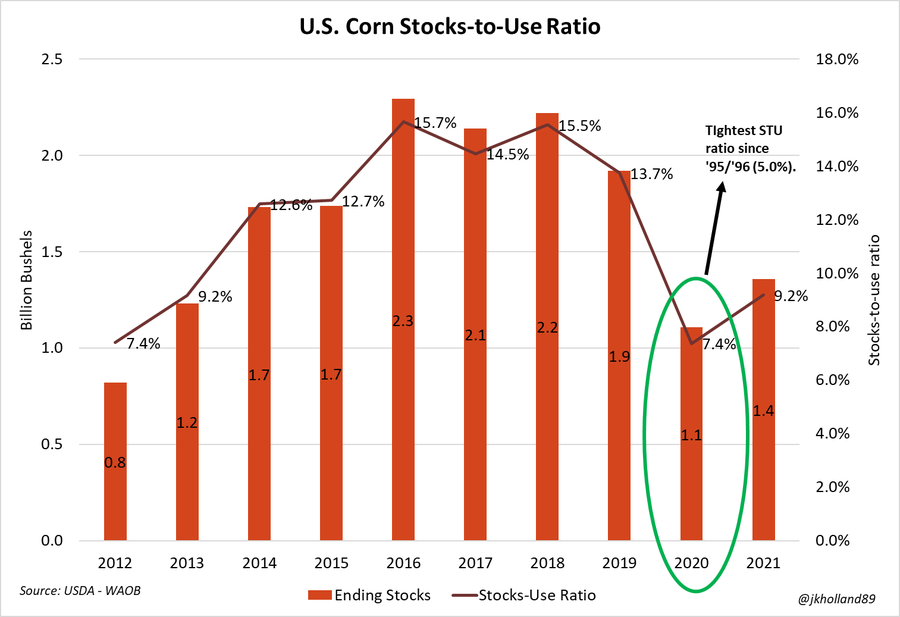

USDA also upped its export forecast by 50 million bushels, but even so, supplies are expected to rise more than usage, with 2021/22 ending stocks moving 75 million bushels higher. In contrast, current marketing year ending stocks eased 25 million bushels lower, to 1.082 billion bushels. The agency also tilted the season-average farm price 10 cents lower, to $5.60 per bushel.

“An additional 50 million bushels was allocated to new crop corn export shipments, based in large part on current record-breaking corn export demand,” Holland says. “The additional 2021 production is expected to ease pressure on old crop ending stocks, which will end the 2020/21 season as the second tightest on record.”

But prospects for 2021 provide more breathing room, adding an extra nine days of carryout to new crop ending stocks from the current year’s meager 26 days, Holland also notes.

World ending stocks for 2020/21 eased slightly, to 11.018 billion bushels. That was a bit higher than the average trade guess of 11.014 billion bushels. But world ending stocks for 2021/22 trended 70 million bushels higher, reaching 11.464 billion bushels – a reversal from trade estimates, which averaged 11.377 billion bushels.

Soybeans

USDA did not change its previous soybean production estimates of 4.4 billion bushels – largely consistent with analyst estimates of 4.394 billion bushels – with a stable harvested area of 86.7 million acres. Still, that’s 4.4 million more acres than U.S. farmers harvested last fall.

USDA lowered its forecast for soybean imports, crushings and exports. The agency notes “offsetting changes” for supply and demand. Ending stocks for 2020/21 and 2021/22 remain unchanged, at 135 million bushels and 155 million bushels, respectively. Analysts were hoping to see modest reductions for both of those numbers. The season-average farm price fell 20 cents to $11.05 per bushel.

“U.S. soybean production and usage were left largely unchanged in today’s WASDE report,” Holland says. “Smaller 2020/21 imports were offset by lower crush and export estimates in the late months of 2020/21 as Chinese demand shifts to Brazil and processors scramble to source what few old crop soybean bushels remain in the countryside.”

World ending stocks for 2020/21 soybeans improved from 3.233 billion bushels in June to 3.361 million bushels, bucking the average trade guess of 3.219 billion bushels. World ending stocks for 2021/22 also trended higher, moving from 3.400 billion bushels in June up to 3.472 billion bushels in today’s report.

