Traders had plenty of reasons for standing on the sidelines recently, including the Independence Day holiday and July 11 USDA report. Not surprisingly, that just where they put their money too.

Here’s what funds were up to through Tuesday, July 9, when the CFTC collected data for its latest Commitment of Traders.

![]()

More of the same

Big speculators went into the USDA reports doing more of what they had been doing, buying stuff they were bullish on and selling contracts they were bearish. The net result was to add 18,915 contracts to their small net short position in crops and livestock.

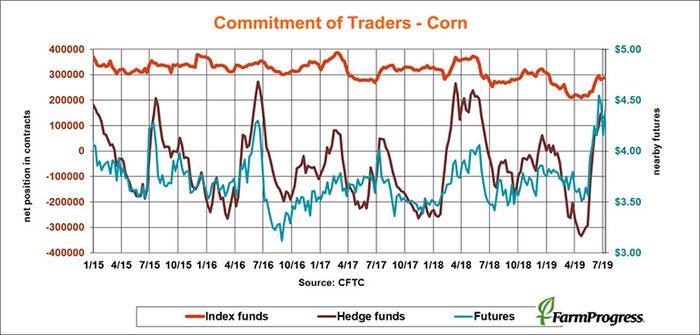

Neutral gear

Big speculators didn’t do much in corn as they waited for the USDA’s reports, buying only a net 226 lots through Tuesday according to the CFTC tally.

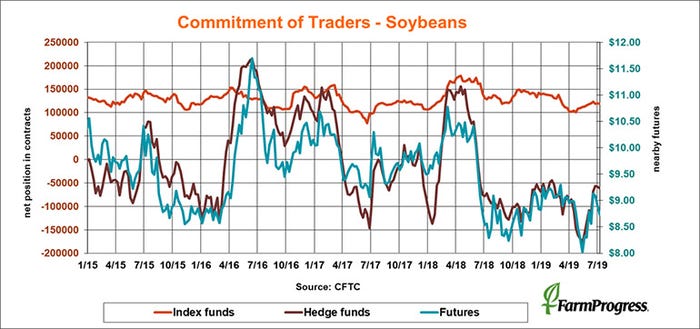

Wrong side

Big speculators in soybeans leaned the wrong way into the USDA reports, selling a net 4,l119 contracts to take their short position to 62,103.

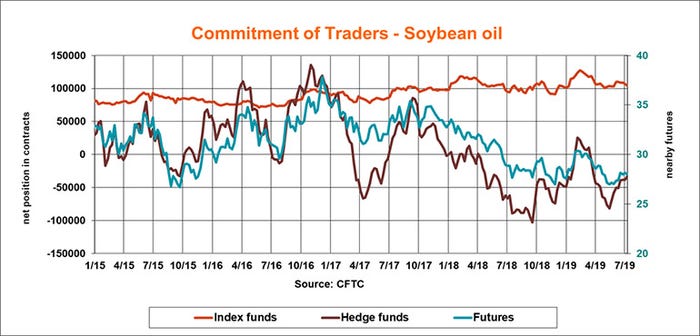

Right stuff

While palm oil futures made new contract lows this week in Malaysia, soybean oil fared better. In the U.S. futures got help from big speculators, who covered 4,446 of their bearish bets.

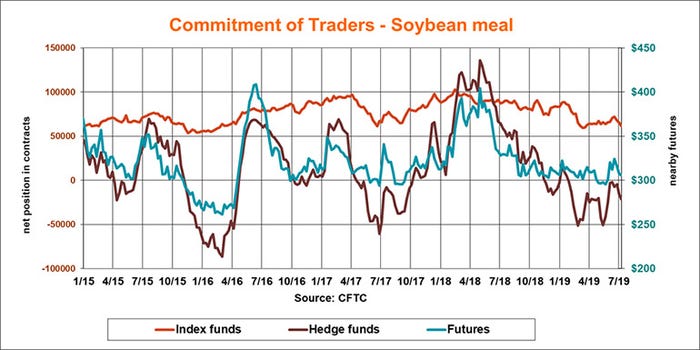

Crushed hopes

Big speculators sold soybean meal this week, adding 5,359 contracts to their small bearish bet traders believe crush is slowing down.

