May 27, 2021

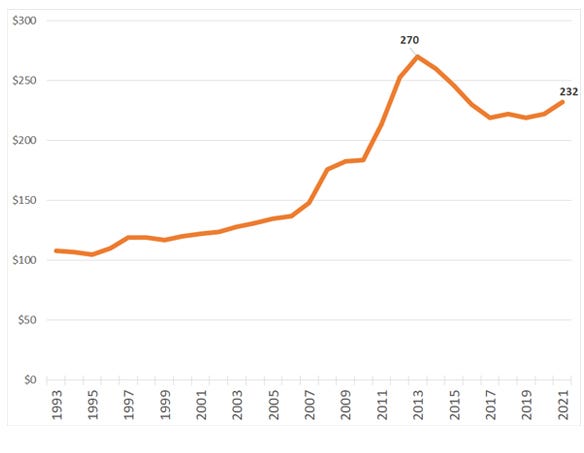

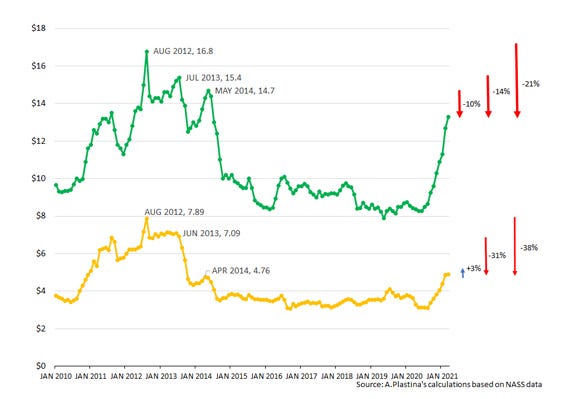

The most recent annual survey of cash rental rates for Iowa farmland shows that rates increased, on average, by 4.5% in 2021 to $232 per acre. This is the first substantial increase in cash rents since 2013, when rents peaked. Four years of declining rents and three years of relatively stable rents followed (see Figure 1). In comparison, nominal corn and soybean prices received by farmers in Iowa declined by 31% and 14%, respectively, since mid-2013.

Figure 1. Average cash rents in Iowa, $ per acre (nominal)

Graphics for figures 1-4 courtesy of Alejandro Plastina

Iowans supplied 1,363 usable responses about typical cash rental rates in their counties for land producing corn, soybeans, hay, oats and pasture. Of these, 41% came from farmers, 33% from landowners, 11% from professional farm managers and real estate agents, 9% from agricultural lenders, and 6% from other professions and respondents who chose not to report their status. Respondents indicated being familiar with a total of 1.5 million cash-rented acres across the state.

Ag Decision Maker (AgDM) File C2-10, Cash Rental Rates for Iowa 2020 Survey, at bit.ly/admicrr, provides detailed results by county and crop. There was considerable variability across counties in year-to-year changes, as is typical of survey data, but 76 of the 99 Iowa counties experienced increases in average rents for corn and soybeans. The report also shows typical rents for alfalfa, grass hay, oats, pasture, cornstalk grazing and hunting rights in each district.

Survey shows rent increases in all districts

The survey was carried out by Iowa State University Extension and Outreach. Statewide, reported rental rates for land planted to corn and soybeans were up from $222 per acre last year to $232 in 2021, or 4.5%. This percent increase is slightly less than two-thirds of the percent increase in Iowa farmland values between March 2020 and March 2021 reported in surveys conducted by the Iowa Realtors Land Institute and summarized in AgDM File C2-75, Farmland Value Survey (Realtors Land Institute), at bit.ly/irlifvs.

However, the 14.1% accumulated decline in rental rates since 2013 is in line with the cumulative 13.3% decline in land values over the same period reported in the Iowa Land Value Survey published by the ISU Center for Agriculture and Rural Development (AgDM File C2-70, Farmland Value Survey), bit.ly/isuilvs.

