Last month I introduced you to Aunt Tilly and her simple approach to pre-harvest marketing. Tilly prices 80% of her anticipated new crop corn and soybeans in 20% increments (March, April, May and June), with the remaining 20% priced at harvest. Despite a disastrous 2020, Tilly’s approach has proved effective over time.

Simple is good, but I remain uneasy with one aspect of Tilly’s approach: her willingness to take action regardless of the price level. That meant she was active last spring, when a pandemic-induced crash had Nov’20 soybean futures as low as $8.50/bu. and Dec’20 corn futures below $3.50/bu.

Ouch.

I am a proponent of spring and early summer sales, but I think every producer needs a minimum price objective that is consistent with production costs.

This is the approach that guides my friend Terry Timer. Like Aunt Tilly, Terry prices 80% of her anticipated new crop corn and soybeans in 20% monthly increments, March to June, and the remaining 20% at harvest. Unlike Tilly, however, Terry has a minimum price objective for new crop corn and soybeans that is consistent with her break-even cost of production.

That difference led to dramatically different results in 2020. While Tilly was busy pricing new crop at prices well below production costs last spring, Terry stood aside and benefitted from higher prices at harvest.

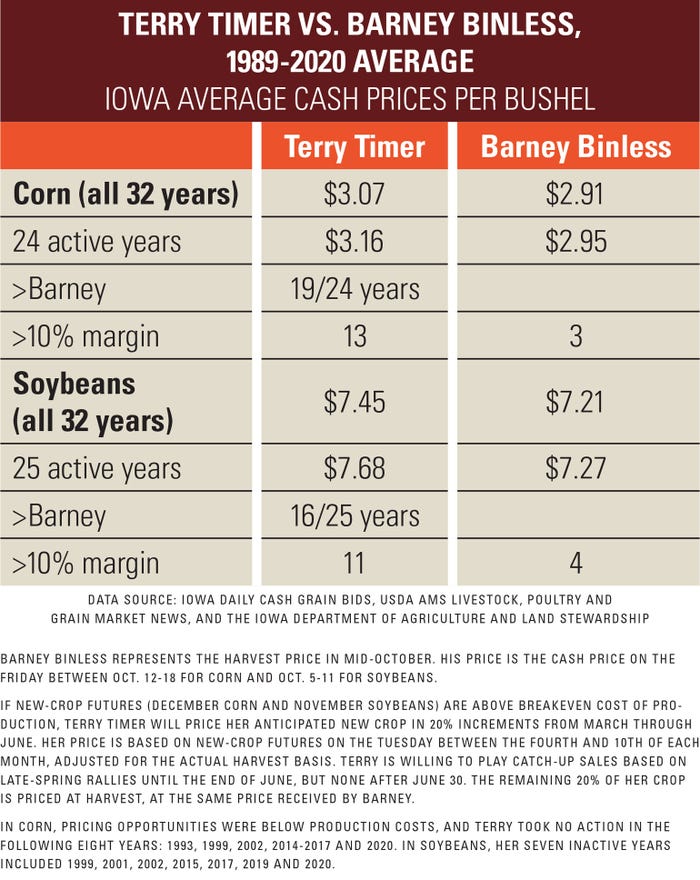

The accompanying table compares Terry Timer to Barney Binless, a producer who does not believe in pre-harvest marketing and represents the harvest price. I compare them over all 32 years, and again in years when Terry was “active” (24 years in corn, 25 in soybeans). There were 8 years in corn and 7 years in soybeans when her early pricing opportunities were below production costs. In these years, Terry’s price was the same as Barney’s harvest price.

The data table from last month showed that Tilly’s simple approach to pre-harvest marketing beat Barney by an average of 16 and 24 cents in corn and soybeans, respectively, over a 32-year period. Terry Timer’s approach is even better. Considering all years since 1989, Terry’s approach beat the harvest price by 16 and 33 cents per bushel in corn and soybeans, respectively. Focusing solely on years when Terry was active (i.e., March-June prices above production costs), she beat Barney by 21 and 41 cents in corn and soybeans.

Terry’s minimum price objective adds a much-needed discipline to Aunt Tilly’s aggressive desire to price grain before harvest. In 2021, Terry’s minimum price objectives are $4.25/bu. Dec’21 corn futures and $9.75/bu. Nov’21 soybean futures. New crop futures are currently above both figures – well above in the case of Nov’21 soybeans. It looks to me that Terry is going to be a busy person pricing 2021 crop this spring and early summer.

Like Aunt Tilly, Terry Timer has a simple and effective plan to price new crop grain in 2021. How about you?

Want to learn more? Check out these past columns.

Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like