With everyone focused on COVID-19 and hoarding toilet paper, I have not seen much mention of the U.S. dollar. In the last two weeks, the U.S. dollar has had one of its sharpest runs ever, making us question how high it can go.

The value of the dollar matters to U.S. farmers. Here’s why:

With all of the uncertainty in the world, the U.S. is still seen as the cleanest shirt in the dirty laundry pile. During turbulent markets, capital begins to assemble from around the world, searching for safe havens. The U.S. is still the safest bet, and money comes pumping in, pushing our currency higher. We are currently trading at the upper end of resistance levels just below 104. Why is this a problem? It makes our exports less competitive. While this makes products that are imported to the U.S. cheaper for consumers, at the same time it makes our exports more expensive.

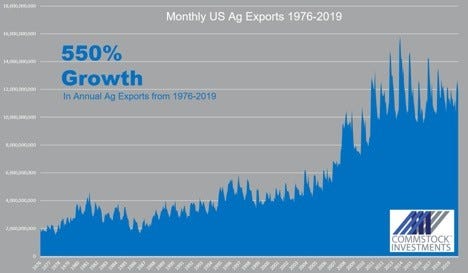

This has major implications for agriculture since we depend so much on exports.

While a strong U.S. dollar is not without positive implications, it is also the primary instigator that led to the 80’s farm crisis. In an attempt to kill inflation, interest rates were raised, and money came flooding into the country at unprecedented rates. Farm incomes collapsed along with land values.

While I don’t see anything quite as ominous as this taking place, it should still be cause for concern. We owe much of our success to U.S. farm exports in the last 40 years. Economists have projected that for every point increase in the dollar, corn values drop by over 2%.

I have read many conspiracy theories on social media about how China will now use this virus as an opportunity to purchase commodities at a cheaper rate. It is not that simple. History has shown that anytime there is a global meltdown, capital seeks out the U.S., and the U.S. dollar spikes. This would only make our grain more expensive for them to buy, and potentially make our competitor’s grain cheaper.

Brazil’s golden era

Corn and beans are a dollarized global commodity. That usually means when our currency strengthens, others weaken. And that is exactly what is happening in Brazil right now. As if it was not enough that Brazil is producing a record soybean crop expected to reach above 125 MMT, they are currently experiencing the highest prices ever recorded in the history of soybean cultivation!

It is the mirror opposite of what we see here in the U.S. Record production is typically followed by depressed prices. But Brazil continues to defy all odds.

Since soybeans are a global commodity traded in U.S. dollars, they are getting more for it in their local currency. The Brazilian real has weakened by roughly 20% since February 1st setting all-time lows. So, while Chinese buying power has diminished towards buying U.S. grain, it has done just the opposite when it comes to Brazil’s. This is why China would prefer to purchase grain from Brazil despite our Phase I trade agreement.

Border tensions are increasing as foreign travel is coming to a virtual halt. While this is necessary to control the spread of COVID-19, it is vital we maintain our food supply chain open and flowing. My fear is that this crisis will generate a tremendous amount of animosity and suspicion amongst our trade partners, which will feed a protectionist mentality.

It is safe to assume this virus will already put a major dent in demand, so the last thing we need is to make it worse by provoking old trade issues.

Reach Matthew Kruse at: 712-227-1110, [email protected]

Disclaimer: Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

About the Author(s)

You May Also Like