November 6, 2018

Even as drought conditions have improved relative to a couple of months ago in many important U.S. cow-calf production areas, other key beef exporting nations are not so fortunate. Both Canada and Australia are facing weather-related challenges that could have important ramifications for the U.S. beef market in 2019 and beyond.

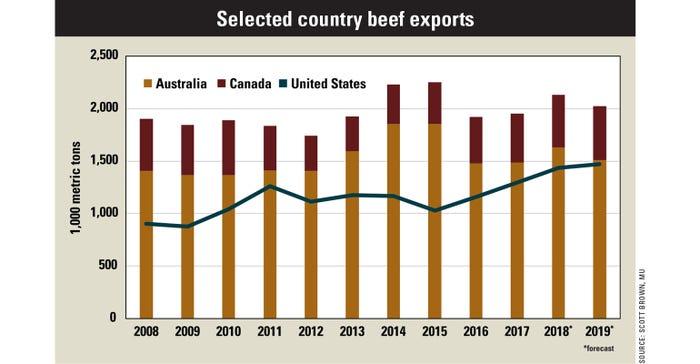

Even though Canada and Australia combined produce less than a third as much beef as the U.S. and just over 5% of world beef output, they supply about half of U.S. beef imports and compete against U.S. beef in many of our key export markets. Few cattle producers who have navigated serious long-term drought would wish that situation upon even our competitors, however, the reality is that weather struggles in other markets could lead to a more optimistic market outlook here.

Drought damage

The Australian Bureau of Agricultural and Resource Economics and Sciences recently projected that cattle farmers are in a contraction phase to manage dry conditions. Feedlot margins are expected down due to rising feed grain prices within Australia. USDA’s Foreign Agricultural Service reports that cattle herd rebuilding efforts will be a top priority for Australia in 2019, following the current persistent hot and dry weather conditions that have forced cattle into feedlots early.

Although in the very short-term drought conditions increase the amount of cattle slaughter and beef entering world markets, the time of rebuilding inventory leaves a gap in world supplies. And with Australia projected to begin 2019 with a cattle herd that is over 13% lower than the 2015 level, much rebuilding is expected to take place as weather conditions allow.

Calf concerns

FAS also reports that severe winter storms this past March and April pummeled parts of western Canada during key calving months, which contributed to a continuation of the long-term decline in the Canadian cattle herd.

Bloomberg recently reported that feed barley prices in Alberta are approaching three-year highs, as short supplies of feed and forage crops in Western Canada are prevalent. Although Canada is projected by FAS to slightly increase beef exports in 2019 compared to this year, fewer cattle are expected to cross into the U.S., continuing a trend that has been in place for the last few years. The U.S. imported more than one million head of cattle from Canada in both 2013 and 2014, but those totals are down nearly 40% in recent months.

Realizing opportunity

With U.S. livestock producers continuing to supply ever-increasing amounts of meat, it is important that opportunities for increased demand continue to be available. Although domestic consumers will continue to be the most important piece in sustaining strong demand for U.S. beef, international developments are also vital.

With situations in place in two other key world beef suppliers that will inhibit their ability to ramp up supply in the years to come, the potential for U.S. trade gains to continue to grow in 2019 is bright.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like