March 11, 2021

The widespread winter storms and record-setting cold that plagued a large portion of the nation in mid-February did not spare the cattle industry, and while some of its effects have already begun to fade, others could shape markets for months to come.

Cattle slaughter from Feb. 12 to 18 plunged 18% from the prior week and was 13.5% lower than the same period a year ago, as the wicked weather combined with power disruptions and a lack of natural gas availability to slow operations at several packing plants.

Lower cattle weights

While short-term supply disruptions caused stress and additional labor for those in all phases of the cattle business, the short-term issues will likely pale in comparison to the long-term effects.

Many analysts agree that cattle carcass weights will decline as a direct result of the harsh feeding conditions, although the fact that some cattle backlog has again developed because of the lower slaughter numbers noted above may offset a portion of the decline.

When lower dressed cattle weights do begin to show up in the data, it will be the first time since the fall of 2019 that weights have declined versus the previous year.

Another long-term effect of the brutal conditions may show itself in fewer live calves per cow.

Greater calf losses

With many producers beginning calving season during the height of the cold and stormy conditions, death loss on a national level almost certainly increased, and in some areas significantly so.

This decrease in supply will lead to firmer cattle prices all else being equal, with fed steer prices likely to average 1% higher on an annual basis for every 1% decline in the calving rate, and feeder steer prices moving 1% to 1.5% higher.

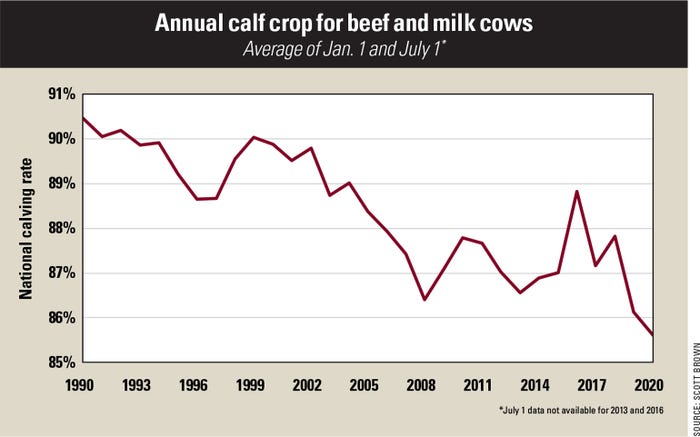

USDA data suggests that the national calving rate has been on a downtrend for decades. After averaging 89.7% during the 1990s, the number of calves born per cow decreased to 88.4% in the 2000s and 87.3% during the 2010s. The most recent 2020 figure fell to 85.6%.

Combining these two measures leaves the fact that only about 80% of cows have produced surviving calves in recent years, and the difficulties early in the 2021 calving season could make it a challenge for the industry to reach that mark this year.

With beef cow numbers already on the decline, slaughter cattle supplies should continue to tighten later this year and next. While this is little solace for those who lost a higher percentage of calves than normal because of the extreme weather, it does set the table for higher expected market prices later this fall and into next year.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like