Consumers are almost giddy in their expectations for the economy, yet economic dark clouds say beef producers shouldn't expect cattle prices to truly reverse the current bear market.

First of all, the national herd by all measures is still expanding and thereby pressuring prices.

USDA’s National Agricultural Statistics Service (NASS) monthly Cattle on Feed report Friday shows the number of head placed in feedlots came in near the highest of the pre-report estimates and was significantly above the average.

Derrell Peel, Oklahoma State University Extension livestock marketing specialist, says the combination of counter-seasonally strong feeder cattle prices this fall, which indicated good demand despite growing feeder cattle supplies, and the large placements reported in the October on-feed report confirmed that much of that demand came from feedlots.

Fed carcass weights are down an average of 14.6 pounds because of lighter steer and heifer carcasses and a growing proportion of heifers to steers in the fed slaughter mix, Peel adds. USDA reports total cattle slaughter up 5.8% year over year, with beef production up 4.2% for the year to date.

If these overall trends continue, we're headed for a peak-cattle scenario, after which we could begin a liquidation phase, as was typical in days gone by.

Bill Helming, a private economist and analyst from Olathe, Kansas, believes beef production will continue increasing through 2019, hurting beef cattle prices through 2020.

He predicted in his most recent newsletter that the beginning of overall US net beef cow and cattle liquidation could start sometime in 2018.

"This will result in significantly lower fed cattle prices that will go below the $100 per hundredweight level," he predicted. "Fed cattle prices will very likely reach the $90 to $92 per hundredweight range within the 2018-2020 time period."

About that demand

Consumers have helped keep retail beef prices strong, and yet they seem of two minds at once if one looks at the latest Michigan University consumer confidence survey for the overall economy and the willingness-to-pay portion of the FOODs monthly consumer survey from Oklahoma State University.

Consumer confidence

In the University of Michigan early-October survey, consumer sentiment reached its highest level since the start of 2004. The October gain occurred among all age and income subgroups and across all partisan viewpoints. Report authors say, "The data indicate a robust outlook for consumer spending that extends the current expansion to at least mid 2018, which would mark the second longest expansion since the mid 1800's."

They also note consumers anticipate low unemployment, low inflation, small increases in interest rates, and modest income gains in the year ahead.

FOODs less optimistic

The sample of 1,000 consumers across the US for the FOODs survey in September showed consumers were pinching their pocketbooks when it comes to meat products, and expect to buy less meat, despite the fact they expect meat prices to decline.

Compared with one month earlier, willingness-to-pay (WTP) decreased for all meat products except pork chops and deli ham. WTP for all products listed was lower than one year ago.

Consumers also said they were eating at home a little bit more and eating out a little less. Their plans to eat out decreased compared with the previous month.

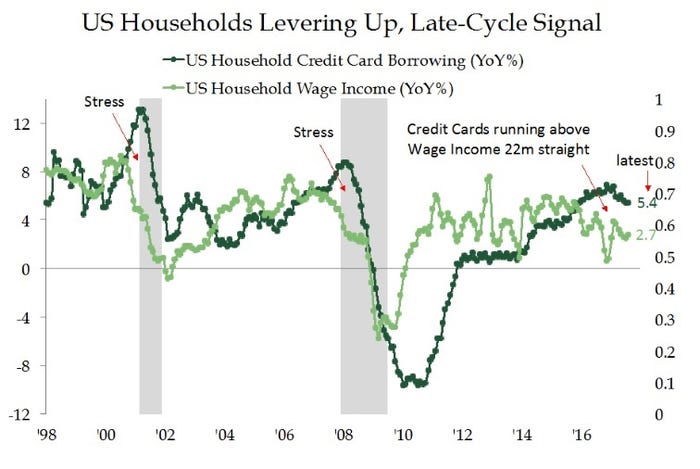

On the macro-economic level, US household debt has again outpaced US household income, as it did prior to the recessions of 2001-2002 and 2008-2009.

This graph shows consumers are once again pushing their debt above their household income, just as they did in the dot.com bust of 2001-2002 and in the great recession bust of 2008-2009.

Although the stock market is flying high, it looks ready for a reversal. The latest Commitments of Traders report from the Commodity Futures Trading Commission (CFTC) showed that commercial traders (the “smart money”) have a record number of short positions in the Dow Jones Industrial Average. At the same time, noncommercial traders (sometimes called the “dumb money”) have a record number of long positions.

This is important because there is a strong negative correlation between commercial trader short positions and the Dow Jones Industrial Average. When short positions increase, the DJIA usually falls.

These things, together with the auto financing bubble, multiple bubbles in China, and derivatives bubbles all suggest the times, and beef demand, could get harder before they recover.

The lesson would appear to be you should manage your business with safety now and through the upcoming down cycle.

About the Author(s)

You May Also Like