July 8, 2021

Pandemic-related market turmoil since March 2020 has resulted in large shifts in consumer demand for many products in many markets. Beef exports have not escaped this phenomenon, as declines in shipments from May through July 2020 nearly wiped out all the gains against the previous year since the beginning of 2020.

But one market has proven amazingly resilient over the past few quarters. Even as pork prices decline and total meat supplies recover from African swine fever, China has been a consistent bright spot for U.S. beef exports.

China is importing beef

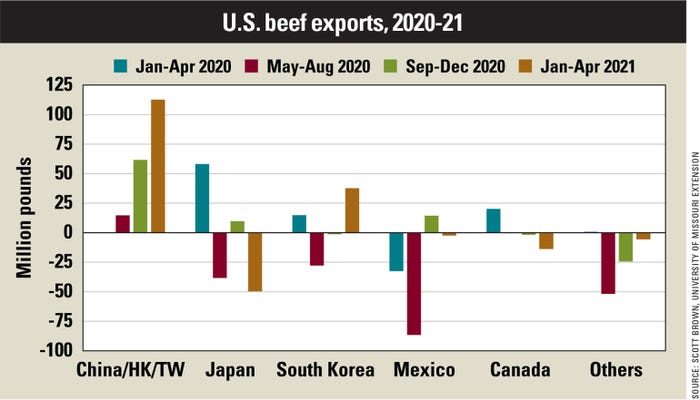

Separating the months since the beginning of last year into four four-month segments shows that combined beef shipments to China, Hong Kong and Taiwan have increased relative to year-ago amounts at a growing rate over the past year. It makes sense to combine these three markets because of their proximity, and the speculation that many beef shipments to Hong Kong eventually find their way to mainland China.

Meanwhile, every other major U.S. beef market experienced a setback in at least two of the past three segments. For the first four months of 2021, the portion of U.S. beef exports headed to China, Hong Kong or Taiwan equaled 22.3% of total shipments, compared to only 15.6% during the 2010s. The only other markets taking more U.S. beef through April of this year are Japan (24.6% of total shipments) and South Korea (24%).

The fact that beef exports to China have been growing is even more impressive when one considers how other U.S. meat exports to the region have fared in recent months.

As China hog producers continue to recover from the multiyear African swine fever crisis, U.S. pork exports to the area have been below year-ago levels since December and are 26.6% lower for the first four months of this year.

Likewise, chicken exports are down 20.9% for January to April 2021. However, beef exports to the region have grown 87.2% for the first four months of the year, an indication that the demand for U.S. beef in China continues to increase, even as pork and total meat supplies recover.

Realizing value of beef

One additional positive on beef shipments to China is the value component.

For the first four months of 2021, the average unit value of beef shipped to China, Hong Kong and Taiwan was $3.87 per pound, 21.6% higher than the average unit value of beef shipped to all other markets.

With all of the challenges facing the beef industry recently, it is refreshing to see a higher-value growth market for the industry that to this point has been very resilient despite the challenges and volatility that consumers in every corner of the world have recently experienced.

The potential for U.S. beef exports to China has been discussed for decades, and it is encouraging to see tangible results. The potential for continued growth remains bright.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like