September 28, 2021

What is more important when figuring cost of production — cash costs or economic costs? Is there value in knowing both?

This question pops up often when discussing enterprise cost of production budgets. It is important to understand the makeup of various cost of production budgets in order to use them for decision-making and risk management in agriculture.

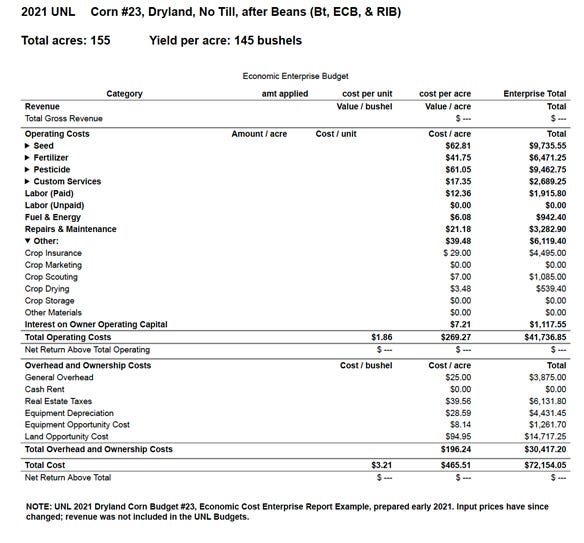

A cash cost per bushel (or unit) and a total or economic cost per bushel (or unit) are included prominently, along with other key cost categories such as operating costs and ownership costs, in the University of Nebraska-Lincoln budgets.

Cash costs

Operators often want to know their breakeven cost of production on a cash basis or, in other words, to project what price is needed to cover all cash costs associated with a particular enterprise. Anything that we are paying cash for in the production of a crop or livestock commodity is part of the cash cost per unit.

Cash costs are made up of operating expenses, such as seed, feed, fertilizer, pesticide, veterinarian, labor, custom services, fuel, machinery repairs and maintenance, plus crop or livestock specific expenses such as insurance, marketing, scouting, drying, storage and materials.

Interest expense for all or part of the production period when cash outlays are made to produce the commodity should be included, especially if borrowed funds are being used to pay for material inputs, services and machine operating costs. To this point, some ag economists might refer to cash operating costs as variable costs or, in other words, expenses that vary with output within a production period.

After cash operating costs, cash overhead expenses such as farm accounting, liability insurance, general farm or ranch utilities, and vehicle costs should be calculated and allocated to the various farm or ranch enterprise budgets.

A cash overhead expense that we don’t want to overlook is real estate taxes, if the land used in the production of the enterprise commodity is owned. If the land is not owned, then the operator’s cash rent expense is an important cash cost to include.

In times of tight margins, farm and ranch businesses might only project revenue enough to cover cash costs. Covering only cash costs may be viable for an operation in the short run (one to three years).

In the long run

In the long run (beyond three to five years), revenue to cover all production costs is needed. Economic enterprise budgets, as shown in the example, include projections to meet all costs, including operating and overhead cash costs as we’ve already discussed, plus ownership costs of machinery and equipment depreciation and opportunity costs, owner labor, and land opportunity costs.

Opportunity cost of labor is a value representing income that could be earned if the time invested by the owner or unpaid family labor was employed elsewhere. Similarly, if the owner-operator did not finance the equity portion of a machinery purchase or purchase other inputs such as fertilizer, for example, that equity could have been devoted to another investment, such as stocks and bonds, or could have been used to pay down the principal on a loan to forgo additional interest charges. Opportunity cost for owned land can simply be the value of what the land could be rented for if not being farmed by the owner.

It is important to understand what is included in cash costs versus total economic costs. A breakeven price can be determined from each. If principal payments, which are not an economic cost, are included in a cash enterprise budget, it could be that the cash breakeven figure adds up to be the larger number.

However, typically the economic enterprise budget’s breakeven figure will be larger because it includes a competitive return to equity or opportunity cost, depreciation costs, and owner labor and management fee. Knowing your enterprise cost of production and various breakeven price levels can provide a good foundation to making timely marketing and management decisions.

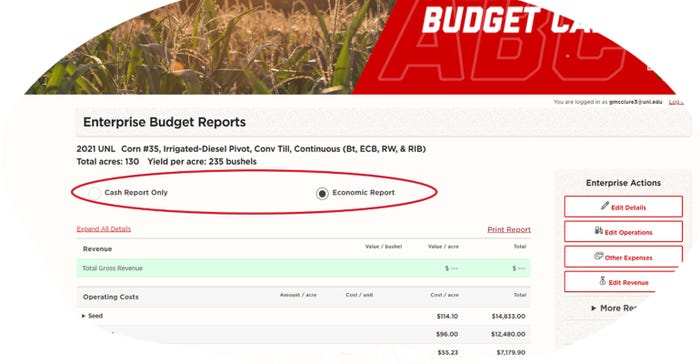

The UNL Department of Agricultural Economics and Center for Agricultural Profitability invites producers and farm managers to begin using the free online Agricultural Budget Calculator program found at agbudget.unl.edu.

The new program allows producers to estimate their cost of production based on field operation expenses, machinery, labor, service and material inputs, along with ownership and opportunity costs. A cash and economic enterprise budget report can be created from entries made into the program, or users can utilize UNL’s annual crop budgets that have been entered into the program.

McClure is a Nebraska Extension educator and farm and ranch management analyst.

You May Also Like