Corn, soybeans to add stocks on lower demand forecasts

North Dakota continues to make waves in the corn market. The state’s 2019 corn harvest was not completed until the end of May, which will drag down test weights on 2019/20 production. With such delayed spring fieldwork progress, many North Dakota corn acres were shifted into prevented plant acreage. Wall Street Journal trade estimates place the 2020 corn crop at 15.92 billion bushels, down 71 million bushels from the May WASDE report.

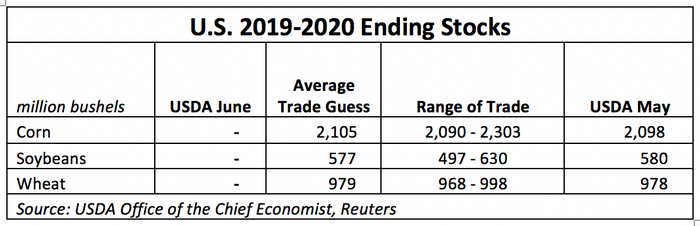

However, a turbulent planting season in the Northern Plains will likely not make a difference to large ending stocks if strong crop condition ratings continue through the growing season. Ethanol demand in the coronavirus pandemic era remains nearly a third lower than the same period last year. Cuts to ethanol output in today’s report will add unneeded volume to ending stocks.

And with marketing year-to-date corn exports 20% lower than 2018/19, U.S. corn exporters will have to ship at least 45 million bushels of corn a week for the next 14 weeks to hit USDA’s 1.775 billion-bushel export forecast, a figure that seems highly unlikely given weekly exports have only averaged 29.4 million bushels/week thus far in 2019/20.

But corn export adjustments could be a wild card in this morning’s report. Weekly U.S. corn exports in the last 10 weeks have averaged 47.4 million bushels as the U.S. dollar has weakened. Seasonal export demand for corn is typically high in spring months, which may deter USDA from adjusting corn export figures. If the dollar continues to weaken amid increased civic unrest and international corn demand is strong, U.S. corn farmers may have a chance to take advantage of favorable summer corn sales.

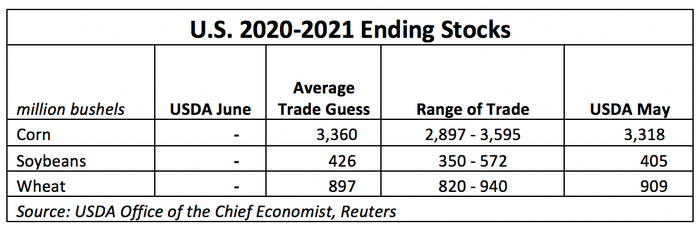

Another cool and wet spring in North Dakota and Minnesota prevented many spring wheat acres from being planted after last week’s final planting date. But that likely increased soybean acreage for the 2020 growing season. WSJ analyst projections added 27 million bushels of soybean output to 2020 production estimates, placing the new crop total at 4.15 million bushels.

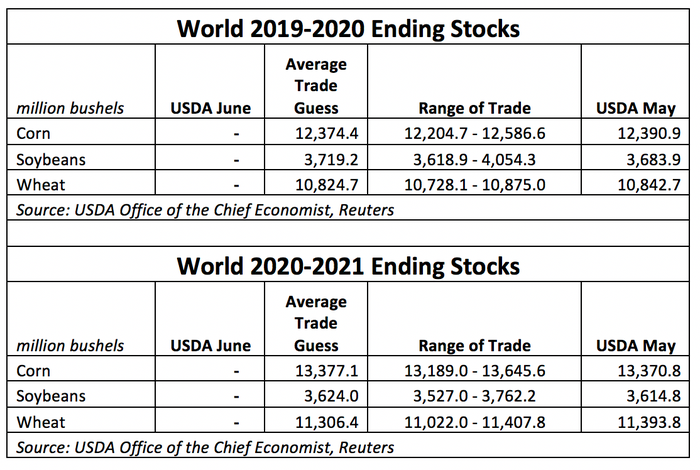

If that holds, tight 2020/21 ending soybean stocks may loosen slightly. Reuters survey estimates place today’s new crop ending stocks figure at 426 million bushels, up from 405 million bushels in May.

Export demand will be a key driver for soybean prices in today’s report. Reuters and Wall Street Journal trade estimates are mixed for 2019/20 ending soybean stocks amid differing export forecasts. Chinese has booked multiple soybean sales in the past two weeks, fueling bullish sentiment for new crop exports but old crop exports remain 19.2% lower than the five-year average.

USDA’s May export forecast for U.S. soybeans registered at 2.55 billion bushels. With only 1.32 billion bushels shipped as of May 28, over 87.7 million bushels of soybeans will need to be physically exported each week for the remainder of the 2019/20 marketing year. Considering exports per week in the current marketing year have only averaged 33.9 million bushels, it seems more likely USDA will lower old crop export forecasts in today’s report. Such a move would favor the WSJ estimates of a higher old crop carryout of 584 million bushels.

