March 1, 2021

In the world of grain marketing, hedging reduces price risk. While it is easy to define hedging, understanding what hedging truly means as a grain producer requires more than just knowledge of the definition.

Hedging operates in a complex environment of unknown yields, unknown prices and our own personal perceptions. With complexity, successful hedging requires a well-thought-out decision process, allowing for the identification of factors important in the hedging decision.

Way too often farmers say, “Well, last year I should not have hedged.” Or, “Well, last year I should have hedged more.” These statements assume that a successful hedging strategy is based off a singular year, and its only benefit is obtained when a higher price is received.

Successful hedging

In this article, we will add additional perspectives to what makes a successful hedging strategy. The use of goals, objectives, logic and market structure help provide a road map when making decisions about the unknown future. Following this road map helps control emotions.

When hedging, it is straightforward to understand the costs. However, the benefits of hedging are more intangible and harder to measure. The benchmark of last year is not enough to evaluate whether hedging is a good idea or not.

Evaluating whether something is worthwhile requires its own set of tools that are adapted to the problem. Understanding the role of hedging requires such tools. A useful philosophy in thinking about what you want to achieve is to think about what you want to avoid.

A well-accepted goal of farms is to have the opportunity to pass the farm on to the next generation. To achieve this goal, avoid bankruptcy. In grain marketing, you must survive times when fall prices are substantially lower than prices offered earlier in the crop year.

Hedging lowers price risk, improving the chances of achieving your goal of avoiding bankruptcy. Avoiding bankruptcy is your benchmark to evaluate hedging. If you avoid bankruptcy �— caused by low prices — in any given year, hedging is working. You will have years where your hedged price is higher than the unhedged price and vice versa.

A second goal, which must happen simultaneously with the first goal, is to maximize profit. As an example, forward-contracting lowers expected profit, unless it is free to forward-contract, while also simultaneously lowering the financial risk of realizing low fall prices.

Minimizing the probability of bankruptcy and maximizing profit work together and should be evaluated together.

Hedge in percentages of actual production history

When you hedge, you are developing a farm average price that consists of prices from hedged bushels and prices from unhedged bushels. Does hedging assist you in creating a farm average that allows you to meet your goals?

The key here is that if prices rise into the fall, you still have unpriced bushels to sell, thereby improving your farm average, allowing you to meet your goal of farm survival. To avoid hedging buybacks, use a revenue protection crop insurance policy and be aware of your production risk.

Some popular opinions state that farmers can or should engage in preharvest marketing up to your guaranteed bushels. Unfortunately, this viewpoint does not account for all costs as it neglects to consider the premium cost, which is guaranteed to be paid, and any buyback costs, if a rare event is triggered. Rare events can happen, so leave unpriced bushels to deal with these events.

Avoiding financial ruin requires giving weight to events we have never or very rarely seen. Absence of evidence is not evidence of absence. Hedging protects you from events you may or may not ever experience.

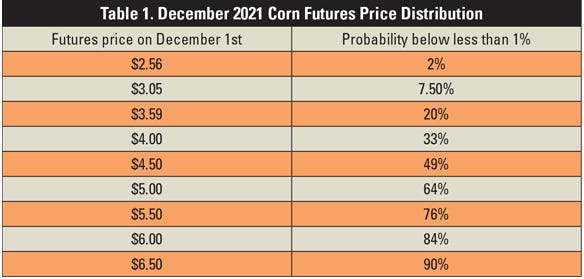

For each crop we plant, we get to observe an average price per bushel, out of a range of possible prices. Using market information as of Feb. 22 — current December futures of $4.63 per bushel for corn and an implied volatility of 27.7% — we can get an idea of the range of December futures prices on Dec. 1. (See Table 1).

From Table 1, we can see that there is an 7.5% chance that December futures ends up below $3.05 per bushel. There exists a 20% chance that December futures ends up below $3.59 per bushel.

If your goal is to pass your farm to the next generation, then hedging is working if you are surviving. Because hedging becomes a revenue source during rare price events, it allows you to lower the amount of working capital needed to survive rare events. If your available working capital is already low, then hedging represents a necessary tool to improve the probability of farm survival.

How much working capital do you need to have? Identify your risk exposure by evaluating the financial shortfall from low yields or low prices.

Powerful tool

Hedging represents a powerful tool to help achieve long-term goals and objectives. Wrapping logic and market structure into your goals and objectives helps clear the path for the role of hedging. Hedging success is found by achieving your goals and objectives.

You will not know the value of hedging until you do not achieve your goals. Hedging does not guarantee farm survival, and you do not need hedging to survive. You may never realize rare events. Or we may realize one this upcoming year.

Do you have enough capital to survive rare events? As Warren Buffet said, “The best way to minimize risk is to think.”

Walters is a grain marketing specialist with Nebraska Extension. Groskopf is an agricultural systems economist with Nebraska Extension. Preston is a farmer in Hardin County, Ky.

You May Also Like