Big speculators lightened up on their bear bets in a few market this week, covering some of those short positions. But by the end of the week they were selling again.

Here’s what funds were up to through Tuesday, Nov. 12, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Rolled by Goldman

Big speculators were light buyers overall this week, covering 11,294 contracts of their net short position in crops and livestock. But after taking their net long position to its second highest level of the year, investors using index funds to gain exposure to commodities lightened up as the Goldman roll got underway. This five-day period, which ended Thursday, is when index traders move positions out of the nearby.

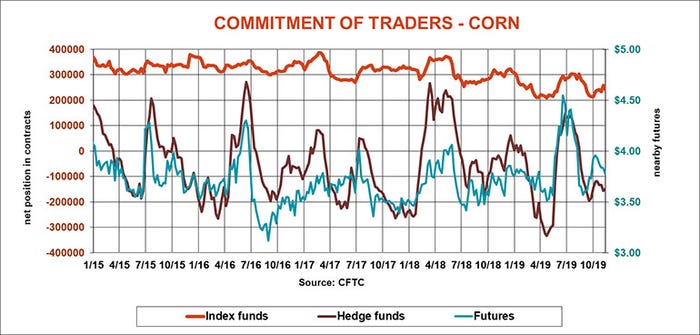

Under cover

Big speculators bought back 8,358 contracts from their bearish bet on corn this week. But the short covering didn’t last long. Hedge funds were selling again after the CFTC collected its data on Tuesday.

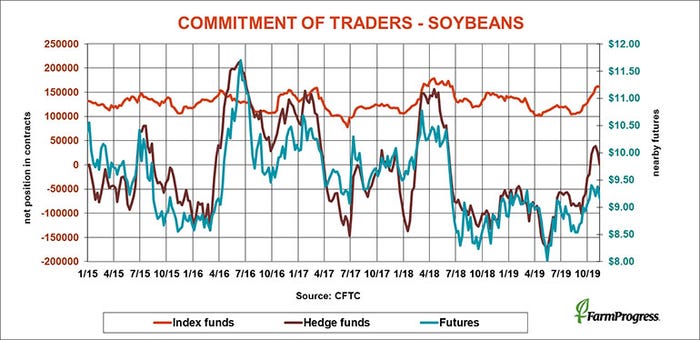

Square one

After holding a bullish net position in soybeans for four weeks, big speculators dumped 26,343 contracts in the latest week to slip to a small bearish bet. But they were short only 48 net contracts.

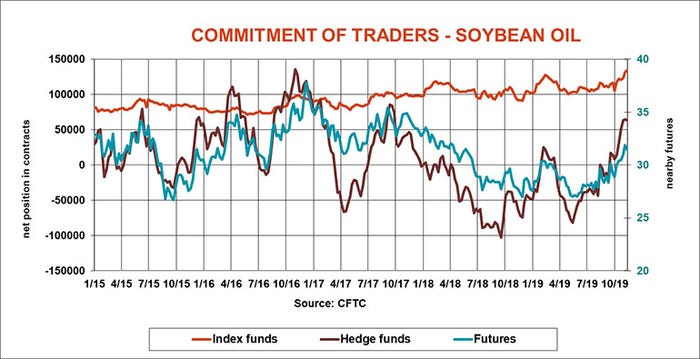

Turn out the lights

Vegetable oil markets were volatile this week, showing signs of a top in Asia. Not surprisingly, big speculators lightened up on some of their bullish bets, liquidating 1,435 contracts early in the week and selling more later. Index traders continued to add to their record net long position.

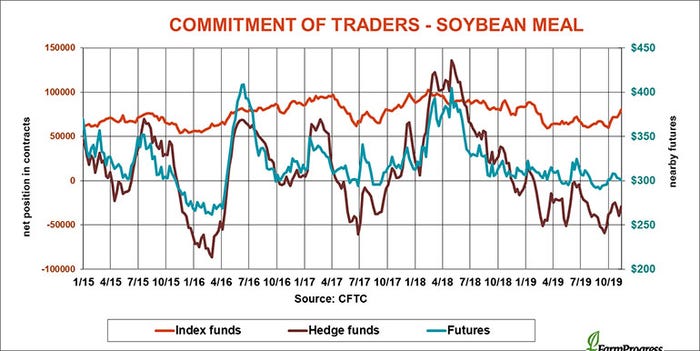

Odd man in

Big speculators sold soybean meal in recent weeks but covered some of those bearish bets this week, buying a net 10,173 contracts.