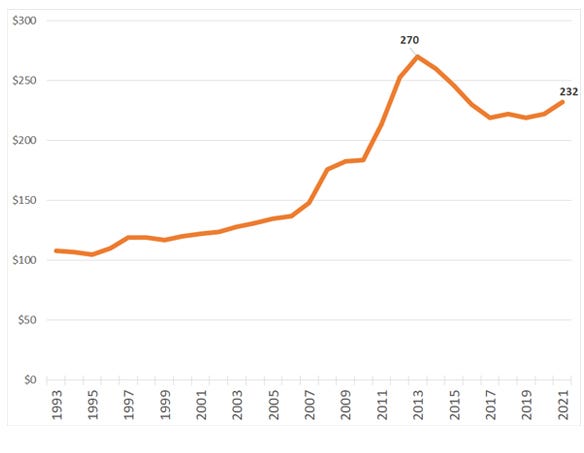

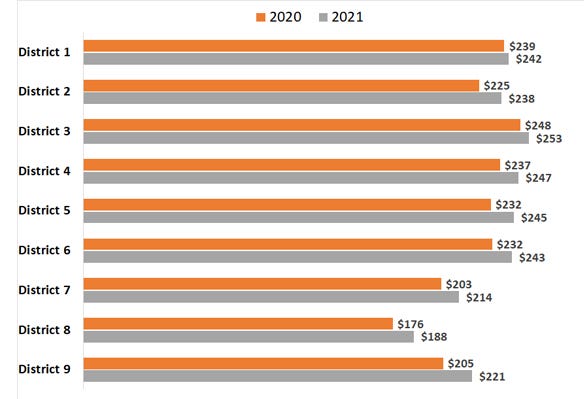

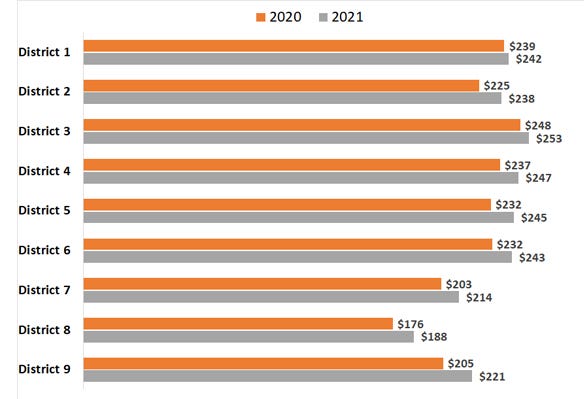

Different regions experienced different increases in cash rents: from a 1.3% in crop reporting district (CRD) 1 to a 7.8% drop in CRD 9 (Figure 2). Except for Northwest and Northeast Iowa (CRDs 1 and 3), where average rents increased by $5 or less per acre, all CRDs experienced at least a $10 increase in average rents.

Figure 2. Average cash rents by crop reporting district, $ per acre

Percent increases in rent similar across land qualities

All land qualities have seen their average cash rents increase by similar percentages. High-quality land experienced a 3.9% increase, from $257 per acre in 2020 to $267 in 2021.

Medium-quality land had a 4.5% increase, from $223 per acre in 2020 to $233 in 2021.

Low-quality land prices rose 4.8%, from $188 per acre in 2020 to $197 in 2021.

Setting rents for next year

Survey information can serve as a reference point for negotiating an appropriate rental rate for next year. However, rents for individual farms should be based on productivity, ease of farming, fertility, drainage, local price patterns, longevity of the lease and possible services performed by the tenant.

