In our most recent blog, we talked about why you should maintain separate accounts for your prepaid crop inputs and your inventory. In this article, we’ll talk about the mechanics of the transactions.

To keep this article as straight-forward as possible, we are only dealing in dollars (no bags, tons, etc.)

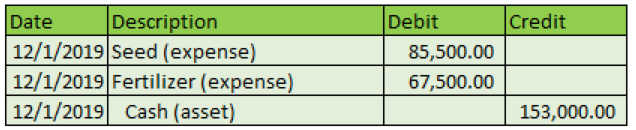

Farmer Marsha just finished up her tax planning meeting and needs to do some prepaids in order to get her taxable income down. She stops into the Co-Op to get discounts by prepaying for all her seed and fertilizer for next crop year. She is going to make the following transaction for her cash/tax basis books:

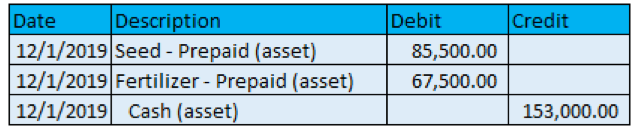

Marsha keeps accrual books as well. On an accrual basis, the purchases are not expenses (because we do not record expenses until the grain is sold) and they are not considered inventory (because she does not have the seed in her possession). She will record the same transaction in her accrual books like this:

Everything stays on the balance sheet because the prepaid is essentially a receivable – she has not received the inventory yet but has paid for it so she has some rights to receive it.

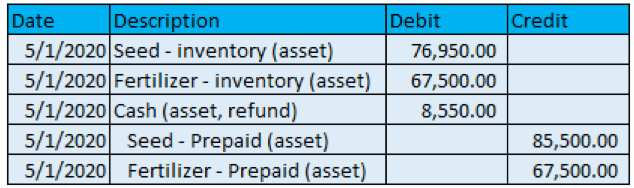

May comes around and the Co-Op delivers her order. Before they came out, they let her know that they could only fill 90% of her seed order and are giving her a partial refund. Since the inputs have been delivered, she needs to move the prepaids to inventory and reconcile the seed refund.

This is important

It is important that you remove all of the prepaid seed – the total $85,500 – from the prepaid asset even though you did not receive all the seed you ordered. Remember: accounting always balances so the value of the total goods received has to equal what you paid last fall.

The value of the seed received plus the refund check equals what you paid for last fall. The journal entry looks like this:

From inventory, the inputs are put on the field to become “Investment in Growing Crop” (an asset) and when the crops are harvested they become “Grain Inventory” (also an asset). It is not until the grain inventory is sold that expenses are realized because we want to line up the expenses of growing the crop with the income from selling the crop – which is our profit margin for that crop year.

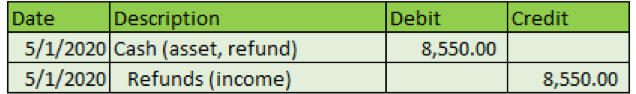

Don’t forget that Marsha is a cash-basis tax filer, so we need to record the refund in her cash basis books as well. The important thing is to credit some relevant account – seed expense (credit transactions on an expense account decrease the balance) or refund income (credit transactions on an income account decrease the balance) are what I see this go to most often. Here is the example with the refund account:

No matter what account you credit, the effect will be the same for your taxes in 2020; an increase of net income.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like