September 22, 2017

By Michael Langemeier

If you hire a custom operater or provide custom-farming services, there’s a good chance you’re looking at published custom rate surveys. Though this information is useful for establishing custom rates, it is prudent to compare your farm machinery costs per acre to custom rates.

If your machinery cost per acre is relatively high, you should consider using a custom operator rather than replacing your own machine. Similarly, if a farm is providing custom rate services and has a higher cost than the published survey rates, it either needs to charge more or try to figure out how to lower costs per acre.

Here’s a look at machinery costs per acre for a case farm compared to custom rates associated with a field cultivation operation and a self-propelled sprayer operation.

Machinery cost computation

Several cost items should be included when computing total machinery costs per hour and per acre. It is common to divide farm machinery costs into two categories: annual ownership costs and annual operating costs. Ownership costs include depreciation, interest, and insurance and housing. Operating costs include repairs and maintenance, fuel, lubrication, and labor.

Depreciation results from wear, obsolescence and machine age. This article is talking about economic depreciation rather than tax depreciation. Depreciation for tax purposes is often accelerated compared to economic depreciation. To compute economic depreciation, information pertaining to economic useful life, list price and salvage value are needed. Economic useful life is not necessarily the same as service life. Many farms trade machines before they are completely worn out. Salvage value is an estimate of the sale value of the machine at the end of the economic useful life. Interest should be included in ownership costs regardless of whether debt is incurred when purchasing a machine. Interest represents the opportunity cost associated with using scarce funds to purchase a machine.

Repair and maintenance costs for a particular machine can vary substantially among farms. It is best to use a farm’s actual repair records to estimate these costs. If this level of detail is not available, it is common to use annual hours of use and machine age to estimate repair and maintenance costs. Labor costs reflect machine time, time required to lubricate and service machines, and travel time. When comparing total machinery costs to custom hire charges, it is particularly important to include labor costs.

Several data sources were used to create the two examples below. A case farm in north-central Indiana with 3,000 acres of corn and soybeans was assumed. Acres farmed, annual hours, useful life and interest rate represent those of the case farm.

Field cultivation

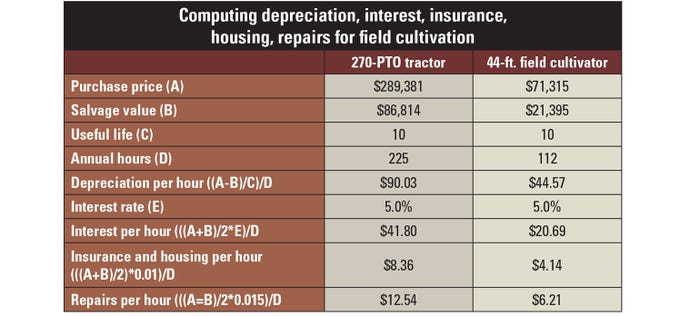

The two tables below present machinery costs for a field cultivation operation on the case farm. The first table illustrates the computation of depreciation, interest, insurance and housing, and repairs. Salvage values for the tractor and implement were assumed to be 30% of the purchase prices. The computations of interest, insurance and housing, and repair costs assumed that the tractor and implement had one-half of their useful lives left. Interest, insurance and housing, and repair cost rates were assumed to be 5%, 1% and 1.5%, respectively. These costs are heavily dependent on annual hours of use and useful life. If annual hours of use or the useful life were lower, the cost rates for interest, insurance and housing, and repairs would be higher.

The information in the first table was used to help compute the total machinery costs for field cultivation on the case farm in the second table. In addition to the costs outlined in the first table, the costs in the second table include fuel, lubrication and labor costs. Fuel costs are based on a $2.25-per-gallon price for diesel. The total costs per hour for the tractor and implement were estimated to be $203.06 and $75.61, for a total combined cost per hour of $278.67. According to Lattz and Schnitkey (2017), the field cultivator represented in these two tables can cover 29.1 acres per hour. Using this information, the total machinery cost per acre was $9.58.

