November 15, 2017

Cow culling time often brings tough decisions for producers. Deciding whether cows go or stay seems to require a sharp crystal ball that can see into the future. At times, the market offers guidance for culling and marketing decisions.

Profits and prospects matter. Cow-calf profit prospects improved since summer, as November 2017 feeder cattle futures rallied $20 from Aug. 21 to Nov. 6. Producers may also capture additional value from holding onto calves, as backgrounding opportunities look promising. Deferred 2018 feeder cattle futures contracts advanced $20 on average since late August. Those price gains are not strong signals to expand herds. But prices are not signaling to liquidate either.

Low feed costs help cow-calf profitability

Costs matter, too. The 2017 average rental rate for Iowa pastures was $54 per acre. This is a new record, up $2 from 2016. But rents have likely reached a plateau. The average sales value of Iowa pastureland is $3,100 per acre, down $300 from 2016. Iowa’s estimated 2017 all hay production at 3.4 million tons is up 6% from 2016. Iowa hay (excluding alfalfa) prices averaged $79 per ton in 2017, about $2 lower than last year. For the week ending Oct. 29, USDA’s last pasture and range conditions report for the year showed 70% of Iowa pastures were still rated in fair, good or excellent condition.

Low feed costs helped underpin cow-calf profitability in 2017. Analysts expect feed prices to remain relatively low for the next few years, pending a major weather impact.

Cull cow revenue boosts returns

Slaughter cow prices matter. Actually, they matter a lot. A common misconception is you can make a profit from a beef cow by just selling her lifetime production of calves. It’s not true. A cow’s salvage value is often needed to show a lifetime profit. Whether you buy bred females or retain heifers, cull cow values five, six, seven, etc., years down the road matter. Cull values may matter more than an additional calf, after considering the cost to produce the calf relative to the price received for it.

Calf prices can fluctuate and culling percentages can vary to affect the share of revenue, but overall cull revenue is important. Research shows cull cow income makes up 10% to 20% of the total revenue for a cow-calf operation. Management strategies alone can boost values by 25% to 40%. Producers can hike cull cow values by adding weight, improving quality and marketing cows during seasonal price rallies.

Before deciding whether to retain or cull a cow, you should evaluate the economic value of cows exiting or remaining in the herd. Considerations include:

• what you paid for the replacement female or cost to develop a retained heifer

• past and future calf prices

• annual cash costs to maintain cows

• cull cow values

• interest rates

Producers can use the Net Present Value of Beef Replacement Females decision tool on the Ag Decision Maker website to evaluate if now may be an opportune time to cull a cow. This tool can be used to calculate payback period, internal rate of return, and net present value of purchased or retained replacement females entering or exiting the herd.

Understand what drives cull cow prices

An old market maxim says, “Sell your cows the first day of baseball season.” As grazing becomes available in the spring, daily costs to maintain a cow ease, which encourages producers to keep cows, which tightens supply.

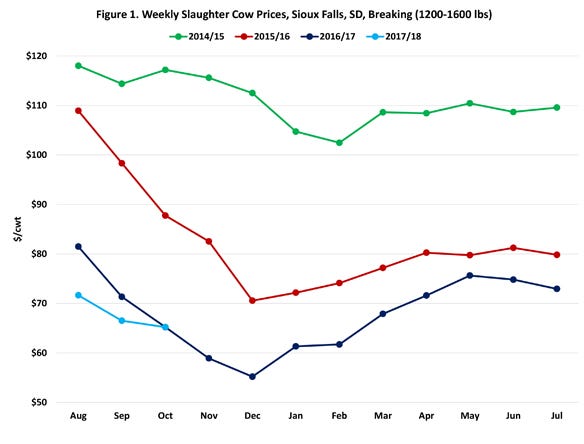

The slaughter cow market was very strong through the spring and early summer (see accompanying graph). The longevity of the strong market provided a longer period to optimally market cows than has been typical in previous years. However, late summer proved to be less supportive of the slaughter cow market, and the fall months will likely see even larger price declines.

The slaughter cow market price tends to wane during the fall mostly on a rising supply of cows for slaughter as many cow-calf producers market cows at time of calf weaning. Prices typically rise into the new calendar year, often rather dramatically. But in some new calendar years, cow prices rally little, if any.

We’re using South Dakota prices as South Dakota’s cow herd is almost twice the size of Iowa’s so USDA’s Ag Marketing Service finds more data on cow prices there than in Iowa. Similar price patterns are likely in Iowa.

Holding cull cows did not pay from the fourth-quarter of both 2014 and 2015 into the next year. Last year, between December 2016 and the first several months of 2017, the normal seasonal price rally returned. Prices gained $6 per cwt between December 2016 and January-February 2017; $15 between December and March-April; and $20 between December and May.

We expect slaughter cow prices to rise into early 2018. Fed cattle prices are typically highest in winter and early spring, which supports slaughter cow prices. The December to February live cattle futures spread is currently $6.

Price projections for cull cows

Typically, the price of slaughter cows is measured or considered as a percentage of live cattle prices or a basis, cash cow price minus live cattle futures price. During the past five-plus years, the monthly slaughter cow price has averaged 64% of live cattle futures or a negative $46 per cwt basis. More detail or scrutiny is warranted for pricing or cross-hedging, as the ratio has varied from 49% to 77% or a basis of minus $32 per cwt to negative $61 per cwt.

Using 2017 monthly percentage or basis levels suggest a price per cwt for slaughter cows of $68 to $74 in January and February 2018; $74 to $79 in March; $74 to $75 in April; and $72 to $74 in May.

The Cow Sell Calculator decision tool at ISU’s Ag Decision Maker website compares opportunities for marketing cows now or incurring additional costs to target other (later) markets. The approach used calculates the value per animal or other assets to generate the same revenue as a sale at an earlier date.

Cow-calf producers who are set up to economically add weight to cull cows and then sell in the first few months of 2018 instead of this fall at the seasonal price low might want to put a pencil to that soon. Correct decisions depend on the resources available and the degree of staying power or upside in deferred markets.

Schulz is the ISU Extension livestock economist. Contact him at [email protected].

About the Author(s)

You May Also Like