We’re always told that the cure for low prices is low prices. But is that always true? If prices are low, is that a good enough reason for them not to go lower?

Low prices are causing a lot of pain for producers. They fear what pressures may be ahead. This is due to coronavirus, but in reality, it is due to the collateral damage the pandemic has caused.

Crude oil’s price decline is the real culprit. A timeline of ag prices and the spread of coronavirus verifies what agricultural markets have seen as their biggest threat.

The offshoot of crude oil’s decline has been the ethanol industry’s demise, as well as speculator concerns about deflation, all of which have weighed on ag prices. Prices have also been hit by the fallout of COVID-19, as it has caused livestock slaughtering facilities to close, backing up farm supplies and causing some food shortages in the grocery line.

This has created a double-whammy for the consumer -- they are paying higher prices at a time they should be getting bargains and encouragement to buy more.

Disruptions in supply chains and consumer access are driven by the government’s shelter-in-place order, which eliminated restaurant and school demand for meat and milk. The result of all this is historically cheap prices.

Today’s prices in historical context

In 2006, agricultural price structures were given a major adjustment. A new push for greener energy ignited a massive expansion in ethanol production, which ultimately reached the point where it consumes nearly 40% of U.S. corn production. This process caused many prices to realign and adjust to the new demand.

Now, that demand base is threatened.

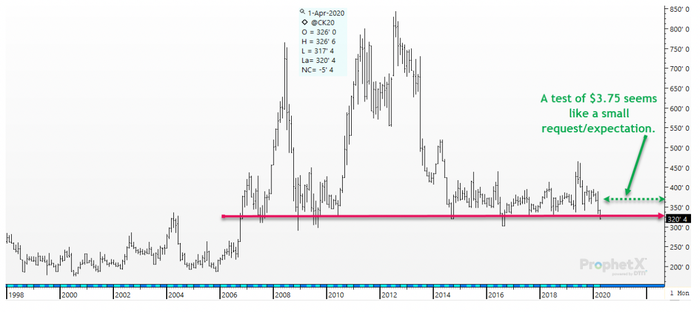

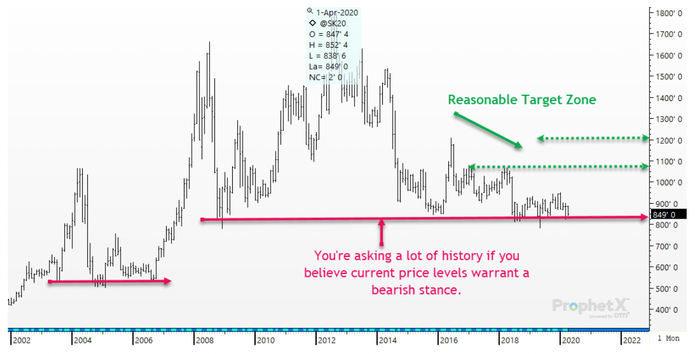

I want to draw your attention to both corn and soybean longer-term charts. From these charts I want you to recognize just how cheap current prices are.

These charts lead to one of two conclusions:

Historically cheap prices have no bearing, so prices can and will go lower, just because there is no ‘fix’ to the problem, or

Between the Fed’s action/desire to prevent deflation and to encourage inflation, and possible government support programs, current cheap prices will prove to be short-lived.

Typically, corn prices below today’s current values have only been seen in the past 15 years during either the harvest window or the late summer dumping of old-crop supplies. We have been experiencing some panic producer sales of old-crop corn during the past several weeks, but the past one to two weeks have seen cash corn basis improve, despite ethanol plants not having competitive bids.

All of this leads the market to ask a series of questions:

Is this a sign that the pipeline is tighter than traders think?

Is this a sign that the panic selling is over?

Will cash basis strengthen further as fieldwork advances?

Will this manage to produce a futures price recovery?

Will China surface as a buyer of U.S. corn, which is not the world’s cheapest source?

Will China buy U.S. ethanol at bargain basement prices?

Will China buy DDGs at current depressed prices?

These are many questions, but a “yes” answer is very plausible. Affirmative answers could combine to produce a nice recovery rally during the next 60 days.

The above chart is a monthly soybean chart. Prices are cheap. There is no better or simpler way to describe the above chart. If you are bearish soybeans at current prices, you are really asking for a lot of historical support to be ignored. You are also assuming that there will be no problem increasing U.S. soybean acres, as compared to the March 31 USDA projection.

The U.S. 20/21 soybean balance sheet needs more soybeans. Current prices may not be enough incentive to get them, despite the doom and gloom found in corn prices.

History has shown it to be very difficult to increase soybean acres from the March 31 projection to the final projection.

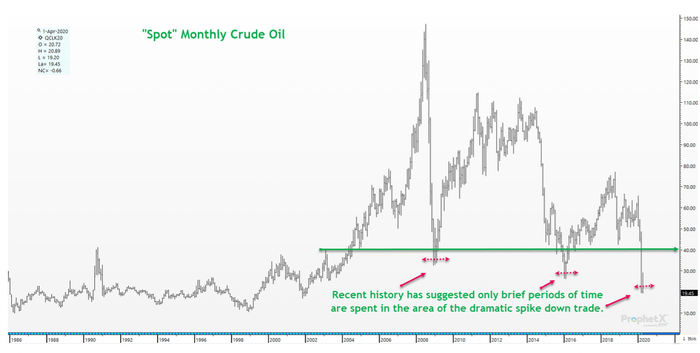

The above crude oil chart is to show just how historically cheap current energy prices are. Also, to show that when we have spike price declines, such as just experienced, they tend to be very short-lived.

The Fed’s role in ag

Lastly, I want to ask you if the Fed is willing to spend trillions and trillions of dollars to prevent deflation, are they really willing to let ag prices stay at depressed levels for very long? Consider the scope of the problem. The entire U.S. corn carryout could be purchased for less than $8 billion. The entire U.S. soybean carryout could be purchased for less than $5 billion. Will they really allow deflation to take hold, or their inflation goal to be stymied, when the fix would be $13 billion?

Now, I realize that they are not going to buy those carryout bushels, but I want to point out to you how small that issue is in the grand scheme of what they are seeking to accomplish. By the time Congress and the Fed are done, they will have created $6-10 trillion of new debt. Why? Because they seek to drive inflation.

That leads us to today’s most important take home point: There has been no time in history where inflation existed without energy and ag markets leading the charge.

I want to be on the side of the Fed, not against them. Be careful not to make longer-term marketing decisions based upon today’s doom and gloom. Markets have a history of changing when it is least expected. And, I can assure you that nobody expects the outlook to improve for agriculture.

Duane Lowry

Senior Risk Manager and Market Research Director

Silver Creek Commodities

Email= [email protected]

Twitter= @DuaneLowry

Phone/text= 563-419-1300

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like