May 24, 2016

NEWS UPDATE: Tuesday, May 24: Monsanto responded in a press release this afternoon, stating the current proposal undervalues the company and lacks adequate reassurance for some of the potential financing and regulatory execution risks. Bayer then responded that the company looks forward to continued constructive discussions regarding the transaction.

"We are pleased that Monsanto’s Board shares our belief in the substantial benefits an integrated strategy could provide to growers and broader society," said Werner Baumann, CEO of Bayer AG. "We are confident that we can address any potential financing or regulatory matters related to the transaction. Bayer remains committed to working together to complete this mutually compelling transaction."

-----

In a press conference Monday, May 23, Bayer went public with their private acquisition proposal that was presented to Monsanto executives in St. Louis on May 10. Bayer CEO Werner Baumann said the two companies are “engaged in constructive discussions” and that “we await a response from Monsanto’s Board, and are fully committed to negotiations”.

The offer, to create a global leader in the agriculture industry, is an all-cash deal of $122 per share, valuing Monsanto at $62 billion.

Bayer executives released details to help answer market speculation, providing a look at the proposal, which states that Monsanto also thinks “a combination of Seeds & Traits, Crop Protection, Biologics, and Digital Farming would be a winning formula.” Bayer has created a website that includes videos, investor presentation, fact sheet, FAQ and more.

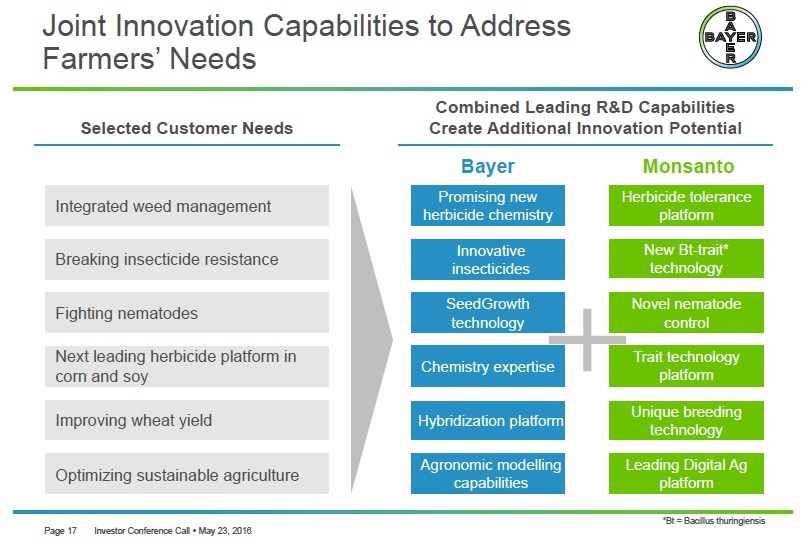

During the presentation, Bayer highlighted synergies that will benefit farmers and investors as the combined company addresses global sustainability challenges of a growing population that will need higher protein intake:

Combining leading Crop Protection and Seeds & Traits platforms

Larger range of products and solutions to be offered to farmers (Seeds & Traits, Crop Protection, Biologics, Digital Farming)

Creating an innovation powerhouse with strong R&D platform, world-class scientists and robust pipeline in Crop Protection, seeds (breeding) and traits

Creating a leading platform in Biologics and Digital Farming

Diversified portfolio across geographies, indications and crops reduces risk

Limited portfolio overlap supports further growth potential

Significantly enhanced access to farmers, best-in-class sales force and comprehensive product portfolio

Anti-trust issues?

Bayer CEO Baumann said the company has extensively assessed possible product portfolio issues “and have found very few due to the complimentary nature of each company’s products and the geographies of their markets. If regulators determine a need to divest of specific businesses, we would comply if necessary – but it is premature for us to speculate.”

When asked about reduced competition and fewer product choices for farmers, Baumann was quick to point out that “if we divest of a business, someone else will be there to buy it, so that competition remains.”

About the Author(s)

You May Also Like