September 8, 2017

The economics of cattle markets remain intertwined with other livestock markets. Supplies of all meats affect the prices consumers are willing to pay, as does consumer demand for these same products. With the growth in beef supplies occurring in 2017 and expected to continue into 2018, domestic meat demand trends remain critical to the cattle outlook.

Market analysts strive to understand two basic industry components: supply and demand. Market behavior has shown that when demand becomes stronger for a product and supply doesn’t change, prices will normally go up. Likewise, if supply increases and demand stays the same, prices will fall. The challenges begin when it comes to understanding why supply and demand are changing as they are (in order to predict future movements), and to what extent each component is affecting market prices.

Consumer strength

This year has been noteworthy for U.S. livestock markets, as consumers have been willing to pay more for meat even as the supply of it has grown. That points to very strong demand.

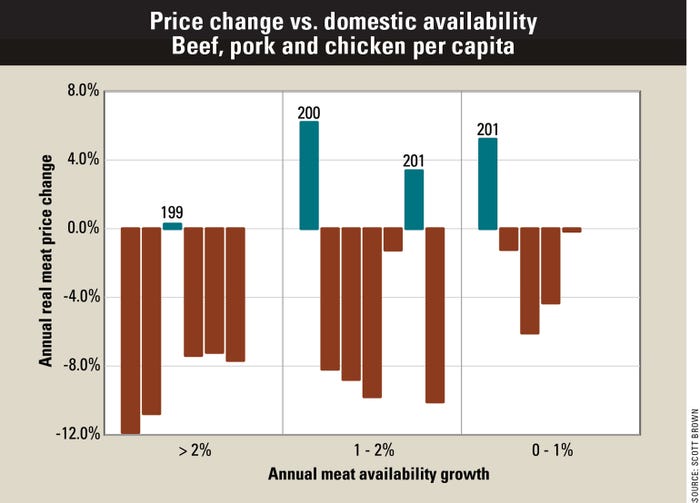

It is not typical to see larger meat quantities move at higher prices, but it is not extremely rare either. There were 17 years from 1981 to 2016 in which the combined amount of beef, pork and chicken per U.S. resident increased relative to the year before. In 14 of those years, the wholesale price (adjusted for inflation) from weighting the Choice boxed beef price, pork cutout price and chicken price by the consumption of each meat declined.

The chart shows that 2017 will be the fourth year since 1980 that both supply and prices moved up in the same year. The biggest price bump in a year of increasing domestic supply occurred in 2004, at the peak of the Atkins diet-fueled protein demand surge. Consumers also paid more when more meat was available in 2013 and 1999. In the 19 years in which per capita supply declined on the year (not shown in the chart), prices increased 11 times. Four of the eight years in which meat supply and price both declined were associated with economic recession: 1981, 1982, 2008 and 2009.

What lies ahead?

USDA currently projects that 2018 will be a year in which combined per capita availability of beef, pork and chicken increases by 1.3%. This would again place us in the middle of the chart, where prices tend to decline and sometimes substantially.

While exports could outperform current expectations, there is also a lot of uncertainty for trade, as renegotiations are ongoing for trade agreements. Production estimates are subject to a little less uncertainty, as animals are already in place on the beef and pork side that will determine 2018 production to a large extent.

So, what will prices do with more meat supply again in 2018?

Here is where it becomes important to decide if 2017 is an anomaly of strong demand, or the beginning of a shift in consumer preferences that will continue to allow for higher prices in the face of larger supplies. While only time will tell, counting on another year of strong demand gains may cause you to plan too optimistically for your operation’s finances. Lower prices are likely to be a reality in 2018 and possibly even 2019. Plan accordingly.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like