U.S. wheat output falls with winter wheat ratings

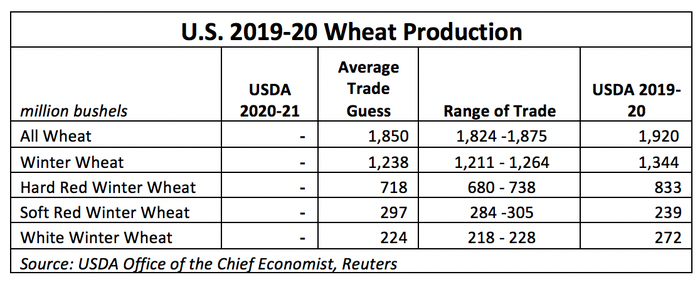

Winter wheat harvest has kicked off in fast fashion in the Southern Plains. Texas was 17% ahead of the five-year harvesting progress average on Sunday and the nationwide harvest is in line with historical averages of 5%. But a dry growing season across the Southern Plains will likely lead USDA to slash 2019/20 production estimates by 70 million bushels.

This comes as welcome news for both old and new crop ending stocks. Food demand for wheat spiked during the pandemic as stay-at-home food prep dominated consumer food purchases in recent months, but it likely won’t offset a weak market for U.S. wheat exports.

A strong dollar kept many U.S. wheat exporters out of the international arena. And even though 2019/20 exports will likely end at the year at their highest volume since 2016/17, they will still finish around 60 million bushels short of USDA’s 970-million-bushel export estimate for the old marketing year.

Global corn and wheat stocks fall while soybeans rise

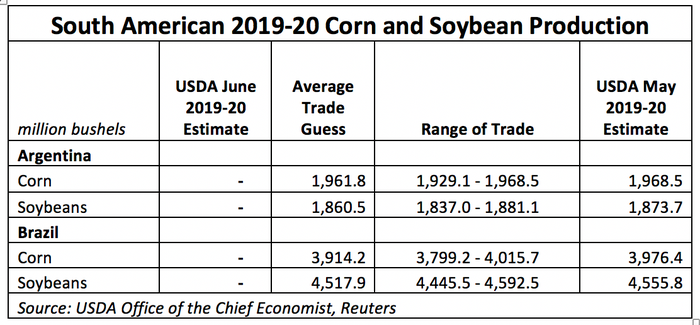

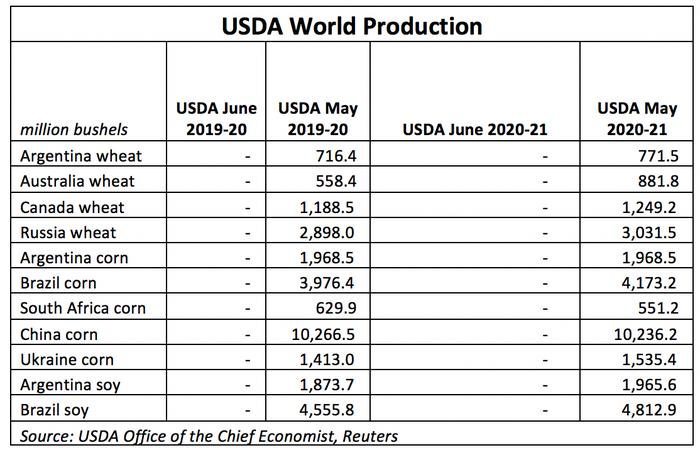

A persistent drought this spring in South America will likely lead USDA to further cut soybean production estimates for Brazil and Argentina. But despite dry weather warnings, USDA has been reluctant to adjust corn production estimates in previous WASDE reports for the two South American grain powerhouses. Trade projections suggest that small but lower adjustments on the Brazilian and Argentine corn crops could be in store from USDA today.

Australia’s Bureau of Agricultural and Resource Economics and Sciences raised new crop production estimates by 25% yesterday to 981.0 million bushels as heavy rains along the continent’s eastern coast alleviated a three-year drought.

Leading Russian agricultural consultancy SovEcon readjusted their 2020 wheat harvest estimate yesterday by 55.1 million more wheat bushels to 3.04 billion bushels after recent rains in key growing areas in Southern Russia boosted crop conditions. But the larger European wheat crop has suffered a dry growing season despite recent rains. And increased global pandemic consumption of wheat products is expected to lead USDA to reduce ending world wheat stocks in both the old and new marketing years.

Decreased South American corn production this year will largely contribute to lower world ending stocks for corn in the 2019/20 marketing year. But global biodiesel production cuts in the wake of international pandemic lockdown measures will likely add to ending world soybean stocks in today’s report.

About the Author(s)

You May Also Like