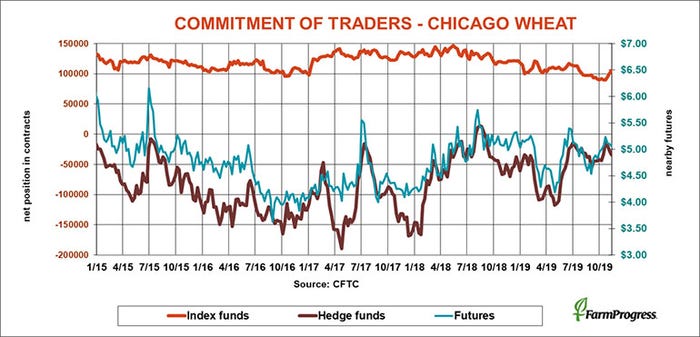

Third time

Big speculators added to bearish bets in soft red winter wheat for the third straight week, extending their net short position by another 5,143 contracts.

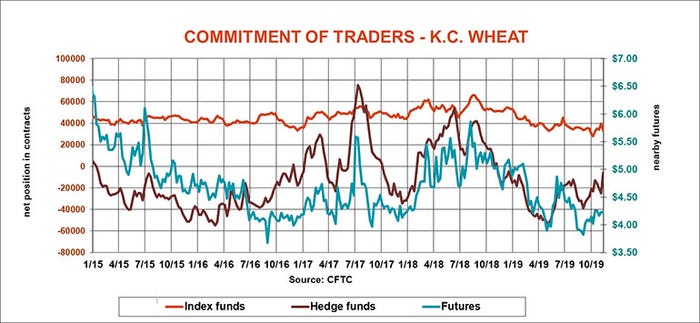

What’s up?

Big speculators ran for the exits in hard red winter wheat as a cold blast threatened the crop on the Plains. They bought a net 18,963 contracts to reduce their net short position to 5,961 lots.

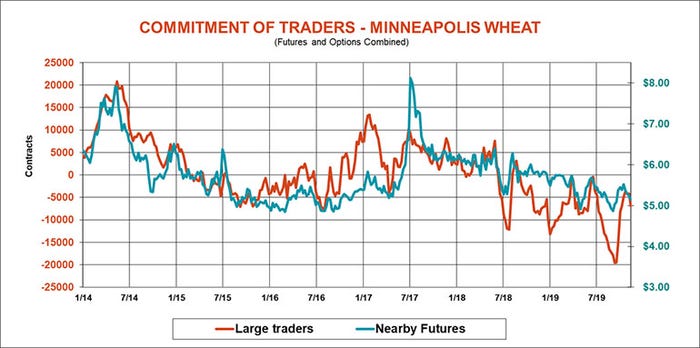

No love

USDA cut its estimate of spring wheat production Nov. 8, but the market didn’t care. Minneapolis futures slipped to new two-month lows by the end of the week, aided by fund selling earlier that adding 2,709 contracts to the bearish bets of large traders.

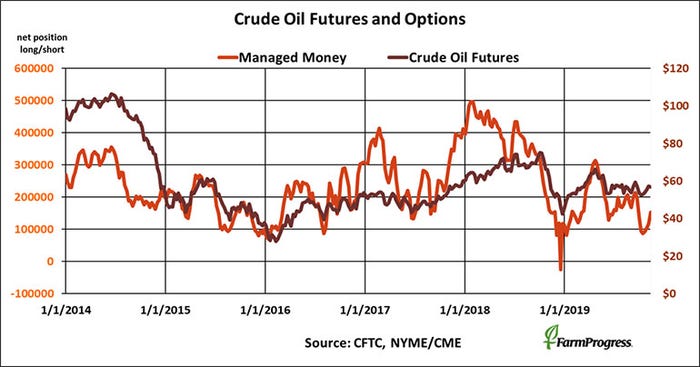

Just in time

Crude oil prices slipped early in the week and money managers were buying when they did, adding more than $2 billion worth of futures and options just in time for the market to rally $1 a barrel Friday.

About the Author(s)

You May Also Like