September 10, 2018

Taxes and death are the only things certain in life, as Benjamin Franklin famously wrote in 1789. The U.S. tax law was changed yet again with the Tax Cuts and Jobs Act of 2017, and the 2018 tax year is the first to which it applies.

For businesses — such as limited liability corporations, partnerships and subchapter S corporations — the pass-through income deduction for 2018 to 2025 is now 20%. This means the Form 1040 Schedule F, which contains farm business net income, now only has 80% of net income added to the front of Form 1040.

“The actual regulations and any limitations have yet to come out,” cautions Ruby Ward, associate professor at Utah State University’s College of Agriculture and Applied Economics. “Experts still argue over what gets included and what doesn’t. Schedule F income should be included for sure, but some of the other things, like farm rental income from cash-rental payments, may not get the 20% deduction.”

Ward says that unless the IRS provides clearer language, the 20% pass-through deduction will be clarified through the court system over the next few years.

Tax on co-op sales

The Hoeven-Thune Amendment in the tax bill allowed farmers to claim a 20% deduction; this was increased from the previous 9%, on income associated with grain delivery to a cooperative. This could have hurt privately owned grain handling facilities and decreased on-farm storage, and competitive markets would have most likely eliminated any advantage to producers via pricing. In March, the Hoeven-Thune Amendment was rescinded due to these concerns, and the 9% deduction was reinstated.

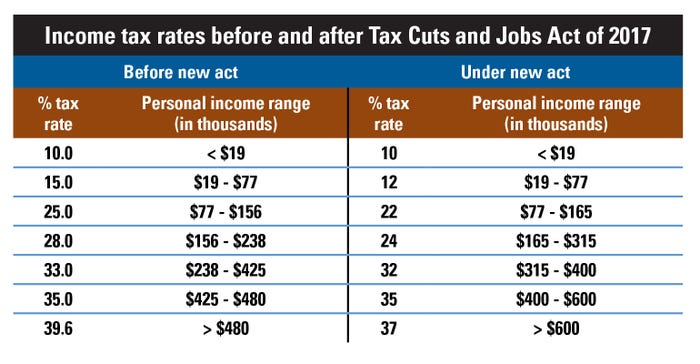

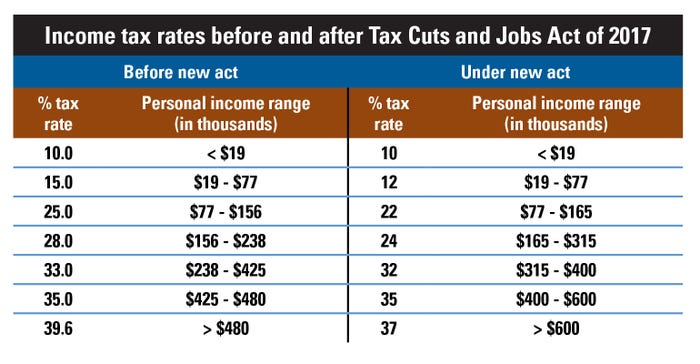

This rundown on tax rates based on income shows how the new tax law could affect what you pay Uncle Sam.

Depreciation changes

Bonus depreciation can now be used for new and used equipment, and 100% of the equipment’s value can be depreciated in a single year from 2018 to 2022. In 2023, the value lowers to 80%; it continues to decrease each year until the value reverts to zero in 2027.

“These changes accelerate depreciation,” Ward explains. “Section 179 allows you to elect to expense equipment in the year purchased. This increased from $500,000 to $1 million, and farm equipment can be depreciated over five years now instead of seven.”

Ward cautions that it’s not always a good idea to accelerate depreciation. “If I use more depreciation in the first year, but I haven’t paid off the entire equipment loan that first year, then in later years I have to pay the loan payments with after-tax dollars. This increases the cost of servicing the debt in future years, because I don’t have depreciation to offset those principal payments.”

Accelerated taxes can become a liability at retirement. “If you’ve prepaid expenses,” Ward says, “and taken all your depreciation up front, then that last year before you retire could result in your entire year’s revenue with no expenses to deduct against it. This means you have a huge tax liability on your revenue.”

The new tax bill also reduced the ability to carry back net operating losses and placed an 80% limit on them. Another change is the elimination of the individual medical insurance mandate penalties. In general, the tax bill’s changes add up to decreased overall taxes.

Estate taxes and more

The new tax bill doubles the basic exclusion amount for 2018 through 2025, which means a person can die with an estate worth $11,180,000 (adjusted for inflation) in 2018, and the estate will owe no tax. Basis adjustment, or step-up, continues at death for all estates, whether taxable or nontaxable.

Property taxes are an issue. There was a lot of attention to the $10,000 limit but for property taxes paid by a business, and they are still fully deductible on Schedule C, Schedule D and Schedule F.

Medical expenses exceeding 10% of the taxpayer’s adjusted gross income are deductible for 2017 and 2018. That adjusted gross income threshold falls for everyone to 7.5% for 2019 and beyond.

A look at other changes

There are several other key revisions in the tax bill:

• Standard deduction rises. Formerly $13,000 for a married couple filing jointly, the standard deduction is now $24,000 for a married couple filing jointly. Both were indexed for inflation and will increase some each year. It all reverts back in 2026.

• Itemized deduction decreased. This should fall with the higher standard deduction. This provision uses actual amounts of qualified expense instead of the standard deduction. The new law limits what can be deducted. It also limits mortgage interest.

• Exemptions disappear. The per-person amount that is deducted from income was $4,150, but it falls to $0 until 2025.

• Child Tax Credit rises. The Child Tax Credit cuts taxes dollar for dollar. Formerly $1,000 per qualifying child under 17, it doubles to $2,000 per qualifying child. The refundable amount falls to $1,400, and $500 for dependents that don’t qualify for the child tax credit.

Research it

Tax law is complex. Articles from Iowa State University’s Center for Agriculture Law and Taxation dive deeper into the topics below regarding what the Tax Cuts and Jobs Act of 2017 means for farmers and ranchers.

Does cash rental income qualify for pass-through deduction?

Proposed regulations for Section 199A

Overall highlights of the changes

Hemken writes from Lander, Wyo.

About the Author(s)

You May Also Like