When you are running your farm, you think of it as a well-oiled machine that won’t stop until you do. You know how many bushels you have out in the bin, you know you need to order feed tomorrow because you’ll be out the day after, and you already paid for next year’s seed but still need to haggle on your chemicals yet. Your brain is in a constant cash-flow mode because you know how all the pieces are working together and what you need to do to pay the bills and get a good deal.

This is great for managing your farm, but it makes it hard working with your banker or accountant, because they don’t think about your farm in the same way. They tend to work as of a specific date or between two specific dates for their ratios and analysis. We call these “cut-off dates” and they are important to understand because it will help you better communicate with your business adviser team.

I think of a balance sheet as a picture; “as of MM/DD/YYYY, this is what your farm (from a financial perspective) looks like”. By setting a specific date to review your financial transactions, balances, inventory, and equipment, we can categorize them in a way so that a person who does not have intimate knowledge of your farm can understand your financial position.

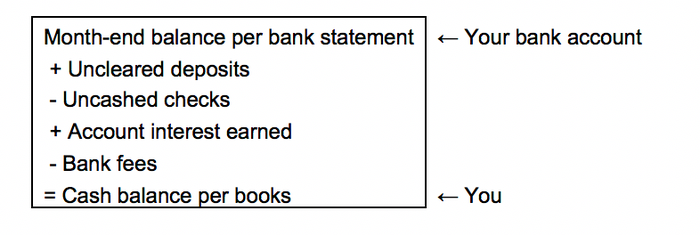

Your cash reconciliation is an example of a cut-off date you see on a frequent basis (hopefully monthly). Here is your reconciliation:

This is how you know that the check you wrote on the 30th of the month won’t bounce if they don’t cash it before the 31st.

Here’s a question I’ve had before: “Why would I separate my prepaids and inventory, they are essentially the same”. Well – kind of; there is a major difference. Inventory is on-hand and prepaids are wherever you purchased them. This is a “one in the hand is worth two in the bush” situation.

If the elevator that you prepaid your seed at would go under before they delivered, they may not have to give you your seed or money. So – as an outsider looking in – your inventory is going to have more value because you have it. Your prepaid account balances will get moved to your inventory when it’s delivered but – from a financial position – there is a difference between the two until the prepaids are delivered.

Cut-off dates are more prevalent when you get into accrual accounting. You know that your line-of-credit is charged interest based on the balance at the end of day. This interest accumulates every day until you pay it. The accumulated, unpaid interest that you owe is your accrued interest expense. Your accrued interest expense changes every day and you need to capture it at a moment in time to accurately convey the amount of principle and interest you owe.

While your business is always in flux, it is important to understand how cut-off dates are used when working with individuals outside of your business. You won’t always have to make these calculations yourself – I would recommend hiring an accountant to help you – but you should understand why others need them when talking with you about your business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like