Commodity funds have a reputation for gunslinging. But the hot money showed a cautious streak in the last days of October, waiting for a series of key events.

Here’s what funds were up to through Tuesday, October 29, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Selective hedgers

Big speculators aggressively covered short positions in crops and livestock during September and much of October. But that streak ended this week when hedge funds overall kept their modest bearish bets little changed. For the week they added 343 shorts, though investors gaining exposure to commodities through index funds were modest buyers again.

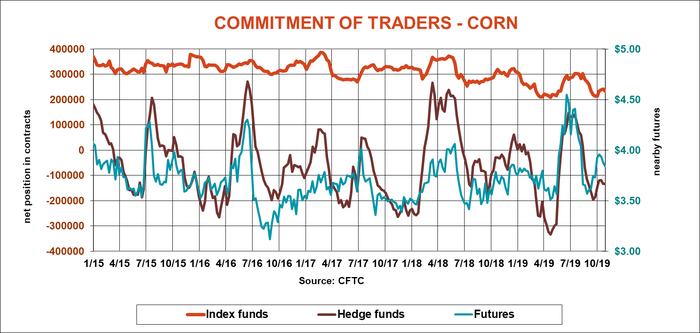

Waiting for harvest

Big speculators added just 686 contracts to their bearish bet on corn this week, preferring to sit on the sidelines as weather stalled harvest.

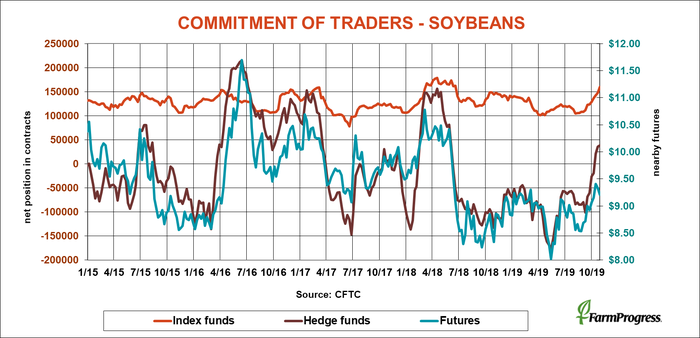

Still bullish

Big speculators also didn’t do a whole lot in soybeans this week, but they were still small buyers even as prices came under pressure. In all the hedge funds added 3,057 contracts to their small bullish bet on beans.

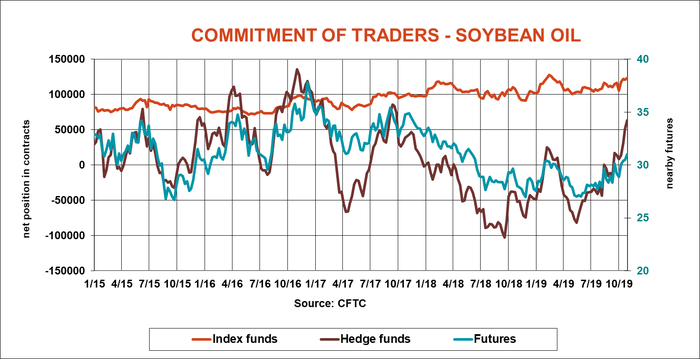

Oily exception

Vegetable oil markets were on fire this week in Asia and big speculators joined the party in soybean oil. Hedge funds extended bullish bets to the largest level in two years, buying another 11,615 contracts.

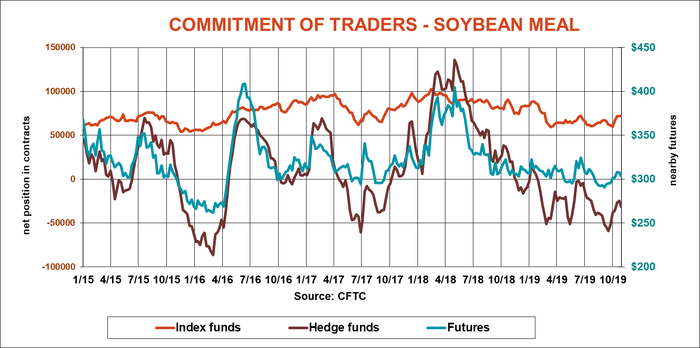

Short end of the stick

The only part of the soy complex not to see buying this week was soybean meal. Big speculators added another 7,329 contracts to their modest bearish bet against the product.

