September 29, 2020

USDA’s Farm Service Agency has recently made two changes regarding eligibility for USDA programs. See the USDA FSA handbook and Federal Register notice for more details.

This is the second article covering those eligibility changes.

Generally speaking, only farmers who are “actively engaged in farming” are eligible to receive certain farm program payments. This requirement has two components: A contribution of assets component and a contribution of labor (and management) component. FSA is finally updating rules that were required from the 2018 Farm Bill.

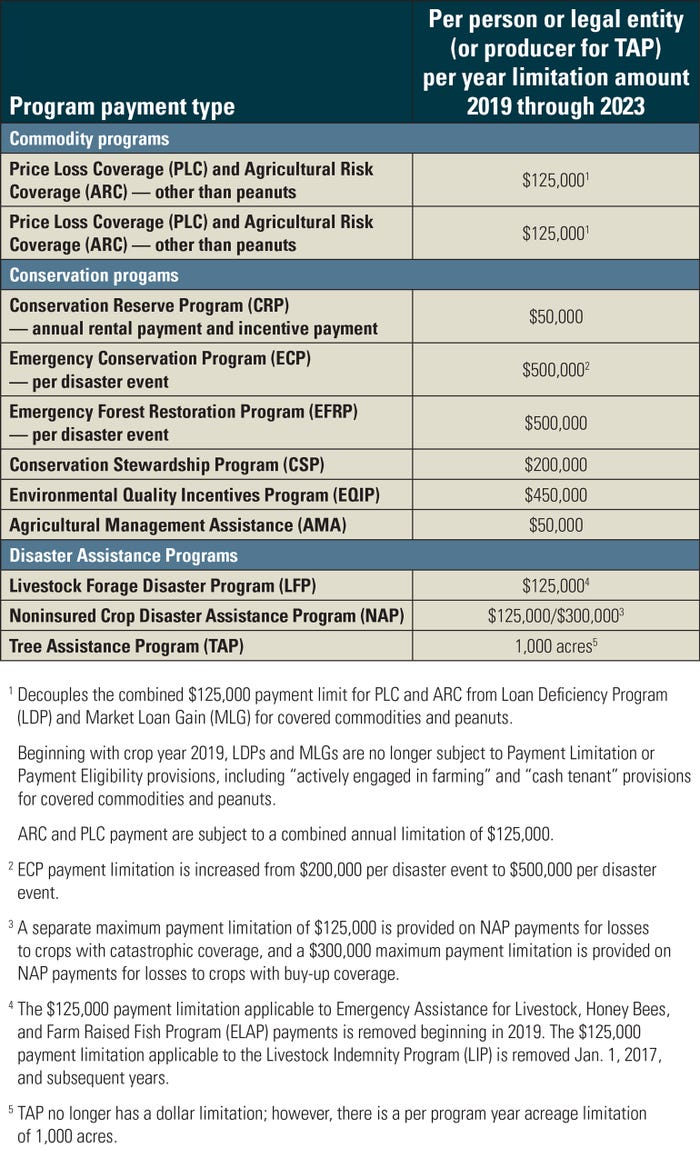

Below is a summary of the annual payment limitations, compiled by FSA, for a person or legal entity for programs that are subject to the 2018 Farm Bill limitations.

Note: Market Facilitation Program payments are also capped per person or legal entity at $125,000.

Being actively engaged in farming means that the person, independently and separately, makes a significant contribution to the farming operation of (a) capital, equipment or land, and (b) active personal labor, active personal management, or a combination of active personal labor and management.

The person’s share of profits or losses is commensurate with his or her contribution to the farming operation.

The person shares in the risk of loss from the farming operation.

Family farms, not a corporation or an LLC, have a special rule where every adult is deemed to meet these requirements. This is good news here in the Northeast as there are a significant number of family farms.

Since the 2018 Farm Bill, in addition to lineal family relationships, siblings and spouses, this also includes first cousins, nieces and nephews. There is also a special spousal rule, where if one spouse is actively engaged in the farm, the other is deemed to be, too.

