Two important things happened in the macro-economic circles in the past month which deserve discussion and the attention of beef producers.

I try to keep up with the meaning of macro events because they have significant effect on the beef industry. I subscribe to several newsletters, some for which I must pay premium fees, and occasionally I write about them and try to make sense of them for you, my readers.

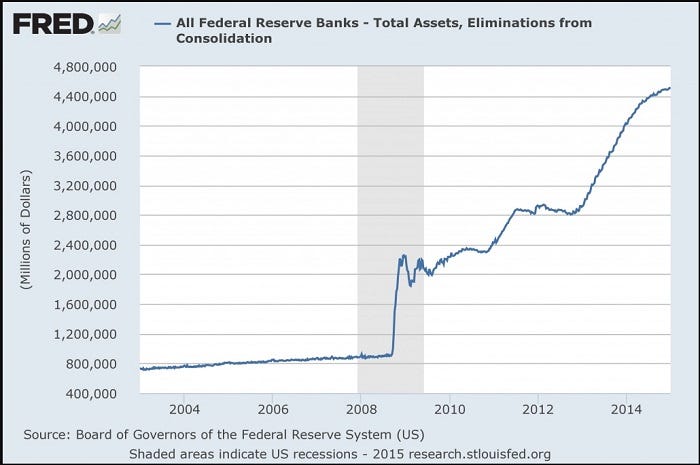

The first occurred June 14 when the Federal Reserve Board confirmed it would stop its bond-buying program, thereby shrinking the bloated US money supply from $4.5 trillion. In some circles, this program is being referred to as "quantitative tightening," or QT. It is the reversal of "quantitative easing," the program in which the Fed and federal government together exploded the balance sheet, which essentially means the pool of available US money, from about $1 trillion at the time of the 2008 financial crisis to $4.5 trillion by about 2014. It has stayed at that level since.

Fedspeak is an odd language and is shrouded within secretive nomenclature, but among other things, this announcement suggests we could enter a period of deflation, when there is significantly less money available for any given purchase desired, including stocks, bonds and commodities contracts.

A Marketwatch story explains the Fed's plans: "The Fed maintains the balance sheet by reinvesting the proceeds of maturing Treasury bonds and mortgage-backed securities. Under the [QT] plan, the Fed will initially allow $6 billion per month in principal from maturing Treasury securities to run-off. This will increase in steps of $6 billion each quarter over a year until it reaches $30 billion per month. For mortgage-backed securities and agency debt, the Fed set an initial cap of $4 billion. This will increase in quarterly steps of $4 billion each quarter until it reaches $20 billion per month."

As is common for the privately owned central bank, the Fed did give any specifics on how much it plans to shrink the balance sheet, referring to its models of measuring the economy as the guide by which it will meter this process.

Nonetheless, many seasoned observers believe the tightening could begin as early as this September.

The Federal Reserve Board plans to begin shrinking the amount of

The second important happened this week when Fed chair Janet Yellen signaled by her trademark doublespeak during congressional testimony that the central bank might not raise rates by another quarter-point of interest rate in September after all. Raising rates typically has not a great effect on markets in small increments, but can certainly be problematic with large changes.

The Fed's primary monetary management model claims to manage inflation with a target of 2% by the amount of money and the rate at which it lends to banks, followed by a slew of other doctored reports such as unemployment to confuse them.

It's possible from the strong up-move of the stock market indexes that traders read this to mean there may be no shrinking of their monetary heroin drip in September, either.

Analyst Jim Rickards explains regularly the Fed wants to raise rates so it can lower them again when the next recession rolls around. This is one of the bank's management plans. Rickards says by raising rates too fast, the Fed might trigger the recession it’s preparing for. This could apply moreso for shrinking the money supply.

Another analyst, Lee Adler, wrote on June 15, "Rising rates never stopped a bull market. I will show you the historical evidence ... But tightening the money supply did stop past bull markets and bubbles and will do so again. Central banks trigger both bull and bear markets based on how much money they decide to add or drain from the system. If you deprive a bubble of its fuel --excess cash -- it implodes."

Yet another analyst, Dan Amoss, notes that the Fed's QT plans could "suck enough cash out of financial markets to offset the inflow" coming from the European Central Bank and the Bank of Japan, which are two other sources of money that have been fueling the debt binge in the US and across the world.

It's a good run while it lasts, but the debt bubbles in consumer debt, government debt, the automotive industry, China's economy, the college loan program and the stock and bond markets keep getting bigger.

We are in uncharted waters and it's hard to imagine how this will play out. All I can suggest is be cautious in your debt dealings for business and otherwise.

About the Author(s)

You May Also Like