There are plenty of reasons why corn prices could be headed higher once harvest lows are confirmed. Final production could be less than expected, or demand could surprise.

But if today’s October monthly USDA report doesn’t provide bullish ammunition, the biggest factor in the market may have nothing to do with old crop fundamentals. Soaring production costs could impact 2022 crop planting decisions, giving a lift to “red” December futures as it works to attract acreage for next spring.

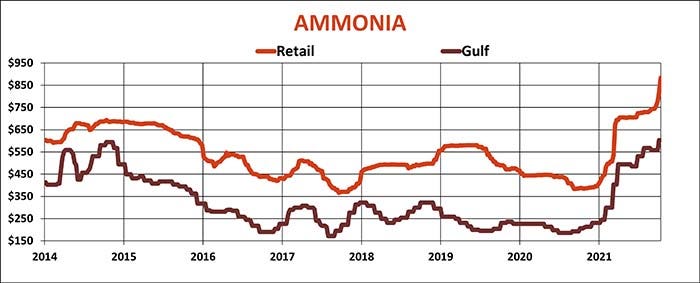

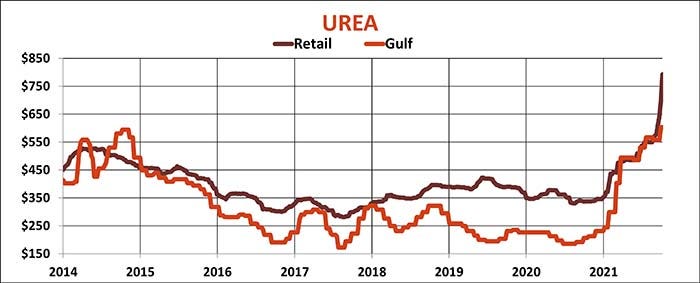

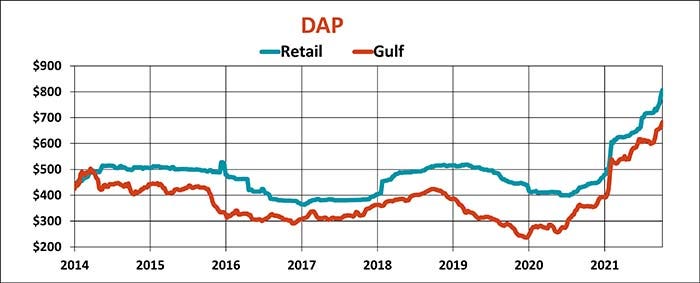

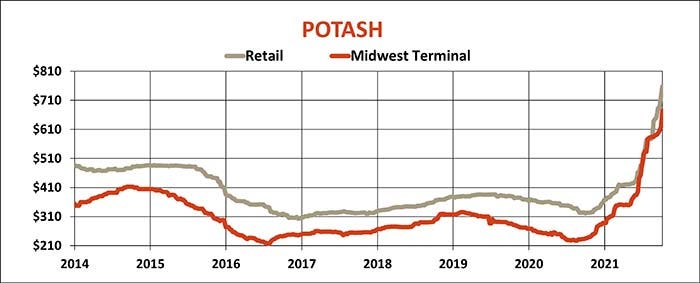

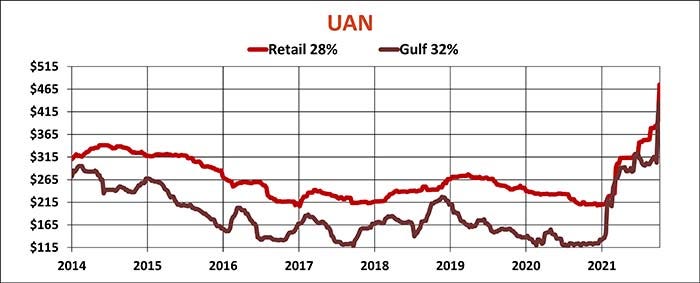

Soaring world fertilizer markets I reported on last week kept moving higher again, with overseas prices making new highs Monday. The sharp rise at wholesale price points triggered big increases at the farmgate level from retailers scrambling to catch up with the rapid changes. New offers for ammonia topped $1,000 a ton at some locations, with our average up to $883. Urea jumped nearly $100 on average last week, closing in on $800. DAP also neared $1,000 some places, though new offers appeared mostly in the $800 to $850 range. The once sleepy potash market made up for lost time, taking average retail prices to $758, while UAN made a big leap of its own, putting some retailers above $500 for 28%.

The increases translate into an average fertilizer bill for an acre of corn of $200 or more. Strong demand and a supply chain disrupted by Hurricane Ida, which slowed shipping, imports and production at key ammonia plants, mean some producers may be unwilling – or unable – to put down fertilizer this fall.

That risk took December 2022 corn to a new contract high last week even as December 2021 languished in the bottom third of its trading range since topping out in May.

While old crop still trades around a nickel premium to new, the spread has retreated sharply after topping $1.10 during the spring rally. Harvest weakness in the spread is not unusual, even in bull years. Old crop has so far avoided its normal tendency to trade at a 15- to 20-cent discount to new, but this year’s fade has been much sharper than typically seen.

Whether bullish, bearish or neutral, today’s USDA report will serve as the starting point for the government’s first estimate of 2022 acreage. While farmers won’t be surveyed for their intentions until March, USDA normally releases plantings forecasts in November based on economic analysis, which are used to update 10-year projections for farm prices generated as part of the budget process.

Farm Futures survey of growers in August found them ready to boost corn seedings to 94.3 million next spring. While potential profits have slipped $25 an acre or more since the survey was conducted, December 2022 futures remain well in the black for the typical grower. But with plenty of other attractive alternatives, corn prices can’t retreat too much unless those other markets, including soybeans, wheat and cotton, turn tail as well.

Of course, a break in N, P and K could make a difference, too. But forward price curves show no sign of that yet, with deferred nitrogen contracts higher through winter.

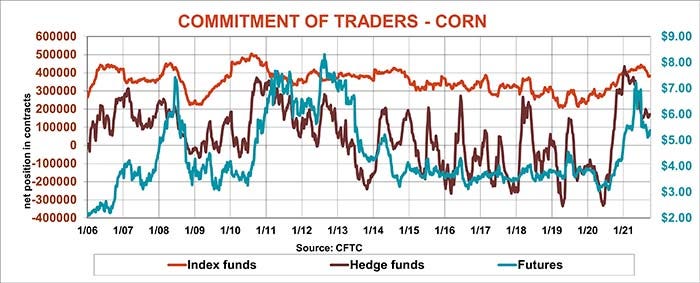

Wall Street funds could tip the scales if big speculators and institutional investors decide to jump back into the market as fears of inflation keep commodities in play. Funds were early buyers when the corn market finally took off in 2020, and investors following commodity indexes have largely held on to those net long positions. But hedge funds – the big speculators – started taking their foot off the gas way back in January, five months before the market peaked. These players are still net long 855 million bushels, but overall trading in 2022 crop contracts remains relatively small, just 12% of total open interest.

Seasonal trends for new crop December futures show the market normally takes a wait and see attitude a year before the following year’s harvest. Lows aren’t confirmed on average until after old crop December goes into delivery. And while there is a 50-50 chance prices will be higher by Thanksgiving, gains of more than a dime happen less than one in five years.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like