January 2, 2018

A harmonizing set of pork supply-and-demand conditions converged in 2017 to bring higher than expected prices. Breeding and farrowing operations remained profitable and were big beneficiaries of the fall rally in feeder pig prices. Finishing operations also made money in 2017. Costs were lower compared to 2016 and hog prices were higher. Iowa State University estimates put 2017 farrow-to-finish returns at the second highest since 2011, only lower than 2014’s phenomenal level.

Hog prices in 2018 should average higher than in 2017. That’s positive, considering production is rising.

Favorable feed prices, strong hog futures

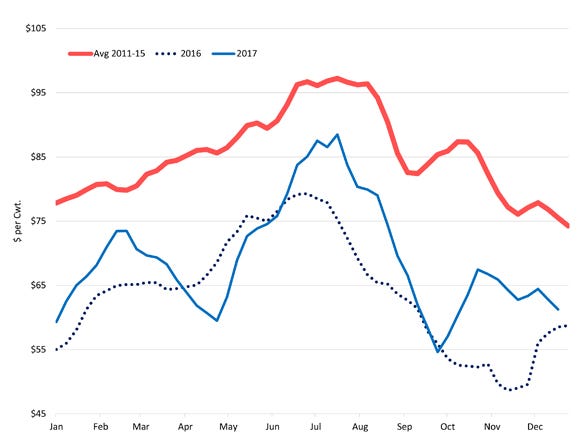

Calendar-year 2017 was full of price runs for Iowa and Minnesota barrows and gilts. January and April both saw prices at $59 per cwt with a price surge to $73 in late February. Prices peaked in mid-July at $88 before bottoming in late September at $55. A fall rally took prices to $67 in late October before easing to the low $60s. They averaged $69.35 for the year.

Weekly barrow and gilt prices, Iowa and Minnesota, weighted average base price for all producer sold and purchased hogs

Surging second-half demand for feeder pigs from finishers was one of 2017’s market surprises. Favorable feed prices and strong lean hog futures prices for 2018 provide the foundation for excellent pig demand and favorable feeder prices. On an annual basis, 2017 feeder pig prices averaged above 2016’s. National prices for formula and cash of early weaned pigs (10 to 12 pounds) and feeder pigs (40 pounds) averaged $38.40 and $57.09 per head, respectively.

Profit prospects projected for 2018

Projected costs and lean hog futures prices suggest 2018 profit potential should average $15 per head for farrow-to-finish operations; $3.50 per head for farrow-to-wean operations; and $2 per head for wean-to-finish operations.

Producers see opportunity to capture profits on more hogs. Nearly every number in USDA’s recent Hogs and Pigs Report, based on the Dec. 1 survey of producers, was larger than pre-report expectations — not dramatically larger but larger nonetheless.

The report showed producers upped the Dec. 1, 2017, breeding herd 1.1% to 6.179 million head from Dec. 1, 2016. It’s up 1% from the previous quarter. September through November 2017 sows farrowing were estimated to be 3.11 million litters, 2.1% larger than in 2016 and more than 1% larger than expected. The September through November pig crop totaled 33.40 million head, 3.2% larger than one year ago.

The December 2017 through February 2018 farrowing intentions of 3.07 million litters are 2.8% higher than a year earlier, 1.7% larger than expected and 45,000 litters larger than the December through February expectations in the September report. USDA’s first estimate for March through May 2018 farrowing is up 2.3% from 2017 and is larger than expected pre-report.

Demand remains strong for feeder pigs

The market says demand is strong for these pig crops. Space is available to house them. Buyers of early-weaned and feeder pigs are betting on strong spring and summer 2018 barrow and gilt prices. Every Friday, USDA’s Agricultural Marketing Service releases the National Direct Delivered Feeder Pig Report (NW_LS255), a weekly price summary based on farm-to-farm delivery. Prices include both formula and open market (cash) prices. In 2017, cash receipts made up 43% of the early-weaned market, while feeder pigs are almost exclusively transacted in the cash market.

Bidding is driving up cash prices. For the week ending Dec. 22 cash early-weaned pigs averaged $67.17 per head and feeder pigs averaged $77.64 per head. These prices are $17.24 and $22.59, respectively, higher than a year earlier. Only four months earlier, cash early-weaned prices dipped to $19.11 and feeder pig prices hit $35.54. Open market prices for early-weaned pigs are considerably above current formula prices, suggesting sizable competition exists for pigs not already priced by formulas.

Canada is a notable supplier of feeder pigs. Purchasing Canadian pigs includes a currency-exchange risk. However, that is usually borne by the Canadian seller because the price is based on delivered prices relative to all weaned and feeder pigs. With a relatively robust U.S. dollar, the incentive to sell pigs to U.S. producers is strong. Imports of Canadian feeder pigs (pigs weighing less than 110 pounds) to the U.S. in 2017 averaged 88,762 head per week, the highest weekly average since 2012. While relatively small compared to the U.S.-born pig crop, Canadian imports add to the already record-large market hog inventories.

Pork production expected to rise again

Pork production in the U.S. is expected to rise 3% to 3.5% in 2018 on top of the 2.6% rise in 2017. Changes in hog slaughter and carcass weights from current expectations may cause adjustments in pork production levels and timing in 2018, which could impact current price forecasts.

There is a lot of grain and feedstuffs available for hogs, and feed costs for producers are some of the lowest in years. But with growing livestock and poultry numbers, feed inventories and 2018 crop developments will be important market drivers.

Rising pork production will combine with higher beef and poultry production for another record total meat supply in 2018.

Strong meat exports needed

Domestic per capita meat consumption is not expected to be a record, depending critically on continued exports of all meats, but is expected to increase another 1.5% year over year in 2018, on top of the 0.8% hike in 2017. Retail pork prices will likely adjust downward in 2018, which is critical to help the market absorb additional pork in the face of large total meat supplies.

A bit of good news, even with higher production, USDA’s Cold Storage Report showed as of Nov. 30 pork stocks were down 15.5% from the previous month and down 2.7% from a year ago. With production being up in the field but product in storage being down, it reflects the relatively strong pork market, both domestically and internationally.

Pork exports had a good year in 2017. Through October, the most current data, pork exports ran up 8.2% on a carcass weight basis. The U.S. is a low cost, high-quality pork producer, with significant production resources, and is a very reliable supplier. These are all important considerations for international buyers. Growth in pork exports is critical to offset a portion of 2018’s rise in pork production. Exports absorbed about 22% of domestic production on a carcass weight basis in 2017.

Trade agreements face uncertain future

International trade and trade agreements are a political hot potato. From the withdrawal of the U.S. from the Trans-Pacific Partnership to the ongoing debate about the North American Free Trade Agreement, trade policy is transforming and trade relationships are in a state of flux. The direct impact on current trade patterns as well as potential future pork trade policies is uncertain.

The state of the economy directly impacts consumer pork demand. In the first half of 2017, consumer demand softened a bit, but the situation improved in the third quarter. Consumer incomes are rising at a faster pace; unemployment is at a 17-year low. Consumers feel more wealthy thanks to higher home values and equity markets.

However, the economy is gearing up for higher interest rates and potentially higher inflation moving into 2018. Taxpayers will be waiting to find out how they will do under the new tax legislation. In addition to U.S. economic uncertainty, global market uncertainty will likely persist through 2018.

Schulz is the Iowa State University Extension livestock economist. Contact him at [email protected].

About the Author(s)

You May Also Like