Wheat

For wheat, USDA assumes reduced supplies, lower domestic use, fewer exports and lower ending stocks. The agency slashed all wheat production estimates by 152 million bushels to 1.746 billion bushels. All-wheat yield potential tumbled 4.9 bushels per acre lower, to a new average of 45.8 bpa.

Meantime, the agency dropped its projected exports to 875 million bushels, with feed and residual usage sliding to 170 million bushels. Ending stocks moved 105 million bushels lower, to 665 million bushels – spilling to the lowest levels since 2013/14. The season-average farm price improved by a dime, moving to $6.60 per bushel.

U.S. ending stocks for 2021/22 tumbled from 770 million bushels in June down to 665 million bushels in July. World ending stocks for 2021/22 also saw a decline, moving from 10.904 billion bushels a month ago down to 10.716 billion bushels.

“Wheat production shortfalls in several key producers paved the day for wheat’s breakout gains in today’s report,” Holland says. “While the European Union, Ukraine and Australia are all likely to have bumper wheat crops this year, weather headaches in the U.S., Canada and Russia will play a big role in shrinking global stocks during the 2021/22 marketing year.”

Tightened wheat supplies will likely draw down usage rates over the next year in the U.S., Holland adds. Though with a large corn crop still anticipated this fall, the tradeoff between corn and wheat in livestock rations – both at home and abroad – could continue to pit the two grains against one another, she says.

“Wheat exports will shrink to the lowest level since 2015/16 as white winter wheat crops in the Pacific Northwest roast in record-breaking heat in recent weeks,” Holland notes. “Some farmers estimate yield losses around 50% as parched crops wither in the heat. Quality concerns continue to rise with the thermometer as increasing protein levels in the maturing crop render white wheat supplies unfit for flour milling.”

White wheat’s low protein content makes it ideal for delicate pastries, noodles, and crackers. "The protein is so high that you can't use (it) for anything but cattle feed," Idaho wheat farmer Cordell Kress told Reuters in a report published overnight.

“Chinese millers expanded interest in white wheat over the past year, sending U.S. white wheat exports to an unprecedented 265 million bushels during the 2020/21 wheat marketing year,” Holland says. “Export hopes remain high at the onset of the 2021/22 season but could be limited if yields fall short.”

2021/22 U.S. Corn & Soybean Production |

million bushels |

Corn Production |

Corn Yield |

Soybean Production |

Soybean Yield |

Source: USDA Office of the Chief Economist, NASS, Reuters |

|

U.S. 2021/22 Wheat Production |

million bushels |

Hard Red Winter Wheat |

Soft Red Winter Wheat |

White Winter Wheat |

Total Winter Wheat |

Other Spring Wheat |

Durum |

All Wheat |

Source: USDA Office of the Chief Economist, Reuters |

|

U.S. 2020/21 Ending Stocks |

million bushels |

Corn |

Soybeans |

Source: USDA Office of the Chief Economist, Reuters |

|

U.S. 2021/22 Ending Stocks |

million bushels |

Corn |

Soybeans |

Wheat |

Source: USDA Office of the Chief Economist, Reuters |

|

World 2020/21 Ending Stocks |

million bushels |

Corn |

Soybeans |

Wheat |

Source: USDA Office of the Chief Economist, Reuters |

|

World 2021/22 Ending Stocks |

million bushels |

Corn |

Soybeans |

Wheat |

Source: USDA Office of the Chief Economist, Reuters |

|

South American 2020/21 Corn and Soybean Production |

million bushels |

Argentina |

Corn |

Soybeans |

Brazil |

Corn |

Soybeans |

Source: USDA Office of the Chief Economist, Reuters |

|

USDA World Production |

million bushels |

Argentina wheat |

Australia wheat |

Brazil Wheat |

Canada wheat |

Russia wheat |

Argentina corn |

Brazil corn |

South Africa corn |

China corn |

Ukraine corn |

Argentina soy |

Brazil soy |

Source: USDA Office of the Chief Economist, Reuters |

Read more about:

WASDEAbout the Author(s)

You May Also Like