December 14, 2020

Many factors impact cattle prices every day as the market seeks a price that will balance expected supply with expected demand.

Obscure and unprecedented supply-and-demand dynamics affected 2020 markets. COVID-19 made beef demand difficult to judge accurately. Collapsing food service demand offset surging retail grocery demand. Beef export volume and value sagged. Part of the drop in exports was due to reduced supply and higher U.S. beef prices. Plus, the strong dollar made U.S. beef even pricier abroad.

Dramatic first-half 2020 supply chain disruptions reduced overall beef availability. Supply conditions stabilized in 2020’s second half, with production topping 2019’s level. That, in itself, is a testament to resiliency of the U.S. beef supply chain.

Where to view big picture

Looking at beef production, without considering beef disappearance, can cause market participants to overstate the effect a change in supply can have on prices. A balance sheet approach shows a more accurate picture of conditions facing producers and consumers.

Each month USDA’s World Agricultural Outlook Board prepares World Agricultural Supply and Demand Estimates. The WASDE report provides recent and current balance sheets, plus forecasts for the next couple of quarters. Separate estimates are made for components of supply (beginning stocks, imports and production) and disappearance (domestic use, exports and ending stocks). The monthly Livestock, Dairy and Poultry Outlook provided by USDA’s Economic Research Service adds detail and projects prices for feeder steers and cull cows, in addition to the fed steer prices provided in the WASDE report. Prices tie together both sides of the balance sheet.

Here we will largely abstract from the domestic demand situation and focus on beef production and disappearance compared to cash cattle prices. We will begin with an annual view, and then look at how 2021 may evolve by quarter.

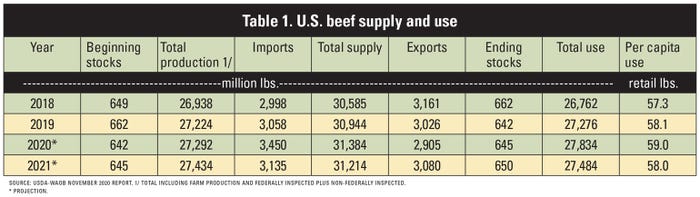

The November 2020 WASDE beef balance sheet pegged total 2020 beef supply at 31.384 billion pounds (up 1.4% from 2019) including beginning stocks of 642 million pounds (down 3%), total production of 27.292 billion pounds (up 0.2%), and imports of 3.450 billion pounds (up 12.8%) (Table 1).

Beginning and ending beef stocks are minor. For example, beginning 2020 stocks were 2% of total supply. For comparison, beginning 2020-21 corn stocks ran 12.1% of total supply.

How much stocks to hold?

Beef stocks consist of cold storage inventories plus in-transit supplies of beef in wholesale and retail markets. Most beef in cold storage is destined for the ground beef market and international trade.

Beef is perishable. Holding beef in cold storage is expensive. The COVID-19 disruption has market participants debating whether to hold more beef in cold storage as a shock absorber. For now, beginning and ending stocks indicate market opportunities and challenges related to beef movement.

Commercial beef production through the first 10 months of 2020 was down 0.1% from the same period in 2019, according to USDA’s National Agricultural Statistics Service monthly Livestock Slaughter reports. Commercial production includes slaughter and beef production in federally inspected and other plants, but excludes animals slaughtered on farms. While small in overall volume, that other production is up 24.3% in 2020. Also up are cattle weights, which have largely offset the 2.7% dip in commercial cattle slaughter through October.

Don’t sweat imports

Larger beef imports in 2020 are a sign of markets working as they are supposed to and not a reason for major concern. At 3.45 billion pounds, this would be 11% of total supply, up from 9.9% in 2019.

Adjustments in import flows serve to smooth out volumes of beef available for U.S. consumers. Robust retail beef prices during May and June attracted higher imports. A strong U.S. dollar also favors imports. The U.S. dollar had been significantly stronger compared to the Mexican and Brazilian currencies and somewhat stronger against the Australian, Canadian and New Zealand dollars. These top five sources represented 86.1% of total U.S. beef imports through the first nine months of 2020.

Impacts of 2020 abnormalities

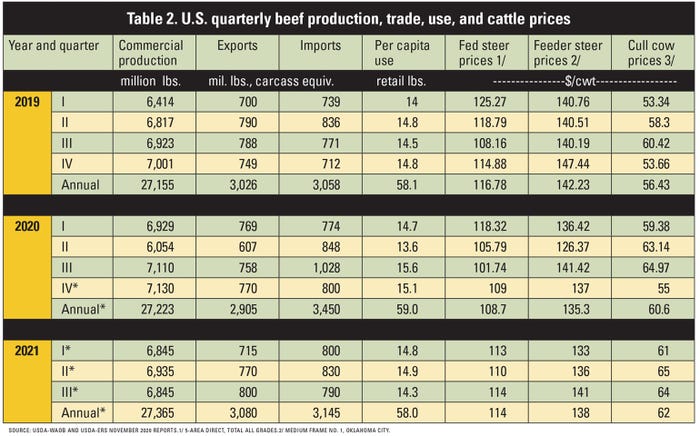

Before we get to 2021, we’ll review 2020 by quarter (Table 2). First-quarter fed and feeder prices faced pressure compared to 2019 due to more beef production and early impacts of COVID-19.

In the second quarter, insatiable ground beef demand continued to spur cull cow prices. But slaughter steer and heifer prices plunged as second-quarter beef production plummeted. That seemed to defy economic relationships. But remember, capacity to convert cattle into beef was the constraint, not live cattle available.

Third-quarter 2020 production climbed to record levels for the quarter. A combination of higher imports and lower exports lifted beef consumption to 15.6 pounds per person, an amount not seen since 2009.

Fourth-quarter 2020 saw lower year-over-year fed and feeder cattle prices. Cull cow prices averaged a bit above, similar to 2019 for the quarter. Early expectations among cow-calf producers that 2020 would be an improved year gave way to fleeting profits.

Where to in 2021?

USDA projects lower first-quarter 2021 U.S. commercial beef production, but higher per capita disappearance. The reason is international trade. USDA projects higher beef imports and reduced exports. So even though first-quarter 2021 U.S. beef production is expected to be lower than first-quarter 2020, fed and feeder prices are forecasted lower.

USDA projects the reverse in the second quarter — higher year-over-year production and higher year-over-year prices. These projections may be more about recovery and a return to normal fundamentals than anything else. 2021’s second-quarter fed cattle price projections fail to capture a return to normal seasonal patterns. That is not lost on CME live cattle futures.

2021’s third-quarter could see less beef production, higher exports and lower beef imports. The resulting disappearance (less beef per person) could support fed cattle prices.

As of this writing, USDA has not released 2021 fourth-quarter forecasts. On balance, 2021 beef production is forecast to be similar to 2020 levels. Beef trade is expected to rebalance with smaller beef imports and higher beef exports in the coming year. These will combine with steady production to reduce per capita beef consumption in 2021.

Again, as a reminder, we glossed over many important aspects of consumer demand. Supply disruptions and pivots were critical drivers for much of 2020, especially the first half. Demand drivers may be more important in 2021.

Schulz is an Iowa State University Extension livestock economist.

About the Author(s)

You May Also Like