International consumers will pay for high-quality U.S. beef.

October 2, 2018

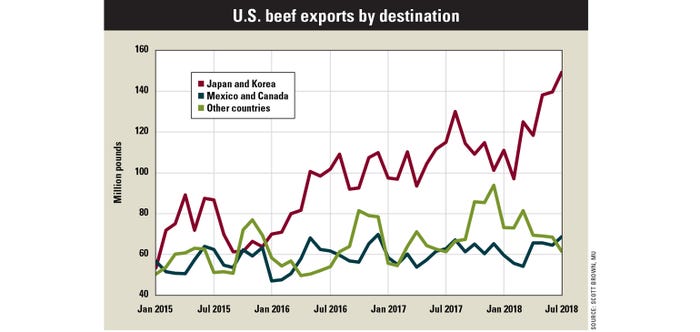

While total demand for U.S. beef has been strong in the last couple of years, exports to Japan and South Korea have been especially noteworthy.

Combined shipments into these two markets are up more than 20% versus one year ago, and 64% higher than just three years ago. And these additional shipments have occurred without sacrificing the average unit value of exports to these markets.

Through the first seven months of 2018, U.S. beef shipments to Japan and South Korea have amounted to 878 million pounds, accounting for nearly half of total U.S. beef exports. Over 70% of the total growth in U.S. beef exports since 2015 has come from these two markets. And while the unit value of combined exports into Japan and South Korea has typically outpaced the combined levels for other markets, that premium has continued to grow in recent years, reaching about 17% during 2017 and the first seven months of 2018.

Expanding exports

A recent report from the USDA Foreign Agricultural Service regarding Japan’s beef market notes that “the ‘meat boom’ which swept over Japan in 2017 has continued to drive beef consumption in 2018 in both retail and foodservice." The report also notes that “strong red meat consumption trends in Japan will continue into 2019.” A similar report for South Korea this spring noted “the increasingly favorable consumer perception of U.S. beef also contributed to growing demand."

With the per capita real gross domestic product level in Japan not far behind the U.S. And with South Korea continuing to close the gap in terms of average wealth, these markets may be experiencing a similar transition to that which has driven demand for high-quality beef in America. The U.S. volume of beef grading prime has exploded in recent months (up more than 35% for the year through early September) and despite the leap in increased availability, the prime beef cutout value has held up relatively well.

Demanding quality

The recent advances in consumer expenditures for higher-valued beef in this country have been addressed in this column, and we may be seeing a similar trend in these two important beef export markets.

With the combined population of Japan and South Korea amounting to nearly 55% of the total U.S. population, the beef industry has more than 175 million people in these two markets alone who appear ready and willing to pay up for increasing amounts of quality U.S. beef.

Given the large beef and total meat supplies expected to be generated in the U.S. for the next couple of years, continuing to grow demand is imperative. Recent growth in export volume and value to Japan and South Korea give optimism that demand for U.S. beef continues to advance, carrying the industry through a time of large supplies without severely depressing prices.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like