November 6, 2017

Raising calves is a long-term investment. This is one of many reasons for the existence of cattle inventory and price cycles. Another is the fact that the first step individual producers take to change inventory size on their operation actually exaggerates the aggregate beef supply situation.

For instance, when tight beef supplies lead to a rise in prices and the economic incentive is to raise more calves, fewer cows and heifers are sent to market, which in the short term reduces the beef supply even more. Alternatively, when large beef supplies lead to the economic signal of inventory reduction, more cows are sent to market and more heifers are placed on feed instead of retained in the herd. This appears to be where the cattle industry finds itself this fall.

Heifers in feedyard

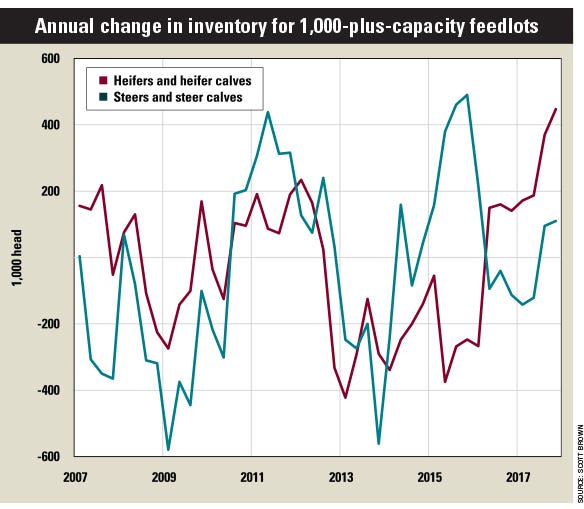

The Cattle on Feed report issued by USDA in October included the quarterly inventory of steers and heifers on feed in feedlots with a capacity of 1,000 or more head. While few in the industry were surprised to see total cattle on feed numbers remaining well above last year’s level, it is interesting to look at the change in animals on feed for steers relative to heifers.

The graphic shows that for the past seven quarters, heifers and heifer calves have added more to cattle on feed numbers than steers and steer calves. It also makes apparent the strong desire for cow herd expansion from 2013 to early 2016, when heifers on feed were much smaller than previous years. This ultimately led to the large increase in steer numbers on feed during 2015, which fueled the largest percentage increase in U.S. beef production since 1976, in 2016.

Sign of slowing expansion

Beef cow slaughter has also been growing. More beef cows were slaughtered in June than for any month since January 2014, and monthly slaughter totals have outpaced year-ago levels for 20 months in a row.

But this information alone does not conclusively indicate that beef herd expansion has stopped. While numbers of heifers on feed have jumped in recent quarters, they have done so from very low levels. When considering the percentage of cattle on feed in feedlots with capacity of 1,000 or more head, the most recent quarterly reading is almost identical to the average reading since 2007 of 36%. Likewise, beef cow slaughter as a percentage of beginning inventory will end the year between 9% and 9.5%, higher than the past three years, but below the 9.7% slaughter rate averaged from 1990-2016.

My best guess is that expansion has slowed significantly in recent months, but may still be continuing at a very modest rate. The Jan. 1, 2018, beef cow inventory number will be higher than year ago, but we could see only meager growth, if any, next year, which should see us begin 2019 with similar numbers. This should bring an end to significant beef production growth (and likely to annual cattle price declines) by 2020. Still, it’s a long period of time after the industry has begun to take steps toward downsizing.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like