September 10, 2021

The Senate recently voted, 69-30, to advance the infrastructure bill. Currently, in the legislation, the Employee Retention Credit will end Oct. 1. In other words, the fourth quarter of 2021 will no longer qualify for otherwise eligible taxpayers.

The bill will be taken up by the House of Representatives, where there is still a possibility of tweaks being made.

The IRS just released Revenue Procedure 2021-33, which provides a safe harbor that allows taxpayers to exclude certain items from the gross receipts calculation when determining ERC eligibility. Important to many farmers are the Paycheck Protection Program forgiveness amounts. Before this, there was some uncertainty on whether PPP forgiveness would affect the gross revenue calculations.

This procedure makes clear that PPP will not be included in the gross receipt calculation under the safe harbor that taxpayers can use. Importantly, if a taxpayer uses the safe harbor, it must be consistent and exclude the amounts for each calendar quarter across all entities treated as a single employer under the aggregation rules.

Notice 2021-49 — amplifying Notice 2021-20 and Notice 2021-33 — also has mostly good news for taxpayers. The good news is that the IRS finally confirmed that the alternative quarter election is permitted for any quarter in 2021. Before this notice, there was only guidance for the first two quarters of 2021.

On the other hand, this latest notice tightens up the family attribution rules that make it very hard for taxpayers and most of their employees who are relatives to have those wages qualify for the credit calculation.

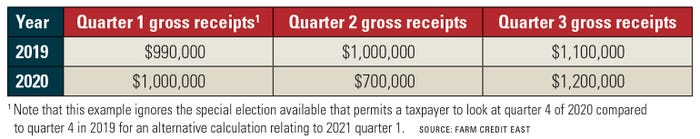

A fact pattern might look like this:

In this example, Farmer Johnny received $300,000 of PPP forgiveness in June 2021. If Johnny had included PPP forgiveness as income, his gross receipts would have been $1 million instead of $700,000, and he would not have had at least a 20% decline in gross receipts.

However, Farmer Johnny chooses to use the safe harbor and exclude PPP from the calculation. As a result, Quarter 2 has a 30% decline in gross receipts. Since Farmer Johnny qualifies for Quarter 2, he could then use the alternative quarter election to also be eligible in the third quarter — since he wouldn’t meet a Quarter 3 decline on its own merits.

If Farmer Johnny had $60,000 of qualifying wages in quarters 2 and 3 — a total of $120,000 — he would receive 70%, or $84,000, in ERC.

Taxpayers finally have some guidance on key ERC issues that bring some clarity. However, looming legislation — if and when passed — would terminate the ERC one quarter earlier than most had anticipated.

Arezzo is a senior tax consultant for Farm Credit East, and this article originally ran in the organization’s Today’s Harvest blog.

You May Also Like