January 21, 2015

The soybean industry is coming off a banner year in 2014. U.S. planted acres, yield, production, and total use set record all-time highs. World soybean production, use, and trade were all at record highs as well. World soybean ending stocks are projected to be the highest in history at the end of the 2014/2015 marketing year. With a bumper crop and increased carryover, the U.S. season average farm price of soybeans in 2014/2015 is estimated at $10.00 per bushel, down from $14.40 per bushel in 2012.

Even with lower prices, soybean acreage is expected to increase in 2015. Preliminary crop budgets prepared by the University of Illinois show higher returns for soybeans over corn in every region of the state. Corn after soybeans in Northern Illinois returns $101 over variable and fixed costs to pay for farmland and provide a return to the operator. Soybeans after corn returns $217 per acre.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

Corn after soybeans in highly productive farmland in Central Illinois returns $191 per acre compared to $206 for soybeans after corn. Corn after soybeans in low productive land in Central Illinois returns $120 per acre compared to $162 for soybeans after corn.

Farmers in Brazil and Argentina are projected to increase 2014/2015 soybean acreage by 4 million acres (+3.2 percent) while decreasing corn acres by 2 million (-4.5 percent).

Soybean price expectations in 2015 face increased acreage and record carryover stocks and will depend on weather and demand. With normal weather, the trend line yield estimate for U.S. soybeans is about 45.4 bushels per acre in 2015, down from 47.5 bushels in 2014. That yield is 4.4 percent below the 2014 record. Total U.S. production would be unchanged in 2015 at that “normal” yield even if U.S. farmers plant an additional 4 million acres. That would mean an increase in soybean acres from 84.2 million in 2014 to 88 million in 2015 with no change in total production.

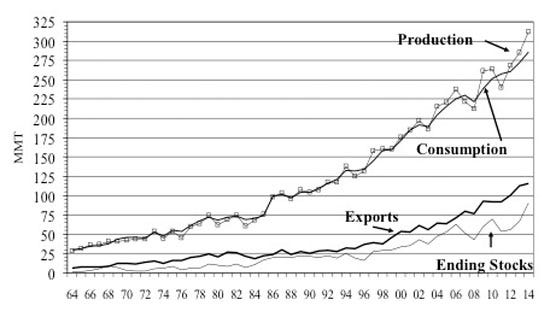

Soybean demand is driven by the food, feed, and fuel sectors. Since the 2000/2001 marketing year, world soybean consumption has increased by 67 percent, from 171 million metric tons (MMT) to 286, about 5 percent per year. China is the largest consumer and importer of soybeans, accounting for 30 percent of total use and 66 percent of total soybean imports. Economic growth and agricultural growing conditions in China will be a major contributor to price prospects for soybeans in the coming year.

World soybean carryover stocks as we head into 2015 are at record highs, both in absolute numbers and relative to use. World ending stocks as of August 31 are forecast at 90.28 MMT, up from 66.85 in 2014 and 56.28 in 2013. Stocks relative to use are at record highs as well. Estimated days of use on hand at the end of the marketing year are for a 115-day supply of soybeans compared to a 10-year average of 88 days and a 20-year average of a 77-day supply. Interesting is where these stocks are held—not China, the largest user and importer, or the U.S., the largest producer and exporter, but Argentina. Argentina is estimated to hold 35 MMT of the world’s 90 MMT soybean stocks (38 percent). The degree to which these stocks become available for world trade will be an important determinant of price movement in soybeans.

You May Also Like