February 27, 2019

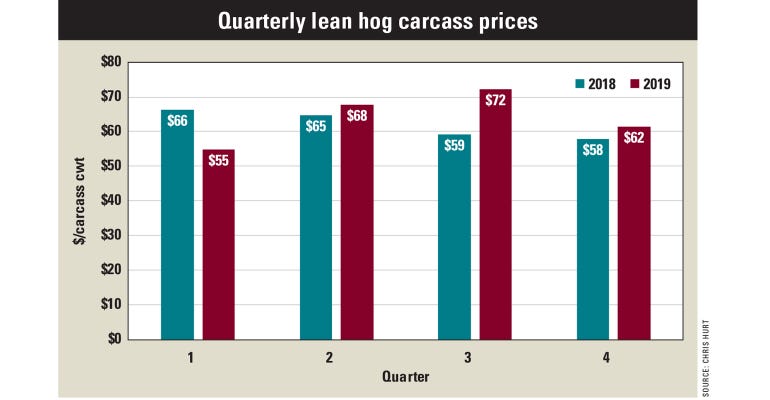

Winter temperatures and hog prices were both low earlier this year. Hog prices got off to a bad start, as they were sharply lower than last year’s levels. In the first quarter, prices for 51% to 52% lean carcasses averaged about $55 per hundred pounds of carcass. This compares with about $66 for the first quarter a year before.

Pork supplies will be at record highs again this year, and trade restrictions remained in place early in 2019. USDA estimates that pork supplies will be up 4% this year. My estimates are a bit more modest, at a 3% increase. Regardless, record pork supplies and record total meat supplies remain a concern, even with the strong U.S. economy.

As the sun gets higher in the spring sky, hog prices should continue to move upward as well. From late March, lean hog prices could move from the mid-$50s to the mid- to higher $70s by the start of summer. Current estimates are for lean hog prices to average around $68 in the second quarter, as the transition from low to more moderate summer prices occurs.

Better prices ahead

The highest prices of the year are expected in the third quarter, at an average around $72. This would be an interesting contrast to last year, when prices were depressed due to concerns about the negative impacts of tariffs. Last year’s third quarter prices averaged only $59. To see third-quarter prices near the lowest quarterly prices of the year was very unusual.

Pork exports in 2018 ended stronger than was expected for most of the year. Data available so far suggest that pork exports rose about 5% in 2018. USDA is expecting a strong 6% growth in exports for 2019. Given the record pork production expected this year, it will be important to settle trade disputes and reduce trade barriers.

African swine fever continues to reduce herds in China. The magnitude of the losses remains uncertain, but it’s anticipated China will import greater quantities of pork in the last half of 2019. What’s not known is whether this will strengthen U.S. hog prices. For the year, lean hog prices are currently expected to average about $64, compared to $62 in 2018.

Not out of the woods

My price estimates are derived from lean hog futures prices, which are currently higher than USDA estimates. Lean hog futures prices are probably building due to anticipated increases in pork exports because of African swine fever.

My estimated total cost is near $69 per cwt. Prices close to $64 mean losses near $10 per head, on average.

The U.S. has had good yields and low feed prices the past five years. As we think about planting 2019 crops, the possibility of an unfavorable growing season once again enters the minds of livestock producers.

Hurt is a Purdue University agricultural economist and marketing specialist. He writes from West Lafayette, Ind.

About the Author(s)

You May Also Like