July 5, 2017

With U.S. beef now officially allowed into China for the first time since 2003, many involved in the cattle business are trying to determine how big of an impact this will have on markets.

Questions remain as to how quickly a significant percentage of U.S. beef producers and packers will be able and willing to meet the protocols determined by China for traceability and product specification — and the ban on certain feed additives and growth-promoters now commonly used in the U.S. Also, there are discrepancies between the beef products China’s consumers are currently familiar with purchasing relative to the quality of beef in the U.S. production system.

While these and other uncertainties make it difficult to pinpoint short-term market effects, the fact remains that the long-term potential for U.S. beef could be one that allows the industry to expand profitably by leaps and bounds.

Demand changes the game

Consider the impact that large changes in demand have had on other commodities recently.

Before the 1994-95 marketing year, corn for ethanol use had never exceeded 500 million bushels. But corn for ethanol during the past three marketing years has averaged 5.25 billion bushels, over ⅓ of total corn production.

Likewise, soybean exports to China, which accounted for less than 1% of total U.S. soybean exports prior to 1995, have risen to more than 60% of total bean exports since 2011. Exports to China now amount to more than a quarter of U.S. soybean production.

Consumption increases

It is way too early to make any bets on whether beef exports to China may eventually yield a similar growth path for the cattle industry. But current beef consumption data in Asia does allow for some assumption-based estimates.

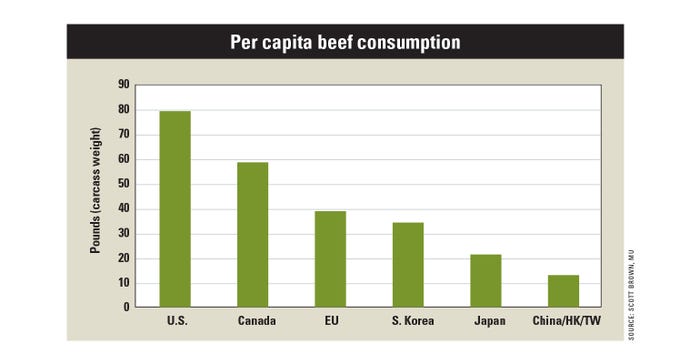

Per capita beef consumption in the combined markets of China, Hong Kong and Taiwan is now about 13 pounds per person (these markets are combined, due to speculation that some U.S. beef was already entering China via the Hong Kong and Taiwan markets).

Comparatively, Japan now consumes about 21 pounds of beef per person, with South Korea near 34 pounds. Note that these are all relatively low levels compared to the nearly 80 pounds of beef per person (carcass weight equivalent) consumed in the U.S., just under 60 pounds per capita in Canada and almost 40 pounds per European Union resident.

If China eventually increased its per-person beef consumption to the 21 pounds currently in Japan, the population of 1.4 billion people would require 12 billion more pounds of beef, about 45% of current U.S. beef production. Moving to South Korea’s consumption level yields a demand for almost 30 billion more pounds of beef.

Exciting times ahead

Obviously, any changes of this magnitude will take time, along with years of strong economic growth and changing consumption patterns in China. And other beef exporters will be tough competition for the lucrative China market. But the potential is there, and it is exciting.

Industry growth requires new demand sources, and that hurdle has now been cleared with resumed market access into China. Taking advantage of this new demand source is the next challenge for the U.S. beef industry.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like