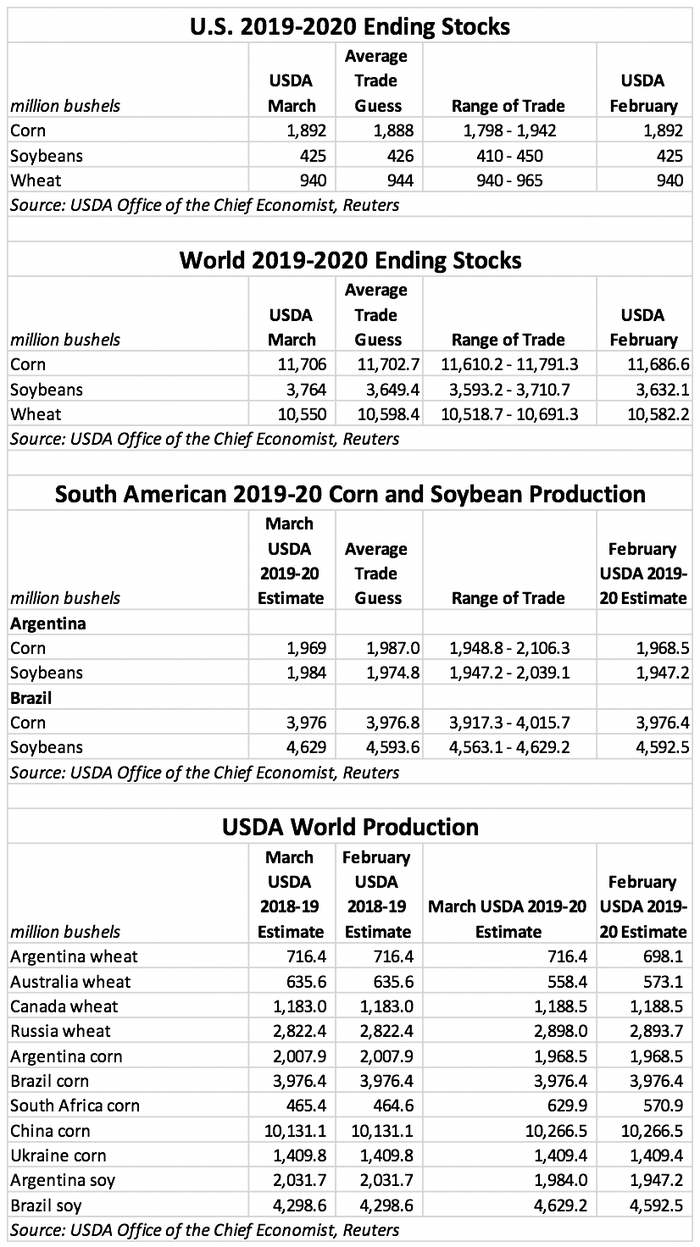

USDA’s March World Agricultural Supply and Demand Estimates (WASDE) report, released late this morning, came in exactly as market analysts expected – relatively quietly. Among the highlights: U.S. ending grain stocks were unchanged, Russian wheat was forecasted higher, Australian wheat production dropped, and Brazilian soybean production for 2019/20 increased 36.7 million bushels to more than 4.6 billion bushels.

“Market prices were relatively unchanged following the release of the report, indicating all of these factors have already been appropriately priced into the market,” according to Farm Futures grain market analyst Jacquie Holland. “High global wheat and soybean stocks chipped away at pre-report futures price gains. However, a 59-million-bushel uptick in red wheat exports lent some strength to May Kansas City futures prices. Stocks will likely continue to be higher in next month’s report as global demand slows due to the coronavirus outbreaks.”

USDA neglected to alter corn supply and demand estimates from February, with the agency still projecting last year’s harvest at 168 bushels per acre across 81.5 million acres for a total production of 13.692 billion bushels and ending stocks of 1.892 billion bushels. The season average price dipped 5 cents to $3.80 per bushel, however, based on “observed prices to date.”

“Corn prices were relatively unmoved by the report, indicating that the markets had already accounted for the 19.7-million-bushel increase to ending stocks, fueled in large part by an uptick in South African production,” Holland says.

Global corn production is also “virtually unchanged” at 1.403 billion metric tons. USDA cited an increase for South Africa, partially offset by losses in areas such as India, Peru and Russia. The agency also expects higher exports from Ukraine, South Africa and the EU. (The chart below contains more highlights of note.) Global ending stocks ticked a bit higher to reach 11.704 million bushels, coming in slightly above trade estimates.

For soybeans, USDA held steady its ending stocks estimates at 425 million bushels, tumbling 484 million bushels below last year’s record-breaking volume. That’s due in large part to a robust soybean crush of 2.1 million bushels, with exports still projected at 1.8 billion bushels for the 2019/20 marketing year. As with corn, the season average price slipped 5 cents lower to $8.70 per bushel.

USDA’s estimates for world ending soybean stocks in 2019/20 were moderately above trade estimates, reaching 3.764 billion bushels, due primarily to increased production estimates for South America and lower overall use. Global production for 2019/20 is now at 12.559 billion bushels.

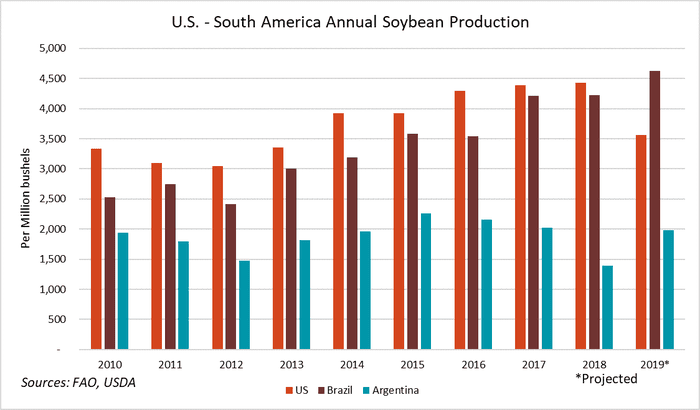

South American soybean production could be a bin-buster this year. For Brazil, USDA is projecting the 2019/20 crop will reach 4.629 billion bushels. And in Argentina, the crop could clock in at 1.984 billion bushels. Both estimates came in higher than the average trade guess.

“South American soybean yields are being rewarded for an excellent growing season as harvest winds down,” Holland says. “Argentine production increased slightly more than analysts’ expectations, but less than a Buenos Aires based FAS attaché’s predictions.”

For wheat, the agency held steady its 2019/20 domestic supply and demand statistics and also left its season-average farm price unaffected, at $4.55 per bushel. Ending stocks for 2019/20 remain at 940 million bushels for now.

USDA’s 2019/20 global wheat outlook, meantime, is on the rise – but increased consumption and exports are still pushing ending stocks lower, to 10.549 billion bushels. Trade estimates prior to the report were moderately higher. China is sitting on 52% of that total.

Overseas production varies widely. On the bearish end of the spectrum is Australia, which is still expecting an anemic production of 635.6 million bushels as it continues to struggle with drought. Then there’s India, which is expecting a record-breaking haul this season of nearly 3.807 billion bushels. For Russia, the world’s No. 1 wheat exporter, production potential is stable from February, at 2.822 billion bushels.

“Russia is expecting a bumper crop this year and has been bulking up shipping facilities in the Black Sea to maintain a competitive edge,” Holland says. “Currency volatility amidst their oil price war with Saudi Arabia threatens the competitiveness of Russian wheat prices should inflation continue to rise.”

Click here to sift through the entire March WASDE report.

About the Author(s)

You May Also Like