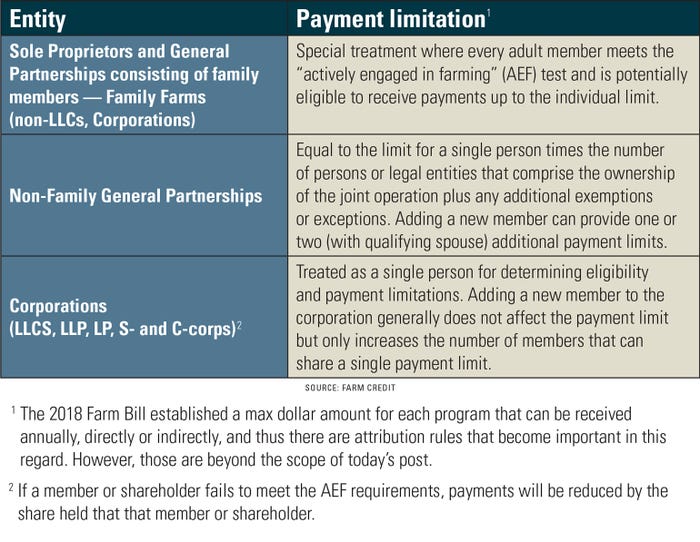

There are also different rules for general partnerships (and joint ventures).

Similarly, corporate and LLC requirements mandate that in addition to meeting the individual actively engaged in farming criteria for profit and risk sharing, each owner make a significant contribution of personal labor or active management that is performed on a regular basis, identifiable and documentable, and separate and distinct from contributions of other stockholders or members.

This chart summarizes payment limitations based on the entity.

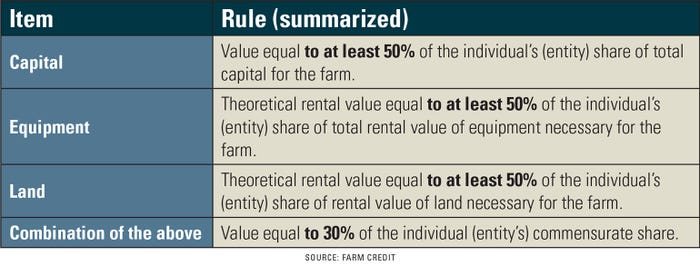

To provide a little more context into that “(1)(a) capital, equipment, land” requirement, look at the following chart.

Note: According to the final rule, there is a “correction to the provision in the regulation that indicated a legal entity’s or joint operation’s eligible capital, land or equipment could not be acquired as a result of a loan made to, guaranteed by, cosigned by or secured by any person, legal entity or joint operation that has an interest in the farming operation, including the legal entity’s or joint operation’s members.

The technical correction removes the legal entity’s or join operation’s members from the provision and relies on “interest in the farming operation” to define the qualifying contribution.”

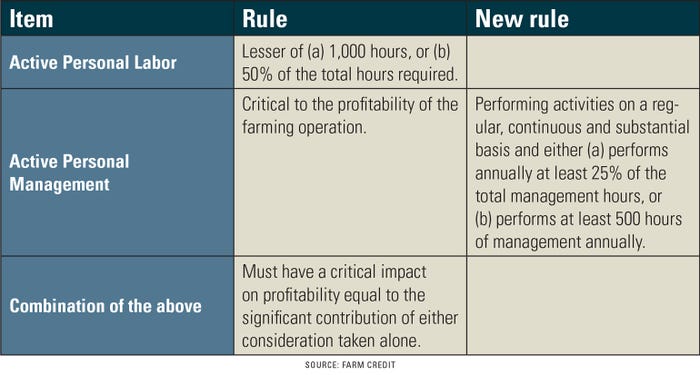

Moving onto the “(1)(b)” requirement of having a significant contribution of “sweat labor” in the business, this chart shows the changes pertaining to the management component.

For tax advisers used to navigating the passive activity rules, this “regular, continuous and substantial” standard seems very familiar. The Congressional Research Service has noted that this change in active personal management has been done intentionally in order to reduce payments to those passive investors who were not actively contributing to the farming operation.

As a result, “a limit is placed on the number of nonfamily members of a farming operation who can qualify as a farm manager … [but] no such limit applies to the potential number of qualifying family members.”

Maximizing farm program payments is one of many considerations in properly structuring farming entities. Farmers should work closely with their trusted advisers to ensure that the business is set up for long-term success.

Arezzo is a senior tax consultant for Farm Credit East.

You May Also Like