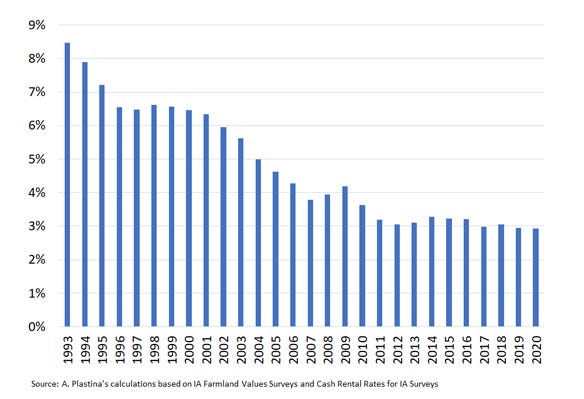

Three major factors with the potential to influence future cash rents are crop prices, government payments and land values. Corn and soybean prices received in Iowa peaked in August 2012 at $7.90 and $16.80 per bushel, respectively. In March, corn and soybean prices received by farmers in Iowa averaged $4.89 and $13.30 per bushel, and, despite the run-up in prices observed since July 2020, they accumulated a 38% and 21% decline since August 2012 (Figure 3). USDA is currently projecting average corn and soybean prices for the 2021-22 marketing year at $5.70 and $13.85 per bushel, respectively. These higher prices would improve net farm income with respect to last year, but would not be able to offset the reduction in income from lower government payments. In February, the USDA Economic Research Service forecast an 8.1% reduction in net farm income between 2020 and 2021.

Figure 3. Prices received in Iowa for corn and soybeans, $ per bushel

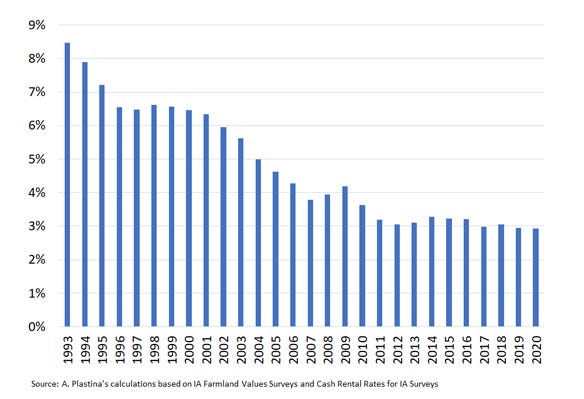

A major factor considered by landowners when negotiating cash rents is the return on their farmland investment. Figure 4 shows the evolution of the ratio of average cash rents to average land values in Iowa. It suggests that the average return on investment for landowners who cash-rent their land to operators has followed a declining trend since the early 1990s, stabilizing at around 3% after 2010.

Figure 4. Ratio of average cash rent to average land value in Iowa, 1992-2019

Note that this ratio does not measure net returns because ownership costs, such as real estate taxes, are not taken into account in its calculation. However, it is indicative that landowners (whose goal is presumably to obtain a reasonable rate of return on their real estate assets) will likely be hesitant to accept lower cash rents in the future unless land values continue to decline. However, with current interest rates at historically low levels and early indications of potentially increasing inflation risks, future interest rates are likely to be higher than current ones.

As a result, the opportunity cost for landowners would increase, and there might be pressure to ask for higher rents. Additionally, Iowa farmland values increased by 7.8% between September 2020 and March 2021 (Realtors Land Institute), putting more upward pressure on cash rents for 2022.

Other resources available for estimating a fair cash rent include the AgDM Information Files Computing a Cropland Cash Rental Rate (C2-20), Computing a Pasture Rental Rate (C2-23) and Flexible Farm Lease Agreements (C2-21). All of these fact sheets are on the Ag Decision Maker leasing page, bit.ly/isuadmleasing, including decision tools (electronic spreadsheets) to help analyze individual leasing situations.

For questions regarding the cash-rent survey, contact the authors. For leasing questions in general, contact a farm management field specialist in your area at bit.ly/isueleasing. An online decision tool to visualize the cash rents by land quality in each county by year, and compare trends in cash rents for a county versus its CRD and the state average, is available at bit.ly/isucashrents2021.

Plastina is an ISU Extension economist.

Source: ISU Extension and Outreach Ag Decision Maker, which is responsible for the information provided and is wholly owned by the source. Informa Business Media and its subsidiaries aren't responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like