Langemeier (2017) and Plastina and Johanns (2017) indicate that the custom rate for field cultivating is approximately $12.75 to $15.25 per acre. The total machinery cost per acre ($9.58) for the case farm is under these custom rates, indicating that it is economical for the case farm to own a field cultivator. It is important to note that other factors such as timeliness, liquidity, solvency and tax management may affect a farm’s decision to own machines or custom-hire certain field operations.

Self-propelled sprayer

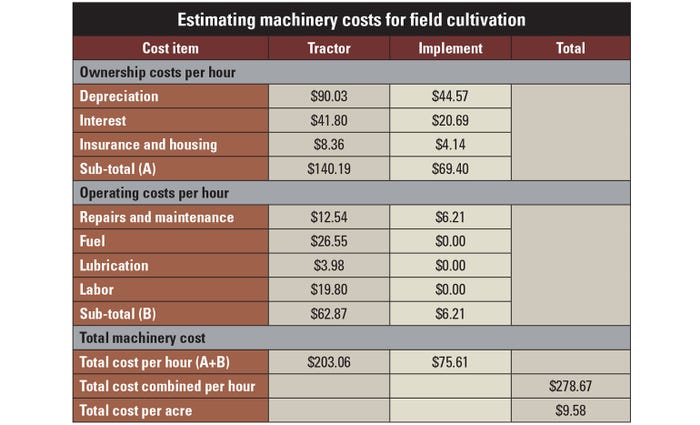

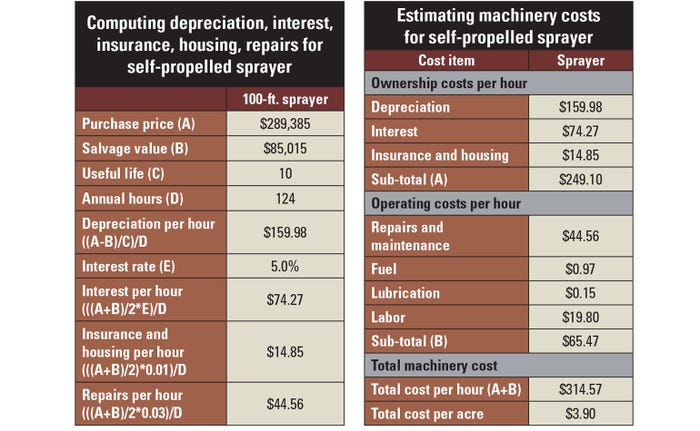

The next two tables present machinery costs for a self-propelled sprayer operation on the case farm. The table on the left illustrates the computation of depreciation, interest, insurance and housing, and repairs. The salvage value for the self-propelled sprayer is assumed to be 30% of the purchase price. The computations of interest, insurance and housing, and repair costs assumed that the self-propelled sprayer had one-half of its useful life left. Interest, insurance and housing, and repair cost rates were assumed to be 5%, 1% and 3%, respectively. These cost rates are dependent on annual hours of use and useful life. If annual hours of use or useful life were lower, the cost rates for interest, insurance and housing, and repairs would be higher.

The information in the table on the left was used to help compute the total machinery costs for spraying on the case farm reported in the table on the right. In addition to the costs outlined in the left table, the costs in the right table include fuel, lubrication and labor costs. Fuel costs are based on a $2.25-per-gallon price for diesel. The total cost per hour for the self-propelled sprayer is estimated to be $314.57. According to University of Illinois ag economists, a self-propelled sprayer can cover 80.6 acres per hour. Using this information, the total machinery cost per acre was $3.90.

The custom rate for using a self-propelled sprayer is approximately $6.70 to $7.65 per acre. The total machinery cost per acre ($3.90) for the case farm is under these custom rates, indicating that it is economical for the case farm to own a self-propelled sprayer. Again, other factors such as timeliness, liquidity, solvency and tax management affect a farm’s decision to own a sprayer or use a custom operator to spray the farm’s crops.

To see this article in its original format, visit the farmdoc website. Langemeier is a professor of agricultural economics at Purdue University and a farmdoc contributing author.

You May Also Like