December 24, 2020

Keeping good records is an important risk management tool for agricultural producers. Good records provide accurate, complete and consistent information that leads to better decision-making. Good records also keep the farm or ranch operation in a good position to participate in USDA programs when those opportunities are available.

The Livestock Indemnity Program, one of the USDA disaster assistance programs administered by the Farm Service Agency, is an example of how good record keeping can be rewarded. LIP provides compensation to eligible livestock producers who have suffered livestock death losses in excess of normal mortality because of adverse weather, such as blizzards, floods, extreme heat, extreme cold, wildfires, tornadoes and lightning.

LIP also covers attacks by animals reintroduced into the wild by the federal government or protected by federal law, including wolves and avian predators. Eligible livestock includes beef cattle, dairy cattle, bison, poultry, sheep, swine, horses and other livestock as determined by the U.S. secretary of agriculture.

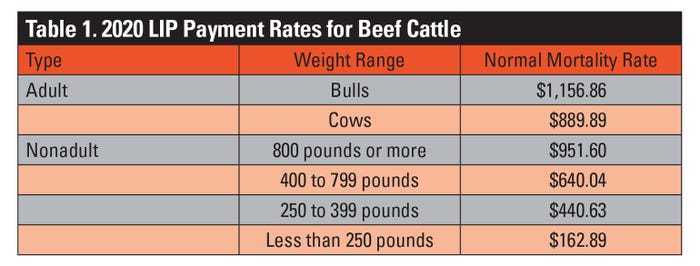

The LIP payment rates are based on 75% of the market value of the livestock. Payment rates for beef cattle losses in 2020 are shown in Table 1.

Good livestock inventory records can lead to good LIP documentation and provide access to LIP benefits that are designed to help recover from unexpected livestock losses. Detailed information about acceptable documentation is contained in the USDA LIP Factsheet available at fsa.usda.gov.

Producers need accurate counts of the number and type of livestock in their inventory before the eligible loss event. Beginning year inventories are needed as a starting point, but they should be supplemented with production records (births, death losses, weaning numbers, etc.), purchase records, sale records, veterinarian records, inventory-related bank loan documentation, records assembled for tax filing, and other verifiable and reliable documents that can help determine livestock inventories at different points throughout the year.

When to file

Producers must file a notice of loss with their local FSA within 30 calendar days of when the death losses because of an eligible event became apparent. The producer then can file an application for payment to request compensation for losses in excess of the normal mortality rate.

This must be completed no later than 60 calendar days after the end of the calendar year in which the loss occurred (i.e., March 1, 2021, for losses occurring in 2020). Multiple notices of losses and multiple applications for payment may be filed by producers that suffer multiple livestock losses during the same calendar year.

When submitting a LIP notice of loss and application for payment to their FSA office, producers should ask themselves, “How can I provide verification of what I am telling them?” LIP provides compensation to eligible livestock producers who suffer livestock death losses in excess of normal mortality because of an eligible event.

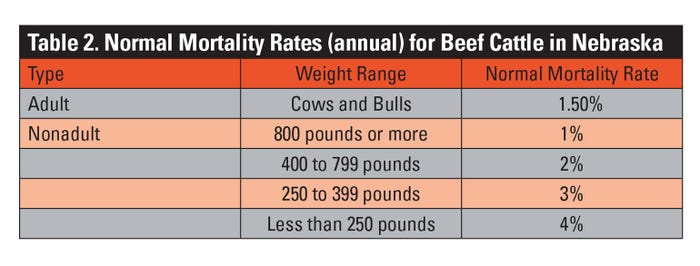

Normal mortality rates are established by FSA on a state-by-state basis using recommendations from state livestock and Extension service organizations. Table 2 displays the normal mortality rates for 2020 in the state of Nebraska.

These rates include some changes taking effect in 2020 that split the non-adult weight range of less than 400 pounds with an annual mortality rate of 5% into two smaller weight ranges with lower normal mortality rates.

For 2020 and later, LIP includes a weight range from 250 to 399 pounds with a normal annual mortality rate in Nebraska of 3%, and a weight range less than 250 pounds with a normal annual mortality rate in Nebraska of 4%.

Records make it easier

Livestock producers with good records will find it much easier to file a LIP notice of loss and an accurate application for payment. There are two types of death losses to be concerned about — those that are attributed to a LIP-eligible adverse event and those that are considered normal death losses.

Supporting documents for death loss because of a LIP-eligible adverse event must show evidence of loss, current physical location of livestock in inventory, and location of the livestock at the time of death. Producers must provide adequate proof that the eligible livestock deaths occurred as a direct result of an eligible adverse event.

Documentation should always include the type of livestock and the date the livestock died, so their death can possibly be attributed to the eligible event. Livestock dying within 30 days of a qualifying event may be considered for eligible loss benefits. Furthermore, date of birth and date of purchase records are extremely important to verify when animals became a part of your inventory, and that they were present at the time the eligible event occurred.

Accurate documentation of other death losses is equally important, so they can be counted as part of normal mortality for the year. In instances where livestock die from a disease that was exacerbated from an eligible adverse weather event — and within 30 calendar days of the eligible adverse weather event — an FSA veterinarian certification form is required to support the death loss.

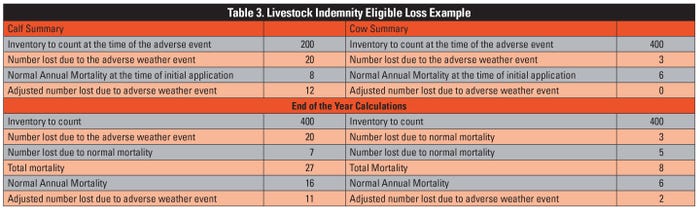

Suppose you own 400 head of pregnant spring calving cows. A wet, spring blizzard in the middle of calving results in 20 dead calves and three dead cows. The blizzard is declared a LIP-eligible adverse weather event by your local FSA office, and your calving records provide clear evidence that 200 calves were born and alive at the time the blizzard hit.

Normal mortality calculations establish a death loss threshold of six cows (400 x 1.5%) and eight calves (200 x 4%). This means that you are currently not eligible for LIP payment compensation for the cows (3 head is less than 6 head of normal annual mortality), but you are eligible for payment on 12 head (20 − 8 = 12) of calves provided you file the proper paperwork on form CCC-852 within 30 days of the blizzard with your local FSA office.

Accurate records pay

However, suppose you also lose five cows during the course of the calendar year due to natural causes. Furthermore, five more calves are lost during the remainder of calving, and two more are lost in the early summer.

Accurately documenting inventory counts and these death losses throughout the year provides you with the information you need to potentially count these death losses toward the annual death loss threshold (normal mortality) and file another application for payment in January.

Table 3 shows how the death loss numbers for the calves and the cows in the above example would work out at the time of the blizzard, and again at the end of the year. Calf death losses would total 27 head at the end of the year, which is 11 head above the updated expected normal mortality of 16 head (based on 4% of 400 total head of calves).

The earlier application for payment resulted in payment for 12 head of calves verified as being lost above normal mortality rate because of the LIP-eligible adverse weather event. Therefore, it does not make sense for you to file an updated application for payment on the calves.

On the other hand, you should consider filing an updated application for payment on the cows that includes documentation of the additional normal mortality. The documentation of the additional cow death losses throughout the year would make you eligible for LIP payment compensation on two of the three cows lost in the blizzard because the eight total losses now exceed normal annual mortality.

Parsons is an Extension farm and ranch specialist with the University of Nebraska agriculture economics department.

You May Also Like