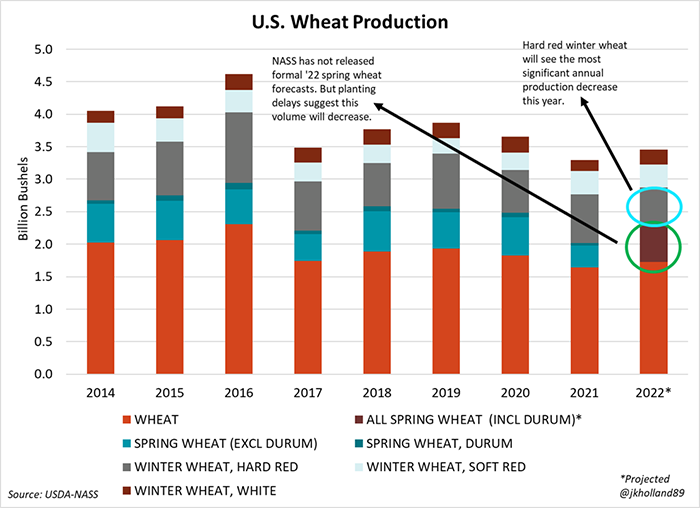

USDA’s May 2022 forecast for U.S. winter wheat production this year looked bleak. And while there was not a formal estimate issued at that time for spring wheat production, persistent planting delays in the Northern Plains this spring due to cold and wet weather do not bode favorably for achieving trendline spring wheat yields.

Winter wheat harvest is ramping up in the Southern Plains and will continue inching north in the coming weeks. Yield downgrades are already apparent. The mid-May 2022 Kansas wheat tour pegged the country’s top wheat-producing state with a winter wheat yield estimate of 39.7 bushels per acre, compared to 52.0 bpa a year ago.

The Kansas Wheat Commission forecasts 2022 production for the state at 261 million bushels as of late May 2022, down over 100 million bushels from 2021. USDA’s May 2022 hard red winter wheat estimates shrunk 21% lower than last year to a meager 590 million bushels. USDA’s National Agriculture Statistics Service expects 2022 will see the highest volume of winter wheat acreage abandonment since 2002.

Elsewhere in the Northern Hemisphere

Global wheat prices weakened in early June as hopes for improved access to Ukrainian grain tempered recent market rallies. But markets remain wary of Russia’s willingness to allow Ukrainian shipments to pass through the Black Sea unhindered, creating more price volatility.

Russia is forecast to harvest its largest wheat crop this summer since the fall of the Soviet Union. The bumper crop could cause bearish price action when it finally reaches the market. If Western countries continue to hold in place economic sanctions against Russia, higher insurance, credit and transportation costs for the Russian crop will likely keep global wheat prices high.

Russian oil tankers have been turning off GPS systems and circumnavigating sanctions to continue trading crude oil products with China and India. Expect to see more of these strategies implemented for Russian wheat shipments as the behemoth crop comes to market, especially if sanctions remain in place.

Despite record-high temperatures in May and year-to-date rainfall only amounting to 15-25% of annual averages, France’s soft wheat crop is likely to benefit from timely rains in late May that could salvage the crop. And Australia harvested a third consecutive bumper crop earlier this year, further helping to ease tight global supplies in the Black Sea conflict era.

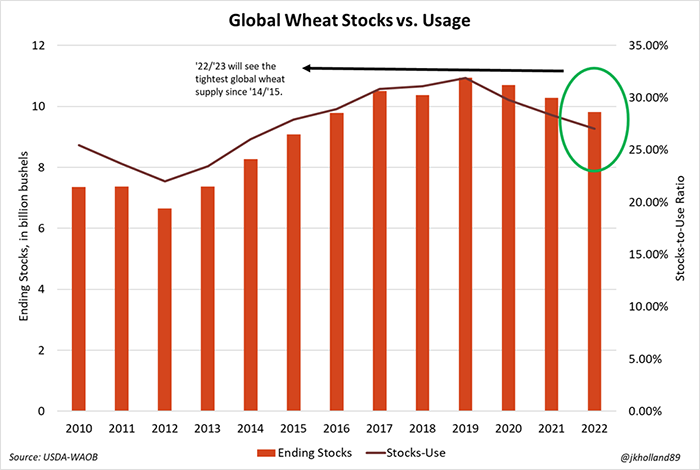

Smaller crops in Ukraine and U.S. will keep supplies tight this year, but demand is not slowing down anytime soon. USDA estimates 2022/23 global wheat usage rates will rise 0.2% this year despite high prices – the fourth consecutive year for global wheat consumption growth.

The one-two punch of tight supplies and growing global demand means that strong wheat prices are likely here to stay for another growing season.

Future implications

The projected shortfalls have sent prices soaring, but that hasn’t necessarily translated into expansion signals for wheat growers. High prices are also proving to be a limiting factor when aggregated with other factors.

U.S. wheat consumption volumes are slated to shrink by 2% from the previous year in 2022/23 due to non-competitive pricing on the global market. As of late May, wheat export volumes have lagged amid a rallying dollar and soaring global wheat prices. A shrinking cattle herd will likely reduce feed demand, especially as wheat and corn prices both remain high.

So what is the demand justification for bullish wheat prices? Even though it doesn’t seem like it from a production standpoint, the U.S. crop shortfalls this year are bullish price news for growers who are able to salvage crops in the Plains this year.

There are two key drivers to this bull market: food usage and tight supplies. USDA expects domestic food consumption of wheat to continue growing in 2022 and these forecasts could increase if a potential recession triggers an increase in wheat-related food purchases.

Global wheat supplies are slated to be the tightest since 2014/15 this year. While supplies aren’t going to run out, the increased scarcity will create additional time lags for transport, processing and retailing, which translates to higher costs across the board.

Global demand is not slowing down for the tight wheat stocks or supply chain lags. Global wheat usage rates have risen for four consecutive years as of the start of the 2022/23 marketing season. Even when factoring in Russia’s occupation of Ukraine and subsequent high wheat prices, USDA’s World Agricultural Outlook Board expects a 0.2% annual increase in worldwide wheat consumption in 2022/23 to 36.3 billion bushels.

Last year, growers jumped at the opportunity to book early sales of high wheat prices as quickly as the wheat crop could be harvested. Some may have missed out on the opportunity for higher prices this spring following Russia’s invasion of Ukraine.

But the Ukrainian war has created a significant volume of market volatility that farmers may choose to hedge against this year by capitalizing on profitable cash sales following harvest. It may be a wise move, considering that U.S. wheat export forecasts continue to shrink especially as the dollar continues to rise.

Will more acres be bought for winter wheat this fall? The price incentive certainly encourages it, though other economic factors may sway growers’ decisions.

High input costs and strong profit forecasts for competing crops could once again deter acreage decisions away from wheat. Pencil out the costs – and don’t be surprised if they are higher this year – and potential revenues as harvest wraps up on your farm to determine if the payoff from early sales and input purchases justify a profitable outlook for more wheat acres in the 2023 season.

About the Author(s)

You May Also Like