Ever since 2013 when the air start coming out of the farm profit balloon, farmers have been refocusing on their cost structure. Or at least, they should be. Leading up to 2013 farms had been adding excess cost – and getting those costs back to reasonable levels has proven elusive for some.

“Unfortunately we are still at the point where too many producers don’t understand their cost structure,” says Tim Koch, chief credit officer at Farm Credit Services of America in Omaha, Neb. “You have to understand all of your cost categories, then look at where you have excess. Is it equipment, family living? Should you seek off farm income, or add custom farming?”

There’s a lot of ways to re-tool farm finances to boost cash flow and margins. Consider these ideas:

Re-structure debt?

Lower commodity prices have forced many farmers to eat away at working capital. “If your cash flow is negative and you run out of working capital, you have a real problem,” says Koch.

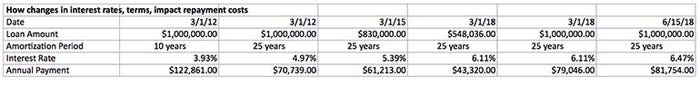

You can get more cash flow by re-amortizing that 2013 loan, but you’ll pay a higher price for the new money. In 2013 a lot of farmers were buying farms on 5-year, 10-year and 15-year amortization rates – resulting in monthly payments that don’t pencil out with today’s lower commodity prices. Lenders are looking to help re-do those loans on 20 or 30-year terms. But rates, on average, are 1 to 2 points higher today than in 2013 – and headed higher.

“The industry has preached no debt for a long time, but the biggest driver in people not wanting to re-amortize their land debt is, they don’t want to give up that cheap interest rate,” says Koch. “So you have to get past that. At some point in time we must convince people that rates are still, today, historically low.” According to USDA, interest expenses on farm loans have risen steadily since 2013. In fact, in 2017 real estate interest expenses were expected to be the highest since 1989, and non-real estate interest expenses were 23% higher than in 2013.

“It’s a big obstacle for some people,” says Koch. “You have to help producers see that they have a cash flow issue to solve, and restructuring debt will help solve that problem.”

Look at benchmarks

How do farmers know when costs are too high? One way is to compare your business to averages. A good place to start is at your nearby land grant university. Other organizations, such as Illinois Farm Business Farm Management, FINBIN, or Farm Credit, can provide average cost information.

“That can provide a real aha moment,” says Koch. “Going into these last few years a lot of people really didn’t have an idea of their cost structure, at least from a holistic standpoint – that is, what does it cost to produce a bushel of corn, including family living and land costs.��”

If you’re going to analyze and make changes, those fixed costs – living costs, machinery, cash rent – are a good place to start.

“Oftentimes you get to a point with a customer and they determine their all-in cost is $4 a bushel and they realize, that’s not going to work,” says Koch. “Benchmarking showed them where they needed to make changes. It can be very powerful.”

Change what you can control

As commodity prices began to tumble after 2014, more farmers came to the conclusion they needed better financial skills. “Instead of hoping for higher prices, they’re trying to manage costs,” says Koch. “Our belief is, prices are not going to lead us out of the current farm economy downturn. The U.S. has become a high cost producer. If we’re going to be a global leader we have to bring costs down, specifically in corn, soybeans and wheat. So people clearly need to understand their financial situation much better.”

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like