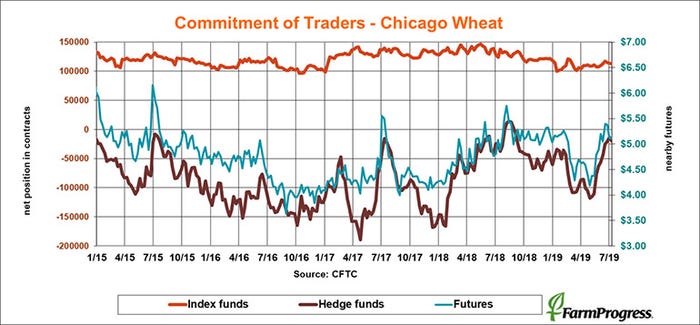

No confidence

After covering most of their bearish bets on soft red winter wheat in June, big speculators started selling again in July. That turned out to be the wrong play as futures rallied sharply after the USDA report.

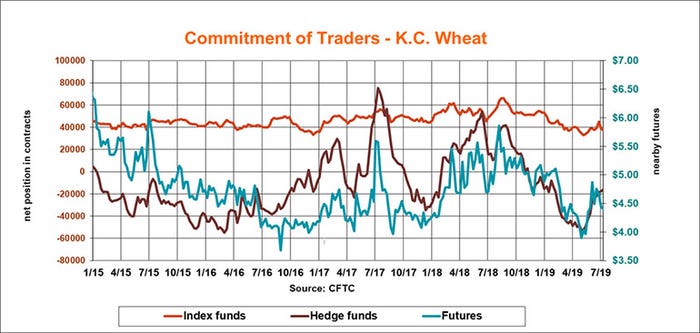

Cheap stuff

HRW futures sold at a steep discount to other contracts, but big speculators tried to narrow the spread a little this week, buying a net 1,231 contracts. USDA raised its estimate of HRW production, justifying the wide spreads.

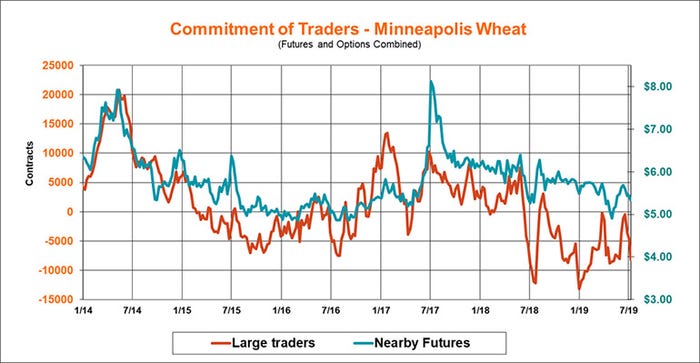

Sad trombone

With the spring wheat crop in good shape, large non-commercial traders sold Minneapolis futures this week. After all who wants to be long into harvest, so they sold a net 3,635 contracts, increasing bearish bets right before the market rallied.

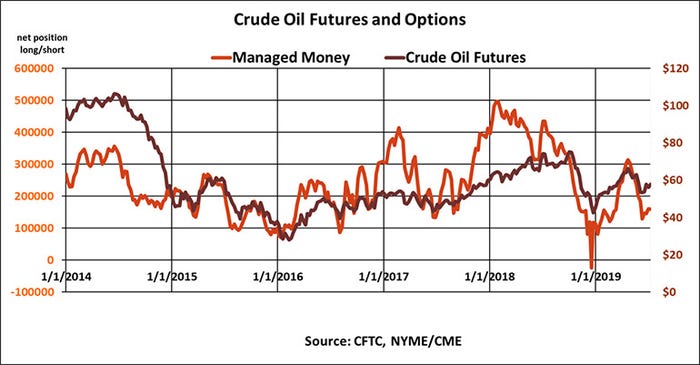

Out of gas

Money managers took profits on long positions in crude oil this week, selling $151 million in futures and options – just in time for prices to rally back above $60 a barrel.

About the Author(s)

You May Also Like