Selling again

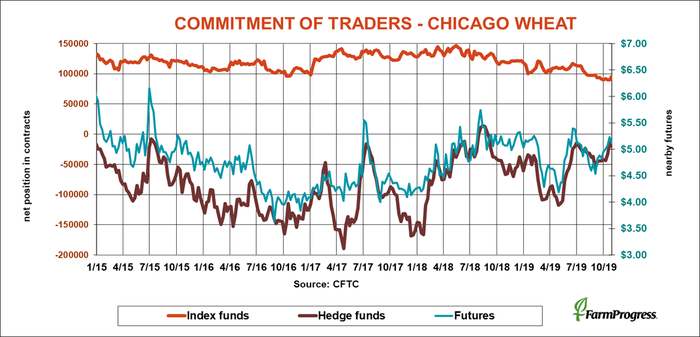

Just when it looked like big speculators might be ready to turn bullish of soft red winter wheat, the fast money reversed again. Hedge funds added 7,617 contracts on to their small net short position.

Hard times

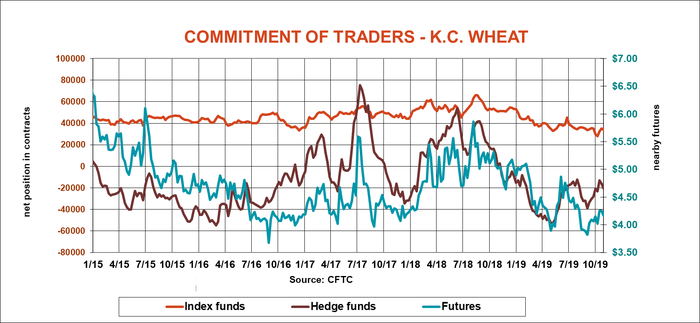

Big speculators continue to go back and forth in their hard red winter wheat position, but it was back again this week. Hedge funds added 4,579 contracts to their bearish bets.

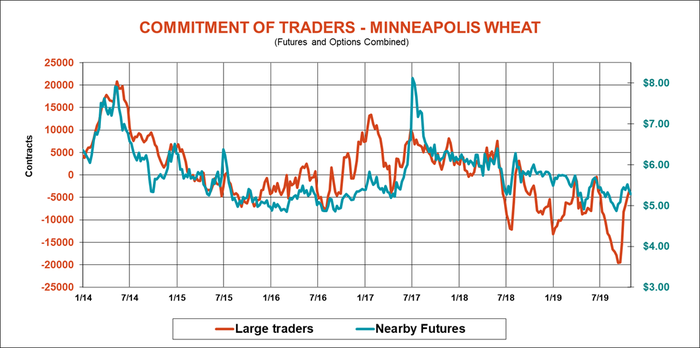

End of the line

After covering bearish bets aggressively in spring wheat, large traders started selling again this week, adding 504 contracts on to their net short position.

Check please

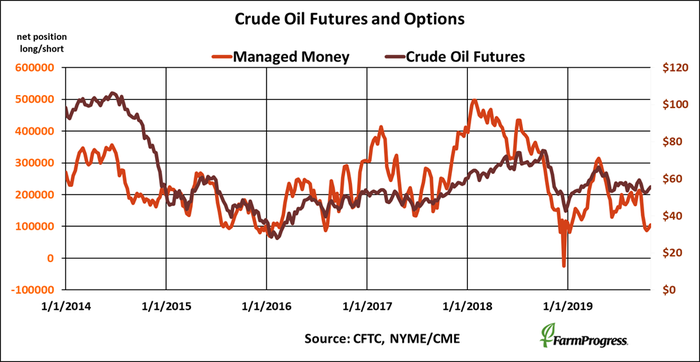

The crude oil market has bounced around lately between bullish and bearish expectations. But money manager helped stabilize prices by buying again this week, added $600 million worth of futures and options.

About the Author(s)

You May Also Like