The farmland market is heating up again! A quick internet search this week found strong sales across the Corn belt. In fact, a farm in my home area in Warren County, IL recently fetched a price of $14,400 per acre! Most all of these were sold under public auction or online bidding environments.

Farmland returns

This same Warren County, IL farm may have fetched a price closer to $3,000 per acre when I first entered the business 20 years ago. At that time, typical land rents were $150 per acre offering landowners a realistic gross return near 5%. Today, neighborhood demand may offer a price to rent at or near $300 per acre, or a 2% gross return on this recent $14,400 per acre purchase.

For the most part, farmers and landowners are satisfied with these lower returns. Why? There are plenty of intangible factors that support land prices and farmland ownership: historical low interest rates, scarcity of land available to purchase, lack of alternative investments, and farmland being a safe-haven asset. These are just a few reasons people want to own land.

Sale leasebacks

What is a sale leaseback and why is it relevant? The google definition states it as an arrangement in which the seller of an asset can lease back that same asset from the purchaser. The seller of the asset becomes the lessee and the purchaser becomes the lessor.

This is not a new concept in the real estate industry. But it does offer another tool in my world of farm transition for helping a family farm, if we can match them to a qualified land buyer.

First, why would a farmer ever want to sell a tract of land? The reasons can vary from reducing debt or placing them in a better financial position to purchase another tract of land – perhaps closer to their home operation.

Why might this interest land buyers? Some are growing discouraged with the highly competitive bidding generated from public venues as mentioned above. A private sale leaseback offers an opportunity to purchase farmland under more favorable terms while also helping preserve a family farm. A potential win-win relationship.

The real estate industry often sets these up based on appraised price, or the market going land and rental rates in the neighborhood. However, in some cases these still don’t pencil out. We offer another method, a strategy we’ve had success with. Example:

A farmer-seller would like to sell a tract of land. An appraisal of the farmland indicates a fair market value near $10,000 per acre. The farmer seller offers to sell the farm to a qualified buyer at a 15% discount, or $8,500 per acre. Why? Not only for the opportunity to lease it back, but to do so under a more favorable lease arrangement as illustrated below:

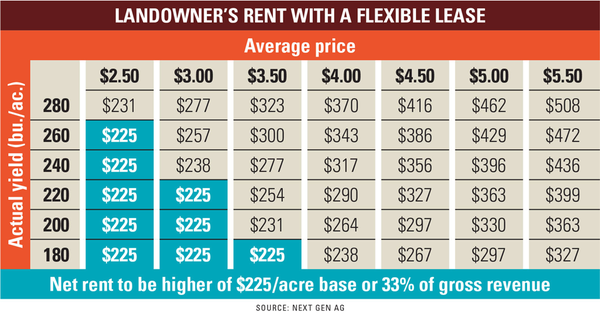

This shows the likely outcomes for a flexible cash lease offering the land buyer a $225 per acre guaranteed rent payment while also leaving their upside open to share in a percentage of the tenant’s profit. For example, if the corn price from the local grain elevator averaged $4.00 per bushel and the farm yielded 220 bushels per acre, the actual rent is $290 per acre. This divided by the purchase price of $8,500 per acre yields a 3.4% gross return.

A successful match

Purchasing a farm at discounted price with the potential to earn a greater return is more conducive for the land buyer. They also have a built-in buyer if they ever decide to sell and in the meantime can enjoy the feeling of partnering and helping a family farm. For the farmer seller, the sale of the farm most likely helps achieve some type of financial planning or farm expansion goal. The flexible lease offers them a better risk management strategy in the poor years while retaining the ability to lease and potentially buy back the farm at a later date.

It’s a win-win relationship.

Seeking qualified buyers

Know of any land buyers who are farm family friendly and open minded to non-traditional methods for purchasing and leasing farmland? They may reach me at [email protected] to learn more.

Downey has been helping farmers and landowners for the last 20 years with their family farm transition, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies.

About the Author(s)

You May Also Like