February 6, 2018

By Scott Brown

As many industry participants had expected, the 2018 USDA Cattle report showed that this year began with more beef cows than the year before. The increase of just over 500,000 head pushed the total U.S. beef cow inventory to about 31.7 million on Jan. 1.

This was the sixth-largest gain in beef cow inventory in the last 43 years since the historical record of 45.7 million beef cows in 1975. It marks the fourth consecutive year of herd growth; only 1991-96 saw a longer period of inventory build.

Efficiency pays

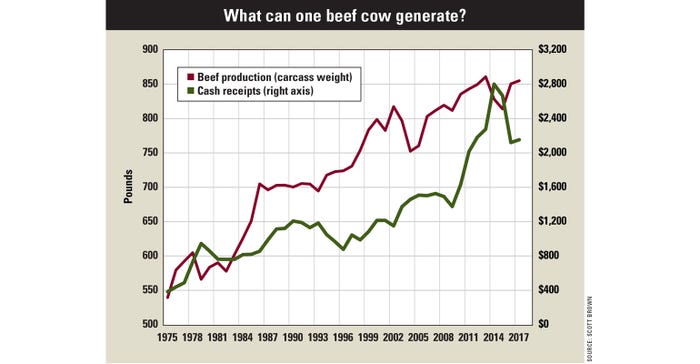

It is important to realize that an additional half-million beef cows means something different in the current cattle cycle than in past decades. With industry efficiency continuing to increase, an average of more than 840 pounds of beef has been produced in the following year for every beef cow since 2010. As recently as 1993, beef production per cow barely eclipsed 700 pounds.

Even more impressive output per cow has occurred in cash receipts, thanks in large part to much-improved demand for U.S. beef, both domestically and in export markets. One beef cow has generated an average of at least $2,000 in cash receipts each year since 2011. This is well above the then-record of $1,215 in 2000. The accompanying figure shows the dramatic growth in both beef production per cow and cash receipts per cow.

Larger calves on horizon

Though it will not be a perfectly smooth growth path, there is little reason to think that the increase in beef production per cow will not continue. Cattle slaughter weights are likely to increase again this year following weight declines during the last two years.

Net imports of cattle, particularly feeder cattle from Mexico and slaughter cattle from Canada, are unlikely to drop off significantly — barring a major change to NAFTA.

And while calving rates will always be somewhat volatile due to weather and other factors, steep declines are not anticipated for any given year.

The consumer factor

The receipts generated per cow are a little tougher to peg, as they depend more on consumer behavior, which can be tricky to project. Yet with the economy expected to remain fairly solid and growth still occurring in high-quality beef sales, there is reason to feel that this measure should not decline too sharply, even in the face of increased supply.

If one assumes 850 pounds of beef per cow, and $2,000 in cash receipts per cow, the latest increase in beef cow inventory not only means half a million more cows, but also means an eventual addition of 425 million pounds of beef production and $1 billion more in cash receipts for the cattle industry. That is a pretty good year of expansion.

Whether industry expansion can continue through 2018 is increasingly in doubt, as recent dry weather has raised forage availability concerns and cattle prices are projected to decline.